The UK government is offering its startups a lifeline with a $2.45 billion (£1.25 billion) package aimed at maintaining innovation during the coronavirus pandemic.

Nearly $1.5 billion worth of grants and loans will be available for high-growth startups to perform research and development which the UK Business Secretary, Alok Sharma, said will help young companies survive a difficult economic climate.

“The UK is a world leader in innovation and at this hugely challenging time, we know that young, fast-growing firms require tailored support to see them through,” Sharma said.

“This wide-ranging package delivers important help that will protect some of the most dynamic sectors of our economy.”

The UK’s startup support package also includes a $1 billion Future Fund that will see the government match capital investment with loans between $245,000 and $10 million for eligible early stage businesses.

In order to access the government loans, UK start-ups need to have raised at least $500,000 on their own in the past five years. The loan amount must also be equalled by private investors.

If they are not fully paid back, the government loans will convert to stock in the company at maturity.

1/ Innovation and entrepreneurship have powered growth in this country for centuries, and it is what will drive our growth as we recover from this crisis.

— Rishi Sunak #StayHomeSaveLives (@RishiSunak) April 20, 2020

So today I launched two initiatives to support the most innovative firms in the county, worth £1.25bn. pic.twitter.com/hZZjh3ftOa

UK Treasurer, Rishi Sunak, said the loan scheme would help small businesses see the light at the end of the tunnel.

“As we look ahead and start to plan for our recovery, it is critical we don’t just maintain companies and jobs that already exist,” Sunak said.

“But that we also encourage the businesses, jobs and technologies of the future.”

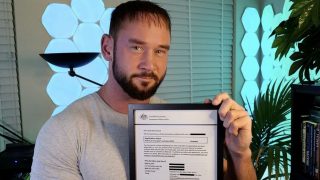

Matching capital in Australia

In Australia, governments’ business-focused stimulus packages tend to be focused on keeping regular pay flowing into bank accounts with the supplemented Jobseeker payment and new Jobkeeper scheme that aims to encourage businesses to maintain their employees during a period of severely disrupted cashflow.

To qualify for Jobkeeper, organisations with a turnover less than $1 billion need to prove their revenue has fallen by 30 per cent compared to the same period last year.

But Neil Alexander, CEO and co-founder of Sydney-based scale-up Data Insite, said the scheme as it stands means Aussie startups could fall through the gaps.

“The number one challenge that startups are facing during this crisis is that they pretty much don’t qualify for Jobkeeper,” Alexander told Information Age.

“Let’s say you started a year or two ago – you’re on the upward trend in terms of revenue so that means, for the same period last year, for the same month last year, your revenue is up sharply.

“However, what’s going to happen is there’ll be a three-month lag and the forward revenue will disappear.

“It’s really challenging because you don’t qualify for Jobkeeper now – but you will.”

He said that, while risk-averse venture capitalists (VCs) are being extra careful with their money at the moment, a UK-style investment-matching loan scheme could encourage VCs to front up much needed money during COVID-19.

“If the government stepped in and said they would match investment, that halves the price of investment which is huge,” Alexander said.

“Now does that mean it would magically make lots of investment available? Well, no. But it’s going to radically change their opinion because it’s an opportunity to double the efficacy of their money.”