Australians are reminded not to invest money with anybody they have only ever met online, days after the AFP seized $22.5 million and charged four Chinese nationals for enabling a global investment scam that has fleeced victims of over $144 million ($US100m).

The complex scam saw a network of criminals employing a mixture of social engineering techniques – including dating sites, employment sites, and messaging platforms – to gain the trust of victims, then steer them towards investment opportunities with claimed strong returns.

Victims would be manipulated into subscribing to a legitimate financial investment service, which would flood them with investment data to steer them towards profitable investments.

Fabricated data substantiating claimed returns were fed into legitimate electronic trading platforms – used every day to facilitate foreign exchange and cryptocurrency transactions – to support claims of a positive return on the investments.

A joint NSW Police and AFP Cybercrime Operations Eastern Command task force, called Project Wickham, was initiated after a tip-off from the US Secret Service and led to the arrest of two alleged perpetrators in Sydney on 20 October.

Two other suspects were arrested on 24 November while trying to flee Australia for Hong Kong.

The first two men have been charged with recklessly dealing with proceeds of crime, while the second pair were charged with dealing in proceeds of crime – money or property worth $10,000,000 or more, potentially carrying up to 15 years’ imprisonment.

The four were said to have been used by a global crime syndicate to establish Australian businesses and bank accounts to facilitate the laundering of the proceeds from the scam.

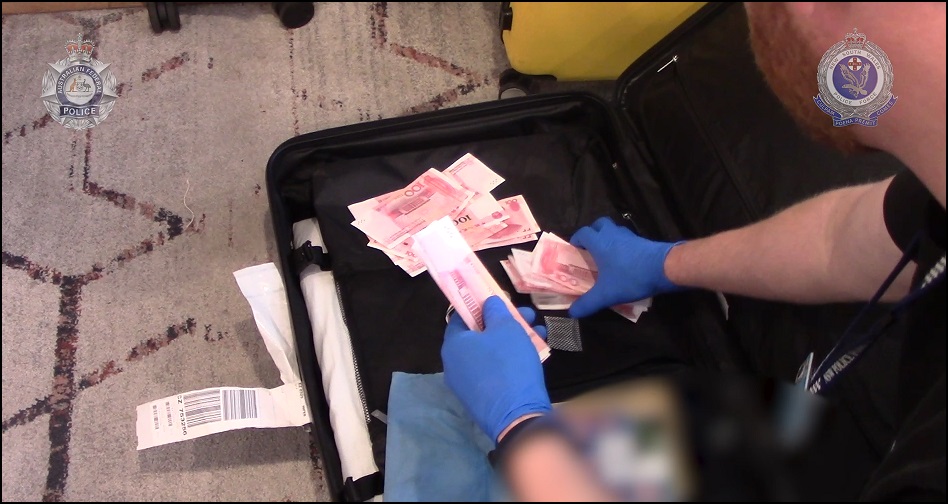

Money was found in suitcases during the bust. Photo: AFP

The scheme’s success in deceiving Australian victims is a timely reminder about the ever-present threat of investment and other scams, AFP Cybercrime Operations Eastern Command detective sergeant Salam Zreika said as the arrests were announced this month.

“It is essential people exercise the utmost caution if cold-approached online or on the phone by people trying to sell financial or investment services,” Zreika said, advising Australians to “refrain from investing in foreign exchange, cryptocurrency or speculative investments with people you’ve only ever encountered in the online environment.”

“Criminals are ruthless and will stop at nothing to take your money,” she said.

Think globally, arrest locally

The successful operation highlights the increasing effectiveness of international partnerships between law enforcement organisations, US Secret Service attaché Ike Barnes said, noting that scammers and cyber criminals are often found “attempting to exploit international boundaries in the hope of avoiding detection and arrest.”

The Secret Service also recently arrested four Americans for using business email compromise (BEC) and credit card fraud schemes to steal over $A13.2 million ($US9.2m), for example, while the AFP also assisted a 10-country investigation that last month saw the arrest of 142 people operating a fraudulent website that had facilitated the theft of over $176 million (£100 million) from victims around the world.

“Together with the support of partners across UK policing and internationally, we are reinventing the way fraud is investigated,” said London Metropolitan Police commissioner Sir Mark Rowley, noting that authorities are “targeting the criminals at the centre of these illicit webs that cause misery to thousands.”

“By taking away the tools and systems that have enabled fraudsters to cheat innocent people at scale, this operation shows how we are determined to target corrupt individuals’ intent on exploiting often vulnerable people.”

Australians lost over $425 million in more than 160,000 reported online scams during the first nine months of this year alone, according to the ACCC, which noted that the figure is a 90 per cent jump over last year.

Total scam losses passed $2 billion last year alone and are expected to reach $4 billion this year, according to the ACCC, whose deputy chair Delia Rickard recently warned that “increasingly sophisticated and unscrupulous” scammers had capitalised on the “recent spate of large-scale data breaches.”

With professional and amateur cybercriminals expected to continue ramping up their activities in 2023, the surge in scam losses is unlikely to abate any time soon – underscoring the importance of scam awareness and education for anybody spending time online.

“While there is a great deal of work underway to disrupt scammers, our best defence against these types of scams is education,” Rickard said. “We want Australians to know what to look for, so they don’t get caught out.”