Having built itself up as a $7.7 billion global fintech, European company Revolut is about to make a big push into Australia.

A neobank in Europe, Revolut has been operating in ‘beta’ mode in Australia for the last nine months, but announced publicly on Tuesday it was ready to take off the training wheels in its first major market outside of Europe.

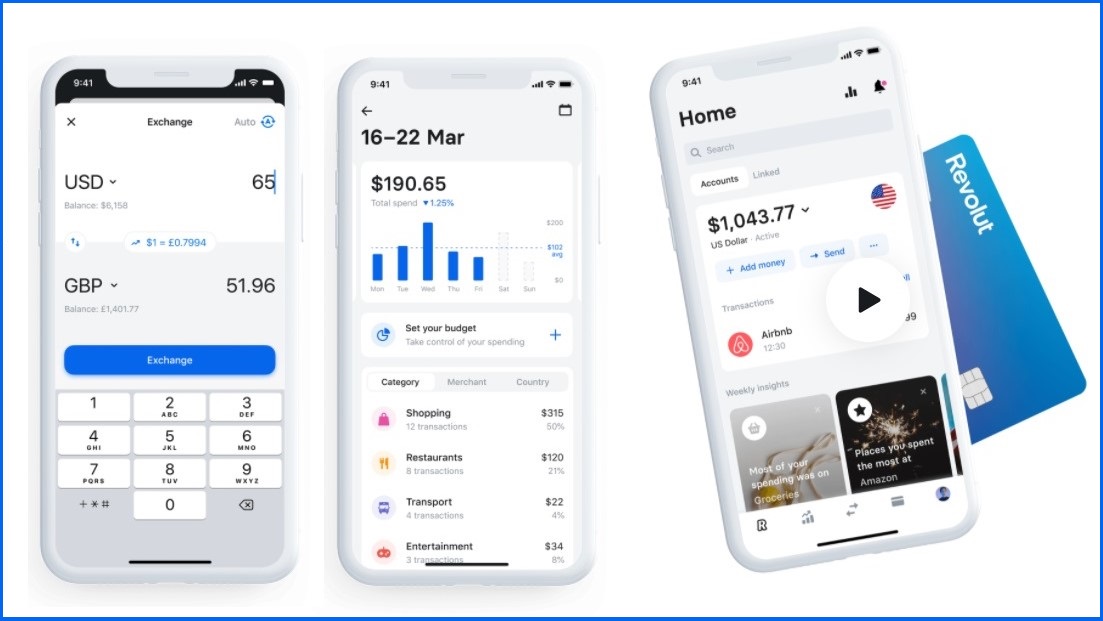

“We’re building towards a super app, where people will be able to manage their entire financial life in just one place,” Australia CEO Matt Baxby told Business Insider Australia.

While that’s the end goal, the unicorn has some way to go to get there – especially in Australia, where it has been operating on a limited basis and within a regulatory grey area since June last year.

In the UK, the fintech cut its teeth as a foreign exchange service, allowing customers to easily and cheaply change their money in a similar vein to another UK unicorn, Transferwise.

With one of its key markets in international travel now off the cards until at least 2021, Revolut is looking to change its strategy somewhat, with an eye to courting Australians sending money overseas as part of the $16 billion remittance market.

That’s just the tip of a very large iceberg, Baxby says.

“Between now and the end of the year Revolut is going to be regularly dropping a lot of new features,” he said. “Being part of a global unicorn means a lot of those are already built and part of our job as the local team on the ground is to localise them for the Australian market.”

Among them will be the ability to hold and trade gold and silver, along with shares and cryptocurrencies for those interested in alternative asset classes. In that sense, Revolut looks like positioning itself firstly as a digital wallet with a trading arm.

“We’ll also be dedicated to teaching young people better financial habits, and we’re looking at having a reward program by the end of the year as well,” Baxby said.

Having clinched its Australian financial services licence (AFSL) in April, he now hopes to now begin growing Revolut’s small local market. It currently has just 15 local employees, a tiny fraction of its 2200-strong global team.

Longer-term, Revolut will focus on officially becoming a neobank in Australia, putting it on a collision course with local upstarts like 86 400, Xinja, and Volt.

With the latter two having been punched in the mouth by COVID-19, Baxby sees Revolut as a different beast — not least of which because it’s partly already been built overseas.

“One of the big advantages Revolut has is that we’re not trying to launch as a bank from a standing start,” he said. “Instead we’re leveraging a global platform and building a profitable payments system in Australia at scale with an established customer base.”

By the time Revolut gets a banking licence Baxby believes it will already have a full head of steam, with a view to attracting one million customers within a few short years.

Unlike its rivals’ strategies thus far, Revolut also operates on an opt-in subscription basis. Users can use the app for free or elect to pay a monthly fee to gain access to improved features – a far cry from the free models most digital banks and fintechs operate on locally.

With foreign exchange largely off the table for now, it’s unclear how much Australians would really be willing to pay right now.

Then again, it appears like Revolut is settling in for the long term.

This article originally appeared on Business Insider and is reproduced here with permission.