A TikTok family has begun spruiking a new cryptocurrency token across their social accounts, an increasingly popular activity that calls into question the government’s hands-off stance on influencer financial advice.

Atis Paul, alongside his sister Anna and girlfriend Michaela Testa, all successful influencers with followers in the millions across TikTok, Instagram, and OnlyFans, took to their instagram stories in late May to promote a new cryptocurrency, Hushcoin.

Paul’s Instagram bio reads “I like my girlfriend and crypto” and displays a link to CryptoBullRuns, an OnlyFans account where he shares crypto insights despite having no background in finance.

With 17,000 likes and 34 posts, the platform promises – for a subscription of $49.99 a month – content such as “Every MUST-have coin to add to your portfolio, “Daily updates on the coins I have recommended,” among other nebulous promises such as “Short Term Investment Strategy.”

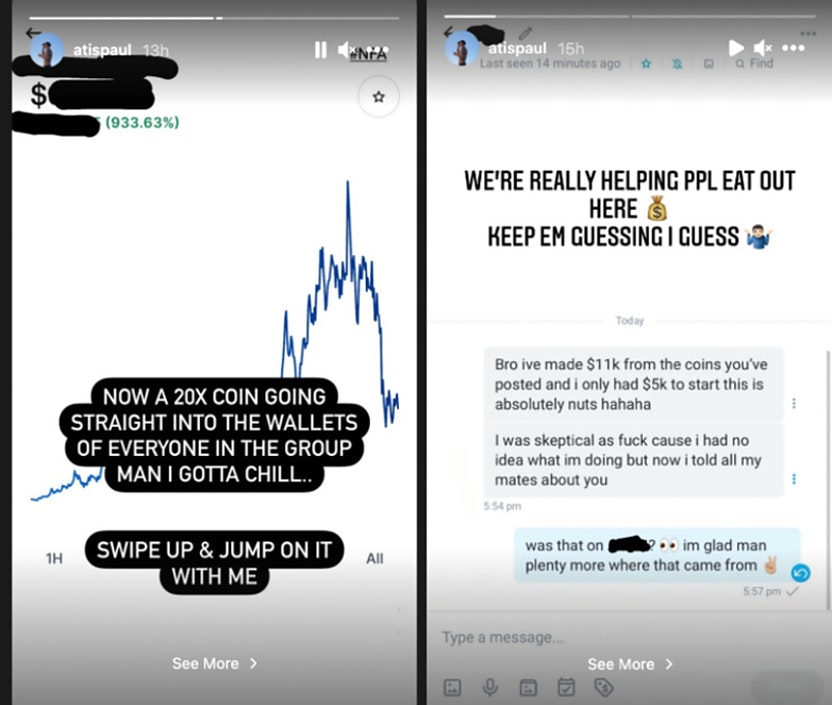

While a disclaimer on the OnlyFans states his content “should be taken as pure entertainment,” a recent Instagram story shows a clear intent for people to follow and implement his strategy.

On June 5, Paul posted an Instagram story showing a message sent to Paul that reads “Bro ive made $11k from the coins you’ve posted”, with text posted over the screenshot that says, “We’re really helping ppl eat out here.”

In late May, commenters first began questioning whether the posts violated the ACCC’s new influencer guidelines, introduced in July 2020, which compel social media influencers to disclose any transaction with financial payment.

Multiple comments below the post questioned the influencer’s credentials to provide advice on cryptocurrency investments.

User averagejoesig posted: “Hi, so you have AFSL Rb. 18 (Financial license) to be operating a financial service product like you do?”

Paul claims that his content is simply “opinion and entertainment,” and his OnlyFans landing page states that the content “is not financial advice and should not be taken as financial advice.”

However, ASIC recommends that an AFS licence is required if you provide financial product advice to clients, and Paul has a subscriber-based income stream from locked OnlyFans content that promises “daily updates on the coins I have recommended.”

Anna Paul, Atis’ sister and one of the top Australian earners on OnlyFans, also pushed the coin in an Instagram story at the time.

“I got into Doge when it just dropped, when it was 0.0000-something cents,” she said in the video.

“I didn’t post it on my story and I regret that so much [because] I could have helped so many people make money — and I’m not making that mistake again.”

“Go Hush. It just dropped and this time I’m actually going to tell you.”

Kate, Amy and Sophie Taeuber of social media watchdog podcast Outspoken, which first broke the story, said that it’s not surprising followers believe the family is involved with the coin, given they haven’t tagged any of their posts as ads.

However, they also pointed out the family has said it definitely does not own the coin.

“In either scenario, they are heavily profiting from their followers buying this coin,” they said.

The sibling’s actions expose the gap between laws governing financial institutions and advertising and the amorphous nature of social media content.

When social media stories disappear within 24 hours, and content easily dodges the gaze of the law, the frameworks set up for monitoring and policing advertising and financial advice appear increasingly unfit for purpose.

The government says financial influencers will ‘better engage younger generations in investment’

In a speech delivered on May 20, Financial Services Minister Jane Hume rejected calls to address the growing number of influencers who have taken to social media to provide questionable financial advice.

“We have to back Australians to be sensible enough to judge for themselves whether to put their hard-earned money into higher-risk assets,” Hume told a conference of the Stockbrokers and Financial Advisers Association.

“Some of the information and opinions that consumers receive from online forums will be bad but some of it will be good,” she said, suggesting that “a lot of it will better engage younger generations in investment and financial markets.”

Hume compared the unsolicited advice to the type that has perhaps always existed.

“The TikTok influencer spruiking Nokia is not that different to the bloke down at the pub who wants to tell you all about the really great company he just invested in but with a much louder voice,” Hume said. “It is an inevitable part of a financial ecosystem.”

RMIT senior lecturer of finance Angel Zhong said that many social media influencers generate income off their content – meaning their motives differ from other non-experts offering generalised advice.

More money being pumped into a stock or a cryptocurrency could help creators cash out their own stake in a market where assets are more volatile.

“Investment advice provided on social media tends to encourage day trading, promote get-rich-quick schemes and FOMO (fear-of-missing-out),” Zhong said.

Crypto-focused content such as that created by Paul “highlights the importance of considering having explicit measures in place to warn vulnerable viewers about the reliability of financial advice in social media,” she said.

‘An inevitable part of the crypto ecosystem’

In an ecosystem where a single tweet from Elon Musk can cause individual coins to plummet or skyrocket, the increasingly private online and social spaces where traders and enthusiasts share tips test the limits of the definition of “influencer”.

As crypto investing advice proliferates online, it becomes less easy to discern who is influencing who.

Mel, a woman living in Queensland and part of the Facebook group “Crypto Investing in Australia – Beginners” – which has increased its membership by 14,000 people since the start of 2021 – said she thinks it is a mistake to assume all young people blindly follow the advice of professional influencers.

While she declined to share her name publicly or those of her children – all of whom trade crypto, too – she said the family gets tips and advice from a range of online sources.

Mel’s 18-year-old daughter has her own CoinSpot account and has bought all the main coins, including Safemoon via a Trust Wallet account.

“She researches but doesn’t buy coins recommended by influencers because they’re only trying to gain followers and make money,” Mel said via Facebook message.

“They’re not stupid, they know influencers are just trying to make money,” she said.

“My 23-year-old daughter has the same and my son is 25 and buys some but is in [a] big Discord group,” where “the main admin guy recommended $CHONK and a lot of people made a lot of money,” she added.

“Don’t be fooled into thinking that young people don’t know what they’re doing in the crypto space,” Mel added.

Similarly, Lucy, also a member of the crypto Facebook group, gave a similar story to many in these online spaces: “I took a random tip off someone in a Twitter thread.”

Lucy claims the tip led to her buying Shiba Inu coin ($SHIB) in February for around $100 and seeing its value rocket into six figures.

She said the volatility of the crypto markets and the absence of an established class of experts reduces the credence of influencers with significant followings.

“Ultimately though, it’s the only opportunity we’ve got,” she wrote.

“Missed the property market boom? Missed bitcoin? I’d rather make $220,000 on $MATIC and $SHIB and lose $2,000 on something else, than never have played at all.”

While on their podcast the Taeubers said advertising a specific coin was “misleading their young and impressionable followers,” even fans of Atis Paul said they wouldn’t necessarily buy the coin because of him.

Jai Cornwall, a 19-year-old follower in Victoria, defended Paul against critics in the comments section but said he wouldn’t necessarily buy crypto just because the influencer promoted it.

He said he was interested in the coin Paul was spruiking, but said he’d “also do a bit of research myself.”

“I’d definitely look into it though, because he is making a lot of money and I know for a fact he is making others money.”

Education, opinion and influence

More established content creators in the space say there’s a difference between pushing a product for financial gain and simply educating people about crypto — and that regulation should account for this.

YouTuber and creator Ravi Sharma hosts “Personal Finance with Ravi Sharma”, a weekly show with around 10,000 subscribers he says seeks to “help educate people” around “cryptocurrencies but also real estate and financial independence.”

He said that his audience, which is 89% Australian and 84% men between the age of 25 and 34, are aware he doesn’t have formal qualifications in finance.

He believes his approach makes it clear to viewers that his content isn’t intended as financial advice.

“I don’t offer any advice, I just share my own experience and what research I am doing,” Sharma said.

Stephan Livera has been running a bitcoin podcast for the past four years, which he says has had over 2 million downloads, with CEO of Twitter and Square Jack Dorsey its most high-profile guest.

He said he started his podcast as a counterbalance to the spread of “misinformation” in 2017.

There was a lot of “very questionable or outright scammy material being presented,” he said, adding “my frustration was with this idea that there was no clean, honest path for people to just literally learn about the economics of the technology of bitcoin.”

Livera’s bullish approach to Bitcoin dismisses other coins as distractions from what he sees as Bitcoin’s eventual dominance and other coin’s obsolescence.

“I’m just not interested in all the other stuff because most of it is scams,” he said, a message he also hammers home to his audience.

“The way I see it is that a lot of young people don’t understand what they’re doing. And they go buy Doge, because Elon pumped it or they’re buying some stupid NFT,” he said.

“That’s part of why I’m able to help educate why they should be learning about Bitcoin. Because that’s how they can benefit themselves.”

This article originally appeared on Business Insider Australia.