Australians lost “significantly more money” to payment redirection scams in 2023 than in the two previous years, according to new data from the Australian Competition and Consumer Commission (ACCC).

The regulator’s Scamwatch program said Australians reported $16.2 million in losses to the scams last year.

That was only a 3 per cent increase in monetary losses, but it came despite a 28 per cent decrease in the total number of reports — which the ACCC said showed “Australians lost significantly more money per scam last year compared to 2022”.

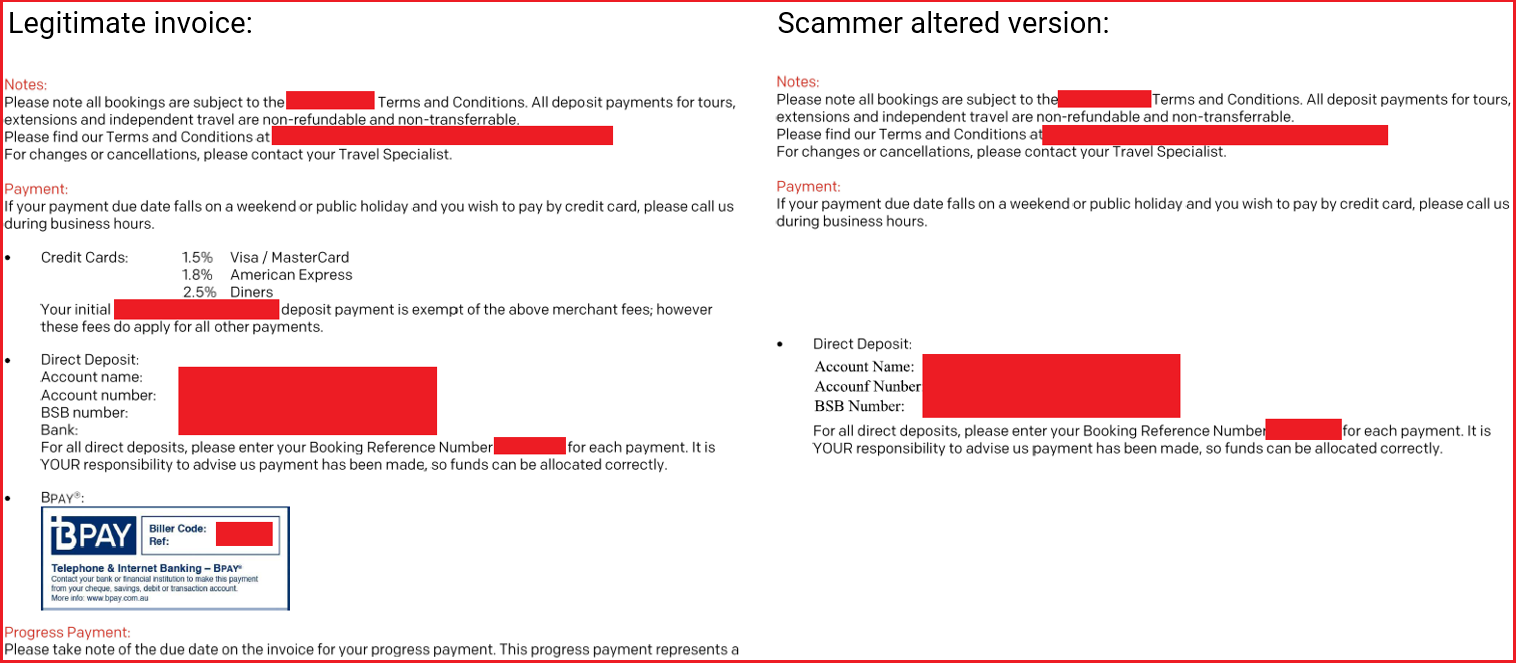

Payment redirection scams — also known as business email compromise scams — involve criminals intercepting emails between a business and their customers.

Scammers will send customers fake invoices with altered payment details to trick them into sending money to them instead.

They may use the business’ email system or a slightly different email address, and victims are unlikely to notice anything suspicious until the business they owe money to says it hasn’t been paid.

ACCC Deputy Chair Catriona Lowe said scammers were “becoming more targeted” in how they approached Australians with fake invoices.

“This scam is hard to detect because the scammer will either hack into the email system of the business or impersonate the business’ email address by changing as little as one letter,” she said.

The ACCC has urged people who receive emailed invoices to always check the payment details with a business directly.

“If you receive an invoice via email, take the time to call the business on a number you have found yourself to confirm that the payment details are correct,” Lowe said.

An example of what a payment redirection scam can look like. Supplied: ACCC

Why Australians are losing more money

The ACCC said industries often targeted by fake invoice scams included real estate, legal and construction industries, as they often handled transfers of large amounts of money.

An ACCC spokesperson told Information Age that Australians generally lost more money to such scams when criminals targeted payments for expensive goods, such as vehicles.

"When reports drop and losses increase in a category it can also indicate that people generally are less able to recognise the scam, avoid and report it,” they said.

“These scams can be very difficult to identify, unlike some common phishing scams where people will recognise it as a scam and report it.”

In 2023, a Victorian couple were scammed out of $139,000 while trying to buy a Mercedes-Benz, after scammers provided them with a altered invoice.

Lowe said the ACCC was also aware of a man who lost more than $35,000 after scammers compromised the email account of a car dealership he was buying a vehicle from.

“After paying the deposit securely through the dealership’s official website, he received an email with an invoice for the remaining amount owed which he paid thinking it was genuine,” she said.

“When he went to pick up his new car, he found out that the invoice was a scam and the dealership had only received his deposit.”

More broadly across the economy, payment redirection scams were found to have caused losses totalling $224 million in 2022, according to combined data from Scamwatch, the Australian Financial Crimes Exchange, and the government’s ReportCyber system.

The ACCC said anyone who has transferred money to pay an invoice but felt something might be wrong should contact their bank immediately and report the scam to Scamwatch.