Australians lost more than $2.7 billion in scams last year, with almost half due to investment scams.

According to a new report released by the ACCC’s National Anti-Scam Centre, this figure represents a 13.1 per cent decrease in scam-related financial loss, a significant drop from the $3.15 billion reported in 2022.

Catriona Lowe, Deputy Chair of the ACCC, said, “It is encouraging to see signs that our coordinated scam prevention, detection and disruption initiatives can stem the flow of funds to criminals and protect consumers.”

However, despite overall financial gains, scam activities are on the rise in Australia and across the globe.

According to the report, 601,000 individuals in Australia were victimised last year, which represents an 18.1 per cent increase from 2022.

“It’s absolutely devastating when we see Australians lose money to the criminal gangs operating these sophisticated scams,” said Anna Bligh, CEO of the Australian Banking Association (ABA).

A majority of successful scams in 2023 were investment scams, which accounted for $1.3 billion dollars – almost half of all financial loss.

Other common cons included remote access scams and romance scams, each costing Australians more than $200 million.

Source: ACCC National Anti-Scam Centre

Scammers targeting at-risk groups

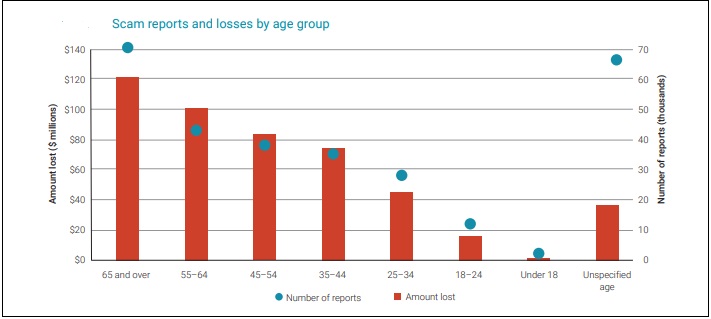

Scamwatch data shows that people over the age of 65 are more likely than others to fall victim to scammers and are particularly vulnerable to investment scams.

This demographic was also the only group to report an increase in financial losses in 2023.

“Reports to Scamwatch indicate scammers are targeting older Australians with retirement savings, who may be looking for investment opportunities,” Lowe explained.

Job and employment scams are also on the rise, increasing by a whopping 151.2 per cent since 2022.

These disproportionately impacted individuals seeking additional income to ease cost-of-living pressures and people from culturally and linguistically diverse (CALD) backgrounds.

Sunita Bose, Managing Director of the Digital Industry Group Inc. (DIGI), noted that 30 per cent of people who fall victim to a scam do not report it.

“Australians should have no shame in coming forward to report scams if they’ve fallen victim to the sophisticated and organised economic criminals committing large scale fraud,” Sunita said.

“Even if you’re not a victim yourself, reporting activity to companies helps prevent future attempts and protect other Australians.”

Source: ACCC National Anti-Scam Centre

More protections on the way

Despite the drop in overall financial loss, Lowe said the ACCC’s National Anti-Scam Centre still has more work to do.

“Over the next two years we will continue to invest in technology-based solutions that will centralise intelligence and distribute information to those who can act on it – such as banks to freeze accounts, telcos to block calls or SMSs and digital platforms to take down websites or accounts,” Lowe explained.

The ABA said that the banking industry is working together to help protect Australians and avoid victimisation.

“The banking industry’s Scam-Safe Accord is a major step-up in protections from banks to shield consumers from scammers,” said Bligh.

“It’s a set of world-leading safeguards by banks to help keep the money of Australians safe.”

The accord includes the introduction of new payee systems, additional warnings and delays to prevent financial loss and the adoption of new technologies and protections to prevent identity fraud.

The Australian Government is also developing a Scams Code Framework, which will outline the roles and responsibilities of banks, digital platforms, telcos and other private organisations to protect their customers.

“Banks and the telcos have said they will back the Government’s mandatory scams code, and I strongly encourage the social media platforms to do the same,” Bligh added.

The government is currently reviewing submissions from the consultation on this framework, which closed on 29 January.