Eftpos has bought money transfer app Beem It in a move toward the digital payments market.

CEO of Eftpos, Stephen Benton, said the company was “excited” to pick up the app as part of its diversification strategy.

“Australians are rapidly moving much of their daily lives to mobile and Beem It is a great Australian-owned and operated option for them to embrace digital payments,” he said in a statement.

“It’s easy to use, secure and free to download.

“In many countries, mobile wallets are the main app for day-to-day life, particularly throughout Asia and the Nordics. These apps make life easier and add value, seamlessly and securely.

“Eftpos the payment system will remain wallet agnostic and be the rails that support a variety of digital wallets.”

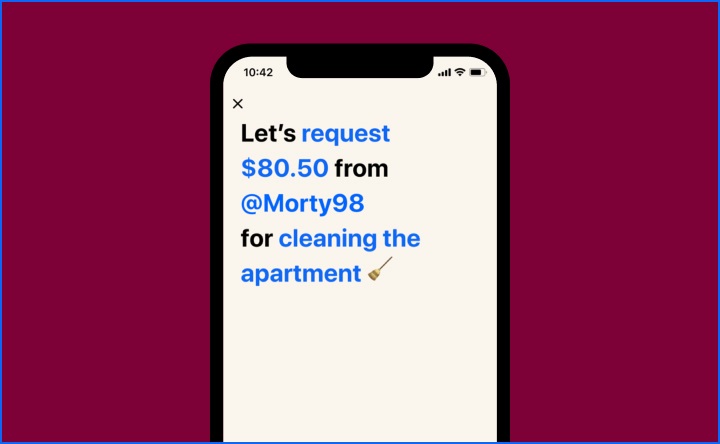

Beem It aims to make bank transfers easier in casual situations, such as splitting a bill at a restaurant, without the old hassle of entering BSB and account numbers.

Instead, Beem It users have usernames and can all interact with each other in a more social, user friendly way.

The app also has a section to store loyalty and rewards cards.

“Its innovative technology is a formative example of the creative ideas and opportunities that have opened up in the area of Australian payments in recent years and we’ve been delighted to support the company in offering exciting new ways to consumers to pay and transact,” a Beem It spokesperson said in a statement.

“Under its new owner, Beem It will be able to take full advantage of the infrastructure, cost benefits and partnerships offered by eftpos which will help it grow faster and expand the innovative services it currently provides."

Beem It has been downloaded over 1.4 million times and holds high rating on app stores.

The app’s user interface is snappy and intuitive, winning it a gold Good Design Australia award in September.

In many ways, the app provides features that already exist baked-in to other banking apps and devices.

PayID and Osko, part of the New Payments Platform, helped do away with entering BSB and account numbers to instantly transfer cash between banks in favour of other personal identifiers such as email addresses, phone numbers, and ABNs.

Neobanks, such as the Bendigo and Adelaide Bank collaboration Up, serve as an all-in-one for deposits, debit purchases, and transfers while also ushering in a new era of user experience and product design for the financial sector without some of the brick-and-mortar overheads of traditional banks.

And the in-built wallets for Google’s Android OS and Apple iOS, along with allowing debit and credit payments, can also store reward cards.