The number of people applying for technology jobs has more than doubled in the last two years, as the number of roles being advertised fell to below pre-COVID levels, according to new data.

The SEEK Labour Market Balance report provides a snapshot of the relative “tightness” or “looseness” of the Australian labour market using a range of indicators and comparing these to pre-pandemic rates.

It defines a tight labour market as one where it is easier for job seekers to find work but harder for companies to find suitable candidates, and a loose one where there is more competition among job seekers for fewer roles.

The new report found the labour market had loosened since late 2021 but was still tighter than it was prior to the onset of the COVID-19 pandemic.

“There are still jobs out there for those searching but they are not as plentiful as they were,” the SEEK report said.

“It is taking 10 weeks longer for the average job seeker to find a job and there is more competition for roles.

“From a hirer perspective, this means that there are now more potential candidates to choose from and roles should be easier to fill than in 2022.”

One of the metrics used in the report was the number of applications for job ads posted on SEEK.

It found the number of applications for higher-paid roles did not increase following the onset of the pandemic in 2020, but have increased substantially since 2022.

Applications for Information and Communications Technology (ICT) roles more than doubled in the last two years.

This may reflect a decline in demand for such roles since 2019, with fewer job ads being posted, the report found.

“It is one of a handful of SEEK classifications where ads are currently below their 2019 levels and applications per ad are elevated as a result,” the SEEK report said.

“So there has definitely been a loosening in some pockets of the labour market relative to 2019.”

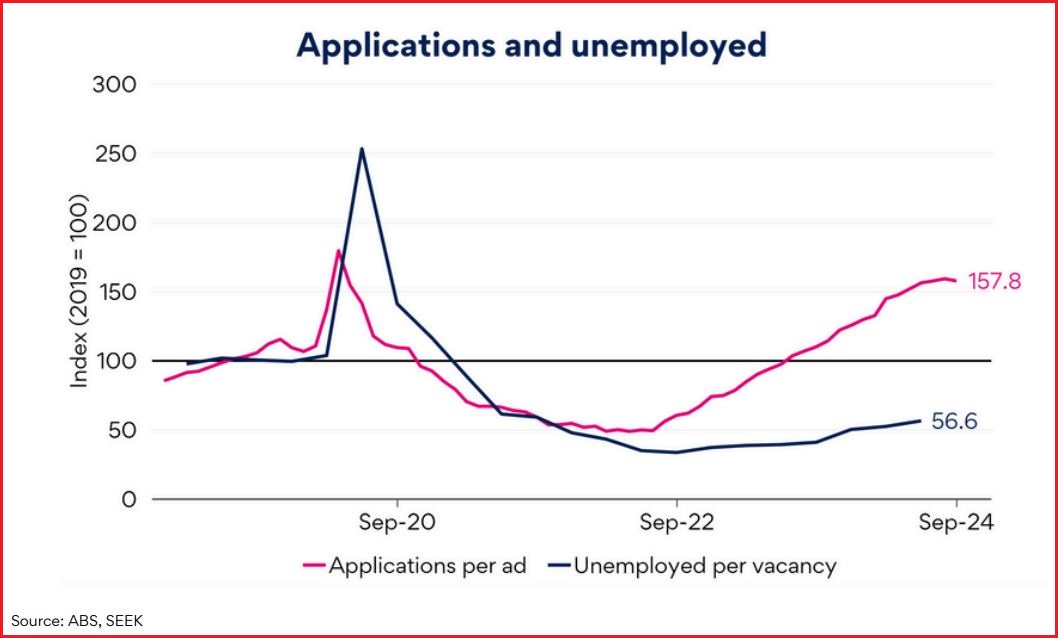

Applications per ad, and unemployed per vacancy across the economy. Image: SEEK / Supplied

Post-COVID readjustment

The report found the labour market was just on the loose side of the balance in 2019, but dropped significantly due to the onset of COVID-19, until 2022.

From there, it swung substantially and became very tight following the reopening of the economy and the end of stay-at-home orders.

It has then been broadly loosening in the last two years, with the balance indicator now slightly favouring a loose labour market.

This is due in part to the underutilisation measure increasing, the part-time share of employment increasing, average hours worked declining, job ads declining, and applications per ad increasing.

The report found Australia’s employment-to-population ratio was sitting at a record 64.4 per cent, up from 62.3 per cent in 2007 before the Global Financial Crisis, and in 2019 before the pandemic.

The number of job ads being posted online peaked in 2022 following the abatement of most pandemic restrictions.

Since then, they have declined significantly, while job vacancies have stayed far above pre-COVID levels.

The number of job ads being posted was now around similar levels to pre-COVID years, the data showed.

The SEEK Advertised Salary Index earlier this year found advertised salaries were rising at a faster rate than inflation.

In December, advertised salaries increased by 4.5 per cent compared to the year earlier, while inflation was recorded at 4.3 per cent.

Separate data recently showed the skills shortage facing the tech sector has eased somewhat, with the share of ICT jobs facing skills shortages down substantially.

Overall, a third of all jobs are now in shortage, compared with 36 per cent last year.

Another study found the number of job ads for roles involving artificial intelligence skills have reduced in Australia in the years since 2021, and these roles were now “extremely rare”.

It found AI jobs made up just 0.17 per cent of all job ads posted, equating to just one in every 588 advertised roles.