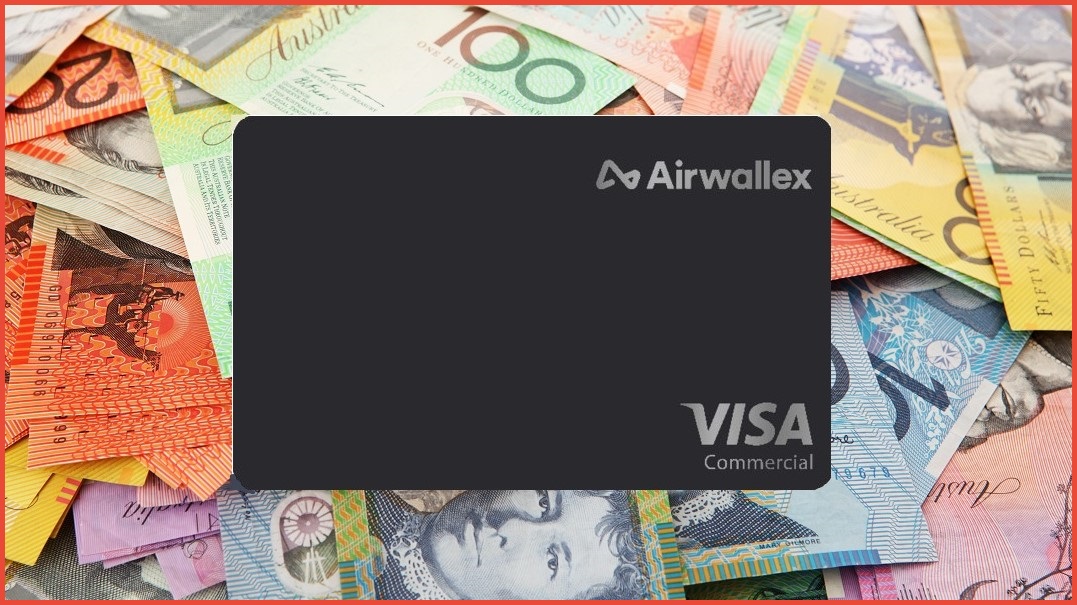

Fast-growing fintech unicorn Airwallex is making a play for business buyers, partnering with Visa to launch a virtual credit card service that handles currency conversions at competitive rates.

Paying accounts from overseas suppliers has traditionally required businesses to absorb heavy transaction fees, or to hedge their exposure to currency fluctuations by stockpiling foreign currencies.

Customers of the Airwallex Borderless Card (ABC), by contrast, can quickly commission new credit cards tied to Airwallex accounts and accepted by any merchant in the world that accepts Visa cards.

By next quarter, the service will expand to allow creation of virtual credit card numbers that are usable through a mobile app.

ABC targets a particular pain point in overseas buying.

Cards are tied to local currencies, leveraging Airwallex’s overseas accounts let them avoid paying often-padded bank fees for currency conversion – which are typically around 3 per cent of the purchase price through Big-Four institutions like Westpac and the Commonwealth Bank.

That kind of fee, on top of the retail margin that banks add to their own interbank exchange rates, quickly adds up for companies paying tens or hundreds of thousands of dollars at a time.

“Airwallex’s goal has always been to set up a global financial infrastructure that helps businesses to grow and scale,” CEO and co-founder Jack Zhang said, noting that the Visa partnership will help the company “offer businesses an end-to-end financial services solution.”

The ABC also allows businesses to set clear rules about: which suppliers the card can be used with; daily and monthly spending limits; detailed reporting, and more – potentially heading off problematic fraud through the likes of business email compromise (BEC) attacks that exploit the lack of checks and balances in Australia’s direct money-transfer system.

Currently, businesses paying accounts can verify the bank branch their money is going to but banks processing money transfers typically don’t compare account-holder details with those on the destination account – allowing fraudsters to substitute their own account details on false invoices.

The better tracking and reporting of credit cards has helped them steadily become a bigger part of the global B2B transaction mix, with a recent European Payments Council analysis noting an increase from 62 per cent of global transactions in 2013 to 69 per cent in 2017 – and from 73 per cent to 79 per cent in the Asia-Pacific region over the same time.

By contrast, use of direct debit for payments declined from 12 per cent to 10 per cent globally, and 7 per cent to 5 per cent across mature APAC economies.

A multi-lingual unicorn

Airwallex’s core business revolves around allowing customers to create business accounts in every international market where they do business, or source products.

Its network spans over 130 countries, giving customers access to interbank exchange rates well below the retail rates they normally charge.

The benefits of a multi-currency payments provider that facilitates cross-border payments have not been lost on customers and venture capitalists, which have warmed to the Melbourne-based company so much that its recent $A149m ($US100m) Series C fundraising round pushed its valuation past $1.49b ($US1 billion) – just three years after it was founded.

The ABC is the first product released by the now-tech unicorn since closing that fundraising, which was led by former Facebook, Airbnb and Spotify backer, DST Global.

The company has grown so quickly that it now operates ten international offices – including Melbourne, London, San Francisco, Tokyo and Bangalore but with a heavy China area focus that includes Hong Kong, Shanghai, Shenzhen, Beijing, and Singapore.

The company’s focus on China reflects the heavy demand for currency services from overseas companies buying products or components from China’s massive manufacturing sector, which often trades in US dollars or other currencies.

The launch gives Visa – which processed over $1.49t ($US1t) in B2B payments last year – the opportunity to elbow into a direct-payments market from which many companies have excluded it simply because of the large fees that multi-currency purchases involve.

Cross-border B2B payments are “a cumbersome and costly affair,” Visa Asia Pacific regional president Chris Clark said in a statement, “which can impact small businesses and corporates who are time-starved and need to keep a close eye on their cashflow.”