We may claim to be worried about the security of our personal data, but new figures suggest Australians are more interested in convenience – and that we are “taking our eye off the ball” during the COVID-19 pandemic as other priorities push data security down our list of concerns.

Just 40 per cent of Australians responding to the recent F5 Curve of Convenience 2020 report said they valued security more than convenience – putting us behind respondents in every major Asia-Pacific country except Japan.

Significantly, the figures – which were collected as the COVID-19 pandemic soared for the first time in late March and early April – marked a big decline in Australians’ interest in security since last year, when security was a priority for 49 per cent of respondents.

By contrast, residents in Indonesia and India had become more secure over the previous year while respondents from Taiwan, Hong Kong, and China were the most security-conscious.

The figures, the report’s authors conclude, suggest a “discrepancy between the value users place on security versus their actual willingness to forgo security for more convenience… [suggesting] that values and behaviours are not necessarily aligned.”

This gap manifested in curious ways: Australians were much less willing than residents of other Asia-Pacific countries to share or store personal data in online applications – with only half willing to do so, compared to 82 per cent of Chinese users.

Yet while just 28 per cent of respondents had previously said they would not use an app after it had been compromised, 96 per cent said they ended up doing exactly that – ignoring often high-profile breaches of tools vendors like Facebook, Instagram, Zoom, Instagram, and others.

Fewer users named security as an important feature than last year, while user friendliness and fast loading times were more important this year than last.

Isolation drives scam losses

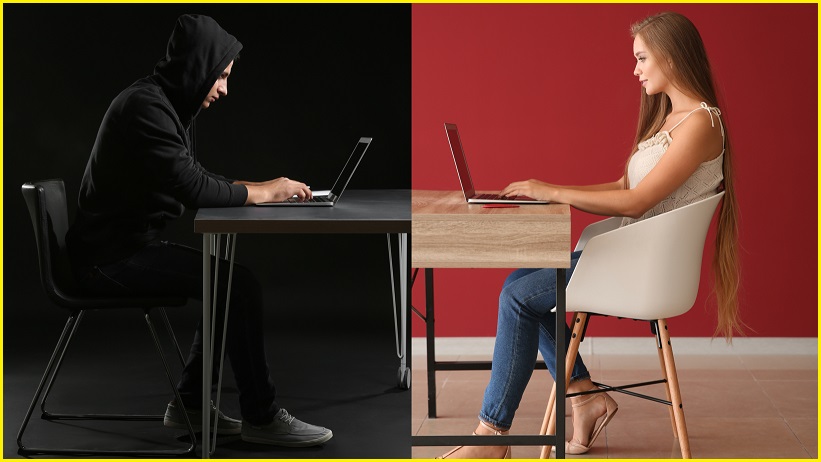

By continuing to use convenient online services even after they have been breached, Australians are subjecting their personal data to compromise and opening the doors to potentially damaging exploits like identity theft.

The risk of compromise is even greater given new figures from the Australian Competition and Consumer Commission (ACCC)’s ScamWatch service, which recorded a record 18,579 reported scams – which costed their victims $12.3m – during July alone.

That was higher even than in April, when cybercriminals moved to exploit growing COVID-19 related confusion to such a degree that cybersecurity experts were bracing for a “huge surge” in demand.

Interestingly, losses to dating and romance scams were up by a third in July compared to April – suggesting that increasingly isolated and locked-down Australians were shelving their scepticism in the hopes of connecting with other people.

Those changes helped drive an explosion in annual scam losses, which ballooned to $153m over the past year – up by a third compared with $115m the year before.

Yet while many of us are letting our guard down in the hopes of finding romance, we’re still reluctant to share information about ourselves even if it would help police help us in an emergency, or for COVID-19 contact tracing.

Just 55 per cent of Australians would share their location data with police in an emergency, according to new Unisys Security Index data that also suggested just 45 per cent of us are concerned about being scammed in the midst of the pandemic.

“Consumers are narrowing their attention during COVID-19 to their families’ health”, the report’s authors note, warning that consumers “appear to be taking their eye off the ball when it comes to security concerns… despite mounting evidence that phishing, scamming and hacking are rising dramatically during the pandemic.”

Over 100 Australians are reporting stolen personal information every day and the 60,000 reported attempts to gain personal information cost us $14.1m last year, according to recent Scamwatch figures released as the organisation marks national Scams Awareness Week 2020 with a multi-pronged awareness campaign including a parody podcast.

“Scam victims who have lost personal information are vulnerable to further scams, fraud or identity theft,” ACCC deputy chair Delia Rickard said, warning Australians to “never give your personal or financial information to anyone you don’t know or trust via email, text, social media or over the phone.”

“If you do have your identity stolen,” she said, “it can take years to recover and people can end up losing more than money. Not only time in trying to undo the damage done financially, but it can also impact greatly on your mental health.”