Australian neobank Xinja is the first local fintech company to be publicly affected by the coronavirus outbreak after it made the decision to no longer sign up new clients to its high interest Stash account.

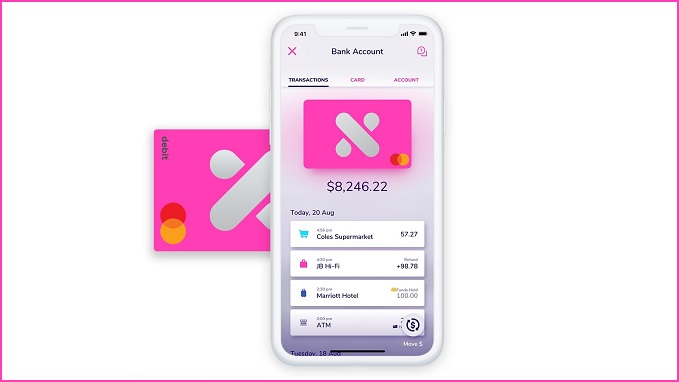

Xinja is one of many online-only neobanks offering savings accounts with interest rates typically higher than traditional banks.

Combined with apps that have slick user interfaces and features, the high returns are used as a selling point to lure customers away from the big four.

The Reserve Bank (RBA) lowered interest rates to a record 0.5 per cent last week with RBA governor, Philip Lowe, saying the decision was made to "support the economy as it responds to the global coronavirus outbreak".

This forced Xinja to rethink its current strategy.

"It’s been a pretty hectic week in the world of finance," Xinja CEO and founder, Eric Wilson said in a statement.

"The RBA has reduced the interest rate by 0.25% paid on money to a super low 0.5%, Xinja has had its biggest couple of days ever for new customers and new deposits, and the Coronavirus has the country and the stock market all shook up.

“Like any business Xinja has to keep control of its costs and when a bank gets lots of deposits and the RBA cuts interest rates, that makes costs go up."

“Because these are uncertain times for everyone, we are holding our rate steady, at 2.25 per cent, but hitting the pause button on customers opening Stash accounts.

“No more new Stash accounts means no increase in cost to Xinja and means we can protect the interest rate for people already with a Stash account.”

25,000 customers have deposited over $300 million into Xinja Stash accounts since its launch in January and is now looking to raise another $50 million from investors.

Other neobanks haven’t yet changed their tune about savings rates in response to the RBA cut.

With global share markets taking a recent hammering from coronavirus uncertainty and a sharp drop in the price of oil, the digital banks could find themselves in a position to scoop up customers looking for a sure thing.

At least that’s the outlook of Volt CEO and founder, Steve Weston, who said its 2.15 per cent per annum (p.a.) savings accounts are particularly attractive for self-funded retirees.

“Whilst the impact of lower rates is positive for borrowers, it is negative for savers – particularly the self-funded retiree market who rely on interest income,” Weston said in a statement to Information Age.

“We have experienced strong demand from retirees who are attracted to Volt’s competitive interest rate with introductory periods and other catches.

“Naturally, they are wanting to know their money is safe, and take comfort from Volt having the backing of the Financial Claim Scheme guarantee.”

Under that scheme, the government guarantees to protect deposits up to $250,000 for account holders which has helped gain the confidence of Australians looking to move their money out of the big four.