A Melbourne law firm is bringing a class action against the government for its widely criticised robodebt scheme.

Since July 2016, Centrelink has issued automated debt notices to welfare recipients based on an algorithm that matched ATO data with reported income.

The formula averaged an individual’s fortnightly income from their yearly earnings, then compared that figure to their income reported to Centrelink each fortnight.

According to Gordon Legal, the lawsuit will question whether it was unjust for the government to make financial claims against welfare recipients, and if the hundreds of thousands of debt notices were issued legally.

Lawyer Peter Gordon said the scheme has been poorly administered.

“According to the government’s own figures, one in five of the people targeted, and the debts raised in this robodebt process, have been mistaken causing of course not just financial distress but pain and hardship to over 160,000 people,” he said.

Former Opposition Leader, Bill Shorten, announced the class action on Tuesday.

“When people receive a debt notice with no explanation of why they owe it to the government, and they actually fight the government, this government has been quietly settling the claims and not proving the legal basis upon which these robotdebt letters are sent out to people,” Shorten said.

Minister for Government Services, Stuart Robert, called the lawsuit a “political stunt” and defended the scheme.

“We have not received any comment from the department saying anything other than that what we are doing is lawful,” he said.

“Citizens at any point have the opportunity to bring forward documents to show that the income they reported to Centrelink matches or explains the discrepancy between what’s been reported in their tax return.”

But Gordon said the government’s expectations are unreasonable.

“The commonwealth targeted benefits paid up to five, six and even seven years earlier, and put the onus on people to re-prove their entitlements, even though in that intervening period the commonwealth’s own website advised people that they only had to hold onto their employment records – now crucial pieces of evidence in these cases – for six months.”

Lawyers will seek to have the government pay back the money it ‘recovered’ from welfare recipients, along with additional fees charged for the initial debt recovery.

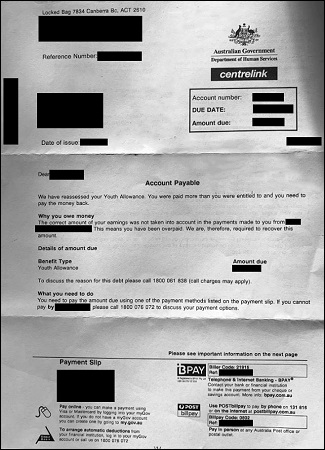

An example of a debt notification. Source: Gordon Legal

The robodebt scheme has produced very public examples of unnecessary hardship. In one instance, a woman received a call from Centrelink asking that her son – who received a disability pension until he died – owed a $6,700 debt.

Another person, who received a notice for $25,000 in debt, said in a submission to the Not My Debt website, that the notice left them feeling like they were tricked into a false sense of security.

“It feels like a bad dream and not something that should be happening in a country like ours,” the person said.

“Vulnerable people are being made to feel like criminals. An agency which is supposed to care is offering assistance with one hand and taking it back and some more with the other hand.

“I am happy to pay back anything I owe but I have zero trust that the amount owing is correct.”