Twitter CEO Jack Dorsey is selling his first ever tweet and so far the highest bid is for US$2.5 million.

His famous first words “just setting up my twttr” are currently up for auction on Valuables, a platform where Twitter users can mint cryptographically signed copies of their tweets on a blockchain to be bought and sold with cryptocurrency.

Once the auction is finished, the one-of-a-kind autographed Dorsey tweet will belong to the highest bidder.

As strange as it may seem, these kinds of cryptocurrency transactions – complete with outlandish price tags – have exploded in popularity this year as artists, musicians, and collectors race to demonstrate blockchain’s latest use-case.

What’s really being traded when Jack Dorsey sells his tweet is a kind of digital certificate of authenticity in the form of a non-fungible token (NFT) – a digital asset with its records of ownership stored on a blockchain, typically the Ethereum network.

— jack (@jack) March 6, 2021

Where NFTs differ from cryptocurrencies like Ether, bitcoin, or Doge is that each token is unique, and not interchangeable – which has been a blessing for the world of digital art where works can be infinitely copied at almost zero cost.

$4.8 million for a JPEG

In February, major auction house Christie’s opened the bidding for its first purely digital artwork sold with an NFT: a 21,069 by 21,069-pixel JPEG collage of 5,000 pictures from digital artist Mike “Beeple” Winkelmann.

Beeple has made one new picture every day 13 years and the ‘Everydays’ collage represents the first 5,000 images, chronicling the development of the artist and broader society between May 2007 and January 2021.

The sale of Beeple’s digital artwork represents a shift in the way art is valued. Image: Christie’s

Due to finish this week, the auction price of Beeple’s digital collage has reached US$3.75 million ($4.8 million).

“Now all of the pieces are in place with the blockchain for the traditional art world to take digital art and really be able to collect it in a true sense,” Beeple said.

“You can prove ownership; there’s scarcity.

“There’s tens of thousands of people making this digital art and it has just as much nuance and message and craft as any other medium.”

Online markets like makersplace, which is partnering with Christie’s for the Beeple auction, and OpenSea mean anybody can become a collector of digital art.

All you need is a crypto wallet that enables smart contracts – MetaMask is a user-friendly wallet commonly used by NFT markets and decentralised finance (DeFi) apps – plus enough Ethereum to pay for the artwork and cover the cost of transfer fees, ‘gas’, which can often be quite high.

Then it’s a matter of finding a piece of art in your price range to add to your collection. These could be one-of-a-kind mintings like the Beeple collage or a meme like the Nyan Cat gif which original artist Chris Torres sold for 300 Ether (around $600,000) last month.

But NFTs also serve as a way of producing limited-edition art like those sold by Grimes – wife of Elon Musk – on the NiftyGateways platform last week.

Grimes sold 303 tokens ($US7,500 each) for her artwork ‘Earth’: a 3D-rendered video of a winged baby floating above the Earth.

There is nothing stopping you from right-clicking the video of ‘Earth’ on NiftyGateways and downloading the MP4 for yourself – but it’s not the copy of the video that’s valuable, rather the digital certificate of authenticity represented by its NFT.

Artists can also benefit from the re-sale of their tokens by using smart contract features that see them receive a small cut of future NFT trades.

A new way to collect music

Musicians are also experimenting with using NFTs to sell albums.

Following two decades of disruption at the hands of digital technologies – first through peer-to-peer sharing software, then the advent of streaming services – NFTs could be a way for musicians to reclaim the scarcity of their work that has been so easily copied and distributed.

US rock band Kings of Leon released its new album ‘When You See Yourself’ simultaneously on streaming platforms and as an NFT through YellowHeart.

The release isn’t restricted to the digital album and includes a host of other NFTs like limited edition artwork and special ‘golden tickets’ that will six give fans front-row seats to Kings of Leon concerts for life.

Bands like Kings of Leon are turning to the blockchain to make music sales. Image: Supplied

YellowHeart CEO and founder Josh Katz said he expects NFTs will encourage music fans to buy their music once more.

“Over the last 20 years — two lost decades — we’ve seen the devaluation of music,” he told Rolling Stone.

“There’s been a race to the bottom where, for as little money as possible, you have access to all of it.

“It’s early stages, but in the future, I think this will be how people release their tracks: When they sell a 100,000 at a dollar each, then they just made $100,000.”

Of course, if you just want to listen to ‘When You See Yourself’, you would be better off heading to a streaming platform where access is instant and integrated.

The band put out a statement saying it wasn’t easy to be “groundbreaking” and acknowledged the difficulty its fans were having getting hold of the NFT.

“Many fans are first-time NFT buyers and are experiencing a learning curve,” Kings of Leon said.

“Please continue to share your experience with us, so we can help wherever possible.”

In the early days of the Kings of Leon album launch, YellowHeart posted three-minute video walking through the many steps of actuallying buy the album: create a MetaMask wallet, buy Ethereum, authorise the trade, redeem the token, download the goods.

But collectables aren’t necessarily about accessibility – especially if their value goes up.

Speculative assets

While art and music does appear to be a new use-case for blockchain through thanks to the advent of NFTs, it is still open to criticisms long leveled at cryptocurrencies: that it is only valuable as a speculative asset.

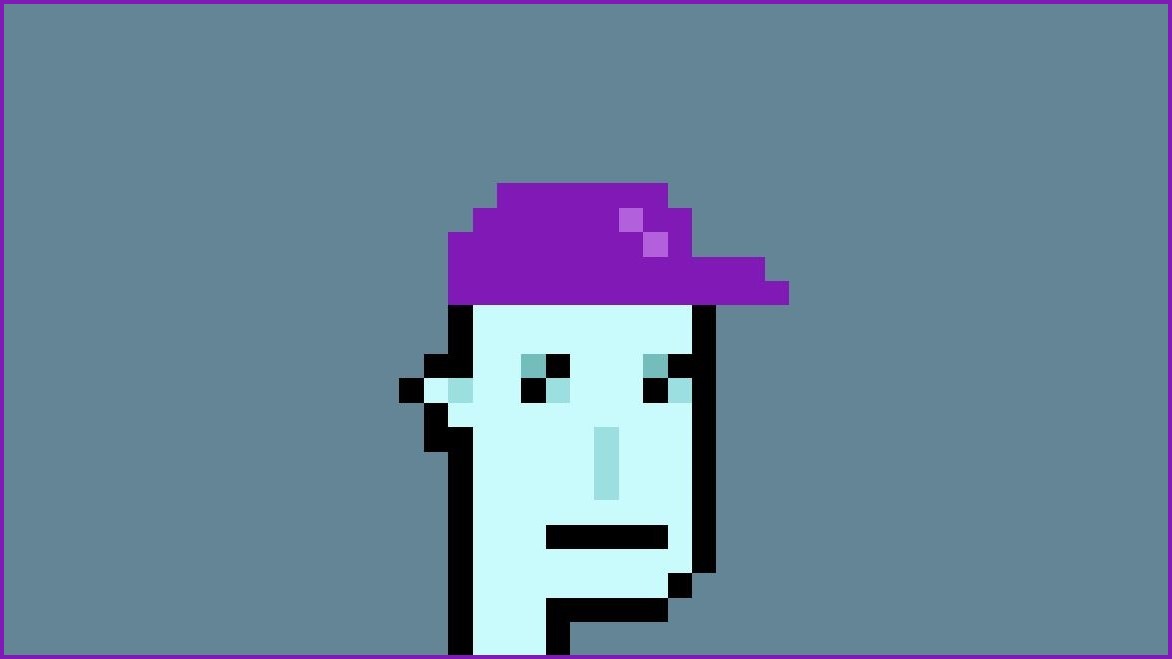

CryptoPunks were one of the earliest examples of using NFTs for art.

Created by Matt Hall and John Watkinson using the ERC-20 standard for Ethereum tokens popularised by initial coin offerings, CryptoPunks are simply 10,000 characters, or ‘punks’.

CryptoPunks don’t look like much but they are worth a lot of money. Image: LavaLabs

Each punk has a different set of characteristics and accessories – but they are all essentially just computer-generated pixel art.

Watkinson and Hall gave away the CryptoPunks for free to anyone with an Ethereum wallet. Initially no one seemed to notice – until US news site Mashable posted a story about the project.

The NFT was a sudden hit.

Within a day, all the remaining 8,600 CryptoPunks were claimed and people began trading the assets using the in-built marketplace and one of the founders’ own alien-type punks (there are only nine) sold for 10 Ether – or about US$3,000 at the time.

“I was just like, whoaaa,” Watkinson told BreakerMag. “The day before that, we were like, will anyone care?”

Today you would be hard-pressed to buy a CryptoPunk for less than five figures. In the past 12 months, nearly 6,800 punks have changed hands at an average sale price of 11 Ether – currently around $25,000.

Rare alien punks sell for much more, such as this alien with a cap that sold for 605 Ether in late January. Today, that image is worth $1.4 million.