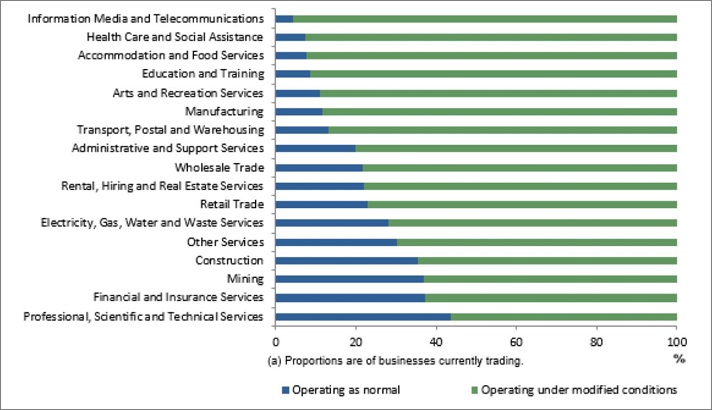

Information media and telecommunications is the sector most changed by COVID-19 with only four per cent of Australian businesses in this industry operating under normal conditions.

The Australian Bureau of Statistics’ (ABS) latest Business Impacts of COVID-19 survey shows the dramatic shift in operating status across the country with more than 50 per cent of businesses operating under 'modified conditions’ – meaning they have either moved online or reduced their work force.

The survey had respondents from 1,430 businesses that were still running despite the unprecedented disruption brought on by the coronavirus.

Along with information media and telecommunications, the other industries whose operations have been altered recently were health care, hospitality, education and training, and the arts.

Head of the industry statistics at the ABS, John Shepherd, warned that the change in business conditions correlated with losses in revenue.

“Businesses that had changed the way they operate were more than twice as likely to report a decrease in revenue compared with those that were trading normally, 83 per cent against 37 per cent,” he said.

Fewer Information Media and Telecommunications businesses are operating as normal than any other industry. Source: ABS

Unsurprisingly, tech companies have proved particularly well-poised to adapt to modified operating conditions like working from home.

The likes of Canva and Atlassian quickly shifted to remote work – following the lead of US tech giants that have been consider the idea of more permanent work-from-home arrangements.

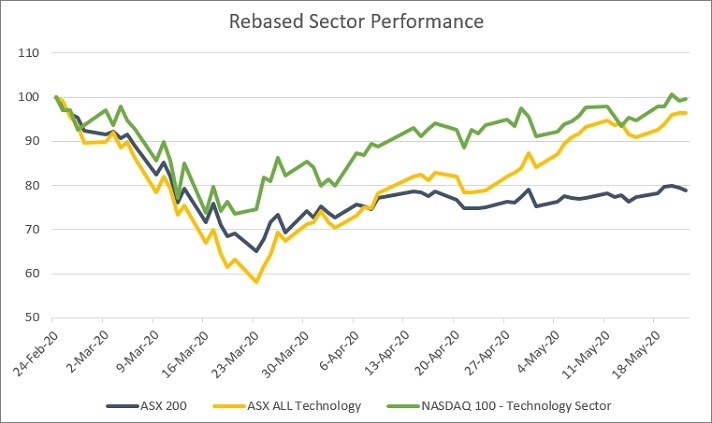

At a time of great economic uncertainty, confidence in the Australian technology sector appears to be stabilising.

In a recent post, Coilin Mcneil, merger and acquisitions partner with accounting firm EY, noted that the ASX All Technology Index has recovered from the initial COVID-19 market shock better than the Australian market overall.

“While the impacts and uncertainty created by the COVID-19 crisis were felt early and intensely in the Australian tech sector, the recovery has also been notably swift,” McNeil said.

“As of closing on the 22nd May 2020, the ASX All Technology Index has recovered significantly to sit at -4% compared to -21% for the ASX200.

“While there are varied underlying factors driving this recovery, from an investment perspective, the technology sector appears more resilient than others.”

The All-Technology index has outperformed the ASX 200 since April. Source: CapitalIQ

Local resilience is echoed by international confidence in technology.

EY’s Global Capital Confidence Barometer report from early May found that technology executives were more optimistic than most about the prospects of a speedy financial recovery.

Using data gathered by surveying nearly 3,000 C-suite executives from around the world, EY found 63 per cent of their technology-related respondents expected global economies to make a fast, V-shaped recovery.

Only 38 per cent of non-tech respondents shared the same sentiment.