Automated order fulfilment may be delivering dividends for some e-commerce giants, but a $12 million automation investment by Australian bookseller Booktopia has proven fatal as escalating losses pushed the company to fire staff and engage administrators.

Reports suggested as many as 60 different companies, including QBD Books and online seller Kogan, were considering making offers for Booktopia’s business after administrators McGrathNicol began soliciting expressions of interest after taking control of the company and its assets earlier this month.

Booktopia – which was founded in 2004 and grew to acquire book retail stalwarts such as Bookworld, Angus & Robertson, and university-focused The Co-op Bookshop – stocked over 150,000 titles and, at its peak, was turning over $2.4 million and handling more than 8.2 million orders per year, or one every 3.9 seconds.

Yet in a competitive climate that found the company facing the cutthroat pricing of global juggernauts such as Amazon and Amazon-owned BookDepository, Booktopia soon found itself out of its depth – last year copping a $6 million fine after a December 2021 investigation by the ACCC found that Booktopia had for nearly two years misled customers about their right to refunds for faulty products.

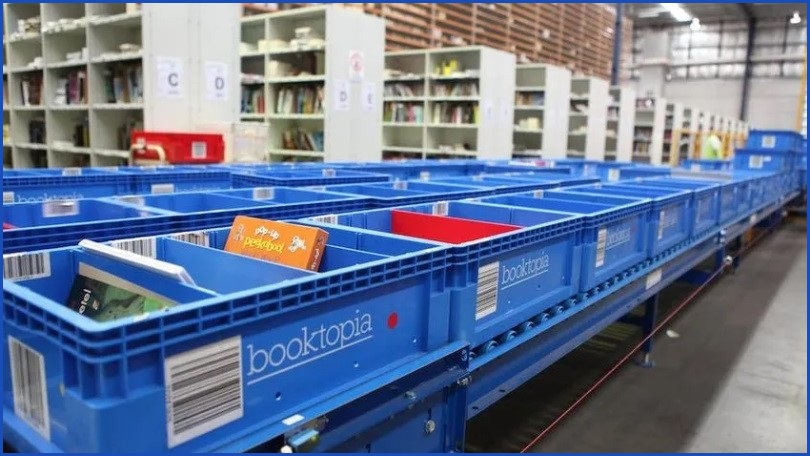

If the magnitude of that fine was enough to give Booktopia pause, the company’s investment in a new, automated warehouse in Strathfield South in NSW proved to be the final nail in its coffin – with consulting firm Grant Thornton helping Booktopia design and build a new automated facility populated by robots.

The new facility incorporated 1.6km of conveyor belts, was set to stock over 6 million books and replace two earlier Booktopia facilities in Lidcombe and Enfield – and was expected to boost the company’s revenues to $360m per year – but problems during its implementation raised costs and left Booktopia struggling to realise its benefits.

Failed warehouse automation projects are nothing new, with a recent McKinsey analysis noting that despite 10 per cent annual growth, companies deploying the technology “face a tricky balance” and warning that “a significant portion of automation projects fail” as predicted benefits never materialise.

Booktopia’s investments were funded by a $43.1 million ASX listing at the end of 2020 – but as its share price plummeted in subsequent years, a dearth of cash left Booktopia with fewer and fewer options.

Booktopia ultimately posted a $16.7 million loss for the second half of 2023 – up from a $3.9 million loss a year earlier – before a series of changes that saw it halting trading, cancelling two proposed securities issues, and entering voluntary administration, with a reported 165 jobs axed and just 18 employees remaining.

Turning a new page?

The sudden administration of Booktopia – which has seen orders suspended and customers in limbo as they find themselves designated unsecured creditors of the failed company – has led some to speculate that the ACCC fine, exacerbated by the challenged automation project, hastened the company’s demise.

Strong interest in the company’s assets means Booktopia may yet emerge in a new form, but in a difficult business environment industry observers were quick to lament the loss of what had come to be recognised as an Australian e-commerce success story.

The Australian Society of Authors (ASA) noted that news of Booktopia’s demise “has generated worry among authors” – in particular, those who had built business models around Booktopia Publisher Services that provided much-needed visibility and support for Australian authors.

Success in the local market is far from assured, with recent figures noting that – after three years of growth, as many turned to books during the pandemic – the Australian book market flattened out in 2023 in dollar terms and that sales volumes dropped 0.2 per cent during that time.

With total sales of 28.3 million units last year, that means booksellers moved just one book for every Australian – each of us is predicted to spend $137 ($US92.70) per year on books – and, particularly as authors explore new models like podcast tie-ins, the competition among authors to be that one book has never been higher.

“For Australian authors and illustrators, having a broad range of thriving local book retailers is essential,” the ASA said.

“As all authors know, we must support bookshops today, so they’ll be here tomorrow.”