#StartupSpotlight is a series on Information Age shining a light on Australian start-ups disrupting the status quo.

It was when she secured the first customer that Charlotte Petris knew she had made the right decision in jumping head-first into the world of start-ups.

Petris and her husband Andrew had recently moved to Australia and rather than going into the cushy corporate world, decide to instead launch Timelio in late 2014.

The peer-to-peer marketplace for invoice financing, was a product of both of their experience in banking and accountancy.

But one of the hardest things for these platform-based start-ups is finding the first customers, the early adopters that were needed on both sides of the marketplace to enable growth and confidence in the platform.

Purpose

The first days and weeks of the company for Petris was entirely focused on bringing in these early customers. She spent countless hours on the phones, in meetings and speaking to anyone and everyone she could to bring them onto the platform.

And it worked. Slowly but surely customers signed up, and some are still using the platform nearly three years later.

“It’s just a matter of really putting in the time - if you’re focused on it you can find customers, even if you have no track record and no credibility yet,” Petris says.

“That first customer was a huge milestone. That’s when you’re actually earning revenue, you’re live and you’ve got a real person who wants to use your product.”

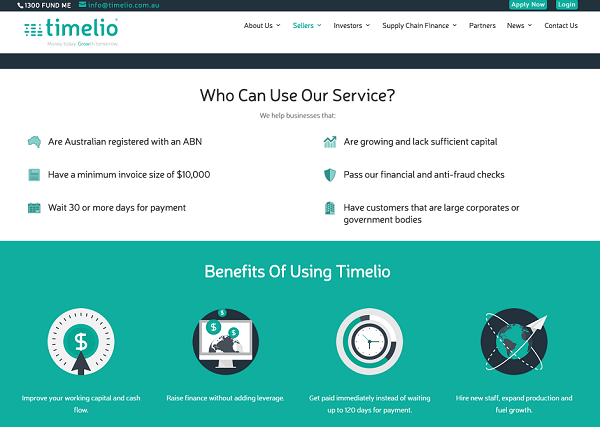

The company’s platform connects SMEs waiting for invoices to be paid, with investors who can buy these invoices and then get a return on investment.

This can help cash-strapped young businesses to get the money they’re owed quicker to help them grow and develop.

“The reason Timelio exists is to improve the financial well-being of business owners. That’s our whole purpose,” Petris says.

The idea came from the co-founders’ time working at a bank in London, with Petris working in corporate advisory and Andrew in investment management.

The start-up is all about efficiency and speed: businesses can sign up to Timelio for free, upload their invoices, set the discount and then wait for investors to bid on them.

Once the invoices have been bought, they receive the money within 24 hours of the payment being made.

Petris and her team are working hard to put the trust and confidence back into this form of short-term financing.

“We are creating a new business model in terms of peer-to-peer marketplaces,” she says.

“As a new business using technology, there’s a huge amount of emphasis from customers placed on trust, credibility and reputation, and that’s something we’ve focused on from the early days.”

Petris says Timelio’s entire purpose is to help SMEs access capital and grow, and this culture is placed front and centre in the office.

“You have to always stay true to yourself and the purpose of the business, what you’re trying to achieve and the values of how you operate,” she says.

“There are a lot of challenges through to the early-stage and scaling to grow the business, so you have to remember to stay true to that purpose and the values to why you’re doing what you’re doing.”

Onwards and upwards

Timelio has enjoyed sharp uptake and rapid growth in its near three years of existence.

Its first year of operation in 2015 saw $10 million in loans facilitated on the platform.

In October last year, the company closed a $5 million funding round from the Thorney Investment Group and former ANZ Banking Group director John Dahlsen.

The team also began working on the Timelio Capital Fund, a unit trust offered to institutional investors seeking diversified exposure to invoice financing, with seed funding also from Thorney.

In July this year, the company reached perhaps its biggest milestone in its two years of life: $100 million worth of invoices had been funded through the platform.

And the growth is set to continue exponentially, with Petris saying she hopes this number doubles by next year.

Working in a start-up is usually all about looking forward towards these lofty goals – and towards the next customer.

But while the first year of running Timelio was filled with uncertainty and risk at the time, Petris now looks back fondly on these times.

“You’re investing a lot personally in it and creating something now – you don’t actually know how it’s going to work and how well it’s going to take off,” she says.

“In hindsight it worked well and was a lot of fun. It was getting something off the ground, it was just Andrew and I at home working out how we were going to get our first customer and build the technology.”

The two co-founders are still completely immersed in the company, with Petris handling the business-side of the platform while Andrew looks after the investors.

The company now has nearly 20 employees, and is setting its sights on growing the current platform and looking to expand around the world.

With getting the first customer on the platform being one of her proudest moments at Timelio, Petris says she has maintained this passion for the company’s users.

“If you respect your customers and the people you work with then that’s a really good foundation for us. It’s amazing that some of those values and the way you operate flows through to the customers, and are a real key differentiator in the market,” Petris says.

“We’re really passionate about customers. We buy their products and we use them in the office. We try to closely integrate with our customers and support their business.”