Have you seen that Google is going to start deleting accounts people aren't using?

The company has announced it plans to proceed with deleting accounts nobody has logged into for two years.

“Before deleting an account, we will send multiple notifications over the months leading up to deletion,” it said.

Sounds perfectly fair, but someone with a long corporate memory might pause.

After all, Gmail took off only after Hotmail began to squeeze its users.

In the early 2000s, Hotmail would let you store only 2MB of data in your account, deleting anything that didn’t fit under the limit, or bouncing emails back to sender.

It would delete your account if you didn't log in for two months. I lost [email protected] in one such purge and never went back.

This was precisely what let Google eat its lunch.

Hotmail had first-mover advantage and was trying to monetise that, but Gmail stole all the users with its promise of enormous storage (then 1GB, now 15GB).

Gmail was released to the public in 2004 using an invitation system (similar to that being used by BlueSky today) and soon became the dominant force in browser-based email, offering a compendium of useful, mostly free services.

But now the great giveaway is being shown to have its limits.

Why now?

So why do tech services all suddenly seem to be getting worse, more expensive, or both?

There are two theories of what’s going on.

One is the viral concept of “ensh*ttification”. That theory was expounded by tech journo Cory Doctorow earlier this year and it goes like this:

“Here is how platforms die: first, they are good to their users; then they abuse their users to make things better for their business customers; finally, they abuse those business customers to claw back all the value for themselves. Then, they die.”

His is a life-cycle analysis. It’s not wrong, but it doesn’t explain the synchronous phenomenon we are seeing now.

Tech businesses everywhere are cutting costs and raising prices.

Google alone is raising prices for Google Workspace, YouTube Premium, and cloud storage.

Spotify is raising prices for Australian customers. Netflix is adding an ad-supported service. Twitter is charging for verification – and it’s all happening as the tech sector has been cutting jobs.

Across the tech space, there is a race to turn profit. Investors are no longer patient. They want returns now, and are willing to reward companies that provide them.

When Amazon beat profit expectations in the second quarter this year - by 89 per cent – its stock rose 10 per cent.

But this is exactly what we should expect in a time of rising interest rates – free things start to cost money, and/or get worse.

When interest rates are low, investors haven’t much better to do with their money than invest in long-term moonshots.

The alternative is making 0.1 per cent on Treasury bonds.

But when those bonds are paying 5 per cent interest they begin to look attractive compared to speculative longshots.

Companies that want to compete for investor dollars need to be spitting out cash.

It’s the opposite of the last few years where growth was everything and making money was almost frowned upon.

That is causing the great buffet of free and cheap online services that we've enjoyed over the last decade to tighten up.

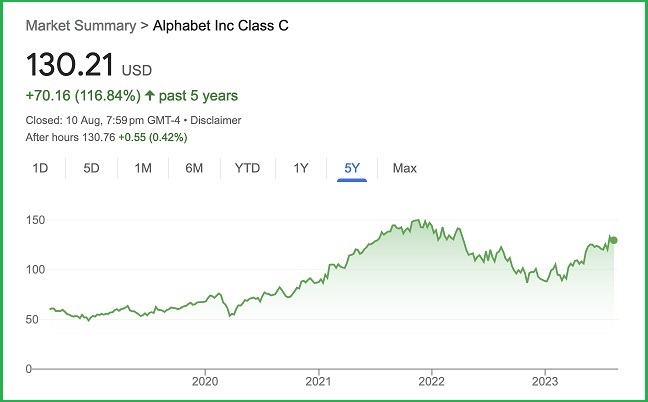

It is why the Nasdaq has been outperformed by the broader stock market since the rate hiking cycle began – all those dull industrial firms with steady profits look a lot more interesting to investors now.

As the next chart shows, Google’s stock price began to sink in early 2022 as it became clear rates were set to rise and it hasn’t recovered its earlier highs.

Cory Doctorow’s life-cycle analysis is not totally wrong, but that’s because loose monetary conditions give birth to free, amazing online services, and later, tight monetary conditions help kill those same services off.

So long as interest rates remain high, expect more of this!

What was free will either get worse or stop being free, and many businesses that won a lot of customers but didn't grip them very tightly will shrink.

But if the US wins its fight against inflation soon, and interest rates can begin to fall once more, then online services can be generous again.

You may not lose that email account you haven’t logged into for two years!