#StartupSpotlight is a series on Information Age shining a light on Australian start-ups disrupting the status quo.

With big plans to disrupt the international payments industry, Australian fintech start-up Pelikin is looking to cash in on our dissatisfaction with the banks.

Sam Brown's own difficulties in accessing his funds while travelling in Europe and Asia inspired him to found Pelikin in 2015 with the goal of first becoming a multi-currency debit travel card provider.

Pelikin is preparing to launch its beta service, with plans to open registration to the public around the middle of the year.

Having relied on seed funding to date, the Australian start-up plans to take advantage of equity crowdfunding to support its next growth spurt.

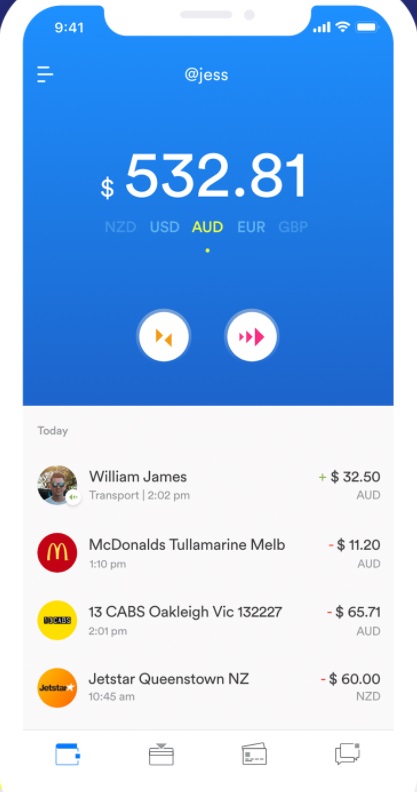

The Pelikin debit card will be accompanied by an app for users to access their account, transfer funds and split bills in multiple currencies.

Meanwhile Pelikin's lack of foreign transaction fees makes it a convenient way for Australians to pay online for services like Uber while travelling abroad.

"I've always been frustrated at the disjointed nature of accessing your money in Australia and then accessing it abroad," Brown says.

"Myself and other members of the Pelikin team have also been locked out of our bank accounts or had access to funds restricted while travelling – with little information provided by the bank which had just left us stuck overseas with no money.

"That lack of transparency really drove us to come up with a better solution for Aussies travelling abroad."

Upon returning from his travels, Brown began to research customer experiences with the Australian travel card market to confirm the demand for alternative options before founding the company.

Getting started

At 28 years-of-age, Brown doesn't come from a finance background like many entrepreneurs aiming to make a splash in the fintech space.

"We obviously needed to validate our start-up idea, and our research confirmed that this is a real problem for many Australians who are dissatisfied with what's available," he says.

"They begrudgingly accept that difficulties accessing your money when travelling are the status quo, so we decided to change that with Pelikin."

Initially covering seven currencies, one of Pelikin's selling points will be pricing – with users able to split bills in foreign currencies and transfer money to each other instantly for free by sending requests as a simple link.

Pelikin also aims to win over customers with ease of use and a slick mobile app.

Pelikin in action. Source: Pelikin

The start-up is "not out to reinvent PayPal", Brown says. Instead it's motivated by the friction between making domestic payments and making payments while travelling.

"Initially we're trying to amalgamate them into one seamless proposition, after which we've got all sorts of features on our roadmap."

Rather than pursing venture capital to fuel the next stage of growth, Pelikin decided to embrace the new equity crowdfunding model through Birchal.

While typical crowdfunding services like Pozible and Kickstarter let would-be customers back specific projects, Birchal's equity crowdfunding service lets a business' supporters take a stake in the company.

For Pelikin, Brown sees equity crowdfunding as a vehicle to raise funds without the concerns over control of the business which can come with an injection of venture capital.

Equity crowdfunding also offers the opportunity to engage with customers who are passionate about the product.

"What appeals to us the most is that these customers will have a vested interest in providing valuable feedback and seeing our business succeed," he says. "That's extremely powerful, not just because they want to make a return on their investment but because they want us to produce a great product for them to use."

You can bank on it

Longer-term Pelikin has ambitions to become a bank, but for now it is developing partnerships with payment processors, card issuers and Authorised Deposit-Taking Institutions in order to get a product to market.

"Hopefully by early 2019 we'll be able to go through that process of becoming a bank, but for now it's not worth the risk of waiting so long without product validation while you raise huge amounts of capital to apply for banking and credit licenses," Brown says.

"When the time is right we'll go down that path but for now we're focused on establishing sound commercial relationships with reputable players in the payment space, which will allow us to build products fast, get feedback, learn and make sure that we've got a great product with market fit before we go further."

Funding aside, Brown says Pelikin faces similar challenges as any start-up – ensuring that you've got all bases covered from managing products to managing a team.

"There are just so many facets of a business which need to stay aligned so you can't be working on one area of the business for too long in isolation, otherwise you fall down in other areas," he says.

"Finding a balance which works in the early stage of the business and then lets you scale out the team is probably one the biggest challenges when you're setting a start-up off the ground."