Tesla CEO Elon Musk could be plotting a takeover of social media platform Twitter, after walking away from a board seat that would have limited his ability to own more shares in the company.

Musk took a surprise 9.2 per cent stake in Twitter in March at a cost of $3.85 billion, becoming Twitter’s largest shareholder and immediately boosting its stock price.

He was then offered a seat at the company’s board which, according to a filing Twitter made to regulators, would have limited Musk to owning no more than 14.9 per cent of Twitter.

In a tweet on 5 April, Twitter CEO Parag Agrawal wrote: "I’m excited to share that we’re appointing @elonmusk to our board! Through conversations with Elon in recent weeks, it became clear to us that he would bring great value to our Board.

"He’s both a passionate believer and intense critic of the service which is exactly what we need on @Twitter, and in the boardroom, to make us stronger in the long-term. Welcome Elon!"

Elon Musk responded in kind, saying he was "looking forward to working with Parag and Twitter board to make significant improvements to Twitter in coming months!"

But an announcement from Agrawal less than a week later revealed Musk had changed his mind.

“I believe this is for the best,” Agrawal said in a note sent to the Twitter team.

“We have and will always value input from our shareholders whether they are on our board or not. Elon is our biggest shareholder and we will remain open to his input.”

Since becoming Twitter’s largest shareholder, Musk has been actively tweeting about potential changes to the platform like the addition of an edit function and ability to pay for blue-check verification.

A few days ago he asked “Is Twitter dying?” after retweeting statistics about the most followed accounts on the social media platform, many of which are quieter compared to Musk.

Some of the speculation around Musk’s decision to decline the board seat has been around fiduciary obligations a board position would impose on him, potentially limiting Musk’s ability to post memes about smoking weed in board meetings or generally rag on Twitter as a platform.

— Elon Musk (@elonmusk) April 7, 2022

But he could also be posturing to take a bigger stake in Twitter – something that would be considerably more expensive now given the share price boost resulting from his investment.

Twitter’s co-founder Jack Dorsey stepped down as CEO late last year following a move from activist investors who took a four per cent stake in the company in 2020 with a view of squeezing Dorsey out.

Musk’s ownership in the company is considerably larger and he has the added benefit of being one of Twitter’s main attention draws after the social media giant banned former US President Donald Trump in the wake of the January 6 Capitol riots.

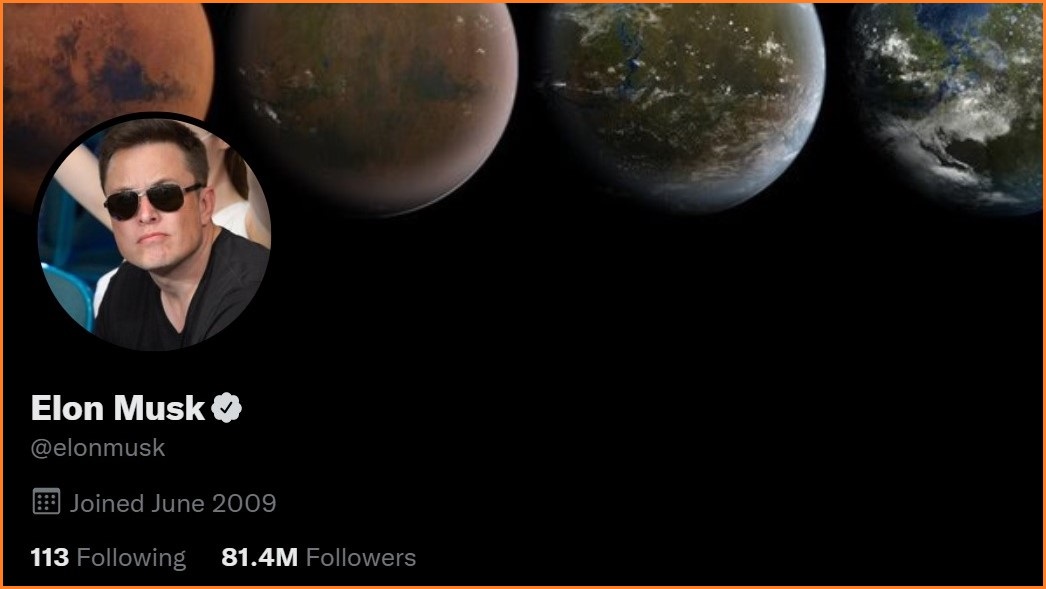

With 81.4 million followers and prolific tweeting activity, Musk is as popular as he is divisive and, as seen with his move into cryptocurrency, has the ability to move markets with a single tweet.

But anti-takeover provisions in Twitter’s bylaws make it even more difficult to land a full aggressive takeover by limiting the ability for a large shareholder to change the makeup of Twitter’s board, as well as the ability for the board to issue a large tranche of voting shares to stop outside parties gaining control.

For Agrawal, the message to Twitter employees is to stay the course and hope Musk’s attention turns elsewhere soon.

“There will be distractions ahead, but our goals and priorities remain unchanged,” he said.

“Let’s tune out the noise, and stay focused on the work and what we’re building.”