Forget the dream of working by a remote beach or in a mountain resort.

'If you want to work in Australia’s IT industry, get to Sydney, Melbourne or Brisbane' is the message from a report released today by the CSIRO and the Tech Council of Australia.

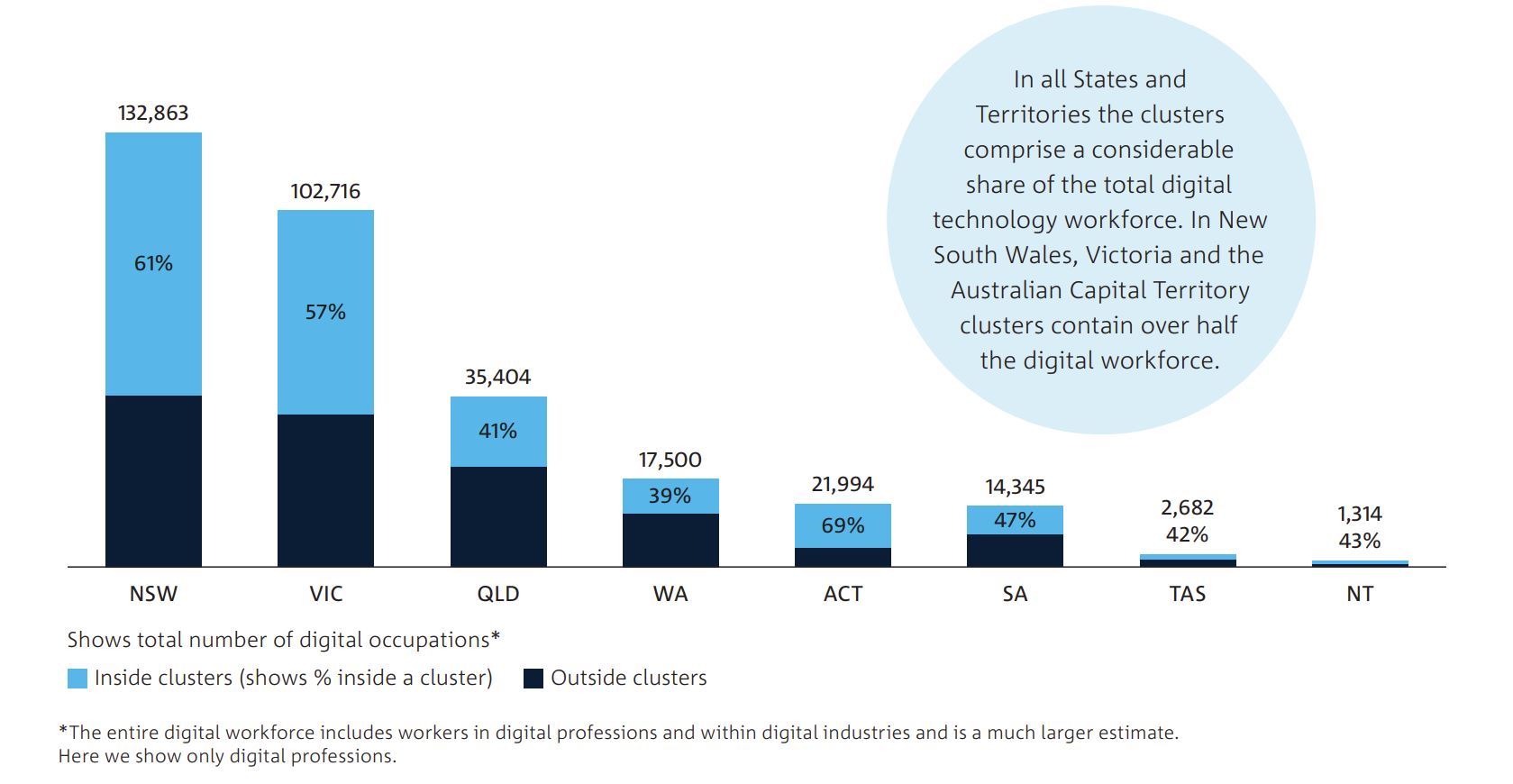

The Geography of Australia’s digital industries report to be launched this afternoon at federal Parliament shows the bulk of the nation’s technology jobs remain in the nation’s three biggest cities, with most of the workforce living in the suburbs and commuting or working from home.

Exploring how Australia’s tech sector is following the pattern of overseas technology clusters such as Silicon Valley in the US, ‘Silicon Fen’ in the UK’s Cambridge and Toulouse in Southern France, the report looked at how the concentration of businesses and workforces boosts growth and productivity.

Lead report author and CSIRO principal researcher Dr Stefan Hajkowicz said the report identified four capital city-based super clusters along the east coast, as well as significant, but smaller clusters in places like Perth, Hobart and Darwin.

“The report has also noted the rise of highly specialised clusters in regional areas, for example we are seeing the rapid growth of the graphic design profession in coastal areas like Burleigh Heads," Dr Hajkowicz said.

“We’re not searching for Australia’s Silicon Valley, we have our own clusters with their own unique blend of technology specialisations, companies, and cultures.

“But we do see the same patterns of intense spatial clustering of technology industry occurring in places like California, Cambridge, Toulouse and other places worldwide.”

Of the 96 identified digital clusters across Australia, the ‘Sydney Arc’ stretching from the city’s North Western suburbs through to the inner city suburb of Redfern is the nation’s biggest employment cluster with 20% of Australia’s tech jobs in those areas.

Source: Geography of Australia’s digital industries

Melbourne’s ‘diamond’ area is more concentrated around the CBD encompassing Docklands, the inner Bayside suburbs and the Victorian government’s innovation precinct around Cremorne, south of Richmond. This area employs 16% of the nation’s workforce.

Third is the corridor along the north bank of the Brisbane River stretching from Toowong in the West to Bowen Hills in the East. This area however only accounts for 5.6% of Australia’s tech employment.

The biggest individual districts for IT employment were the Sydney CBD – described as ‘Millers Point’ in the report – which boasted just 60,000 jobs; the Mebourne CBD with 40,000 staff; Brisbane City with 22,000; Melbourne Docklands with 21,000; and North Sydney – labelled ‘Lavender Bay’ – with just over 15,000 roles.

Underscoring the rapid drop off in tech jobs once an IT worker leaves the Melbourne and Sydney enclaves is the regional employment with the numbers in the clusters outside capital cities being sparse. For instance on the Gold Coast, one of the regional ‘hot spots’, the report found only 533 workers in the entire region with 153 of them residing in Burleigh Heads.

This pattern was repeated across the country with regional ‘tech hot spots’ often reporting less than a hundred people employed in the district.

Source: Geography of Australia’s digital industries

Outside of Brisbane, the bulk of Australia’s IT workers are also commuters. While 57,000 tech professionals live in the Brisbane CBD, the other major places of residence are Parramatta and Blacktown in Sydney’s West with just under 17,000 calling those suburbs home.

In Melbourne, the report noted of the 13,553 digital workers who live in Wyndham, only 2,626 also work there, meaning the remaining 10,927 digital workers who live in Wyndham work in another local government area and either commute or telecommute.

The commuting experience reflects overseas trends, where technology clusters like California’s Silicon Valley, New York and London all see a large proportion of their workforce travelling in from the suburbs.

To overcome the concentration of jobs and ensure Australia doesn’t follow the overseas pattern where tech clusters result in the crowding out of residents and other industries, the report suggest governments look at initiatives that co-locate firms and research organisations, boost training and education, stimulate innovation through better R&D and commercialisation programs, and modernise government services.

CSIRO's acting Chief Executive Kirsten Rose said that understanding the employment patterns of Australia’s tech clusters is important as international research shows the many benefits of these regions.

“The experience globally has shown that firms in clusters grow, employ and innovate at a faster rate,” she said.

“We know comparatively little about this in Australia, but what this report tells us very clearly is that geography matters and understanding that geography can help us catalyse growth.”