Tax write-offs for small businesses investing in tech and skills, a shot in the arm for the Australian Signals Directorate, and increases to the number of skilled migrant visas featured in Tuesday night’s budget as the government pitched its next economic plan ahead of the upcoming election.

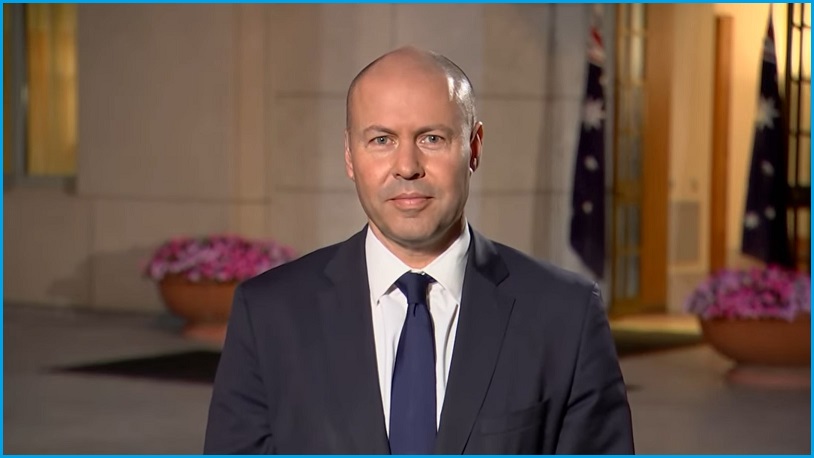

“We live in uncertain times,” Frydenyberg said in his budget speech.

“The last two years have been tough for our country, there have been setbacks along the way. But Australia remains resilient. Australians remain strong.”

The government’s “plan for the times” will see an expanded cyber security budget through what Frydenberg, formally announcing the already leaked policy, called “a new 10 year, $9.9 billion investment in Australia’s offensive and defensive cyber capabilities”.

The Resilience, Effects, Defence, Space, Intelligence, Cyber and Enablers (REDSPICE) package will be run out of the Australian Signals Directorate (ASD).

Much of the $9.9 billion over 10 years for REDSPICE will be offset by moving it out of Defence to the ASD, with the first year forecast in the budget papers seeing $8.7 million less spent on the program.

Over the following three budget years – from 2023-24 to 2025-26 – $597 million in additional funding will go toward REDSPICE, a program slated to triple Australia’s offensive capabilities and add 1,900 new personnel to the ASD’s workforce, according to the ASD.

Frydenberg said it will add “more data analysts, computer programmers, and software engineers to boost our capacity to prevent and respond to cyber threats”.

ACS President Dr Nick Tate said he was “extremely pleased” the government was recognising the importance of cyber security.

“Protecting Australia’s digital infrastructure is essential to guaranteeing the nation’s security and keeping our industries and society running, so we welcome the cybersecurity investment,” he said.

“We would flag however that Australia needs a skilled workforce to maintain a robust cybersecurity sector and meet the demands of an increasingly digital economy and society.”

Small business win

Technology skills demands are to be partially met through small business tax deductions.

Businesses with annual turnovers less than $50 million will be able to deduct an extra 20 per cent of the cost of expenses and depreciating assets for technology investment up to $100,000 per year.

Small businesses will also be able to deduct an extra 20 per cent of the cost of external training courses delivered by registered Australian providers.

“For every hundred dollars a small business spends on training their employees, they will get a $120 tax deduction,” Frydenberg said in his speech.

“[And] every hundred dollars these small businesses spend on digital technologies like cloud computing, eInvoicing, cyber security and web design will see them get a $120 tax deduction.”

Technology investment deductions will apply from spending between now and 30 June 2023, while training expense deductions will continue to apply until 30 June 2024.

The combined deductions are estimated to cost more than $1.5 billion in tax receipts over the forward estimates.

Skilled migration

Migration is also set to increase with the government shuffling around available placements with the hopes of boosting the number of skilled migrants.

Overall migration is expected to ramp up over the coming years, with forecasts estimating Australia will have a net overseas migration of 180,000 people in the 2022-23 financial year – a significant increase from the projected 41,000 in 2021-22 following migration losses in the heart of the pandemic.

The government plans on moving 10,000 partner visas to the skill stream in order to increase the cap on skilled migrants to 89,600 for the rest of 2021-22.

It then wants to increase the amount of skilled visas to 109,900 a year, making it a more significant portion of the total 160,000 migrant places from 2022-23.

Also in the budget was a further commitment from 2023-24 to provide $9 million (over three years) for continuing supporting the Academy for Enterprising Girls – a free entrepreneurship program available to all young women in Australia between the ages of 10 and 18.

Regional telecommunications infrastructure will hopefully benefit from a $1.3 billion regional telecommunications package that includes $811 million over five years to improve regional mobile coverage, which goes alongside the already announced $480 million NBN upgrade to fixed wireless and satellite services.

Over $12 million a year is earmarked to implement recommendations from the Inquiry in the Future Directions of the Consumer Data Right (CDR).