Google has created an illegal monopoly in the search engine industry by violating US antitrust law and spending billions on contracts to be the default search provider on most devices in the US, a judge has ruled.

The case, which could have major implications for Google’s parent company Alphabet and other tech giants, also marks the first major victory for US authorities currently attempting to wrangle the power of Big Tech.

The ruling by District Judge Amit Mehta comes nearly four years after the US Justice Department began its lawsuit, and will see potential changes or penalties for Google to be discussed from September.

The possibility of breaking up Alphabet to make the market more competitive has even been floated, as Google controls more than 90 per cent of the search market.

"The court reaches the following conclusion: Google is a monopolist, and it has acted as one to maintain its monopoly," Mehta wrote in his ruling, in which he described Google as “the industry’s highest quality search engine”.

Google’s president of global affairs, Kent Walker, said the company planned to appeal the ruling.

"This decision recognizes that Google offers the best search engine, but concludes that we shouldn’t be allowed to make it easily available," he said.

US Attorney-General Merrick Garland said the ruling was “a historic win for the American people”.

“No company — no matter how large or influential — is above the law,” he said.

Shares in Alphabet fell around 4.5 per cent on Monday, amid a broader decline in tech shares.

Here’s our statement on today’s decision in the DOJ case:

— Google Communications (@Google_Comms) August 5, 2024

“This decision recognizes that Google offers the best search engine, but concludes that we shouldn’t be allowed to make it easily available. We appreciate the Court’s finding that Google is ‘the industry’s highest quality…

Google paid billions to be default search engine

In his judgement, Judge Mehta pointed to Google’s default distribution deals with companies such as browser developers, mobile device manufacturers, and telecommunications companies as a key reason for its search market dominance.

“Google pays huge sums to secure these preloaded defaults,” he said.

“Usually, the amount is calculated as a percentage of the advertising revenue that Google generates from queries run through the default search access points. This is known as ‘revenue share’.

“In 2021, those payments totaled more than $US26 billion [$40 billion]. That is nearly four times more than all of Google’s other search-specific costs combined.

“In exchange for revenue share, Google not only receives default placement at the key search access points, but its partners also agree not to preload any other general search engine on the device.

“Thus, most devices in the United States come preloaded exclusively with Google.”

Mehta wrote that being the default search engine was “extremely valuable” for Google because most internet users stuck with the default search engine on their devices.

“Google receives billions of queries every day through those access points,” he wrote.

“Google derives extraordinary volumes of user data from such searches. It then uses that information to improve search quality.

“Google so values such data that, absent a user-initiated change, it stores 18 months-worth of a user’s search history and activity.”

Google had said that it dominated the search market because it had a superior product, and argued that users could switch to non-default search engines relatively easily.

It also said it faced competition from the likes of Microsoft’s search engine Bing and some social media platforms.

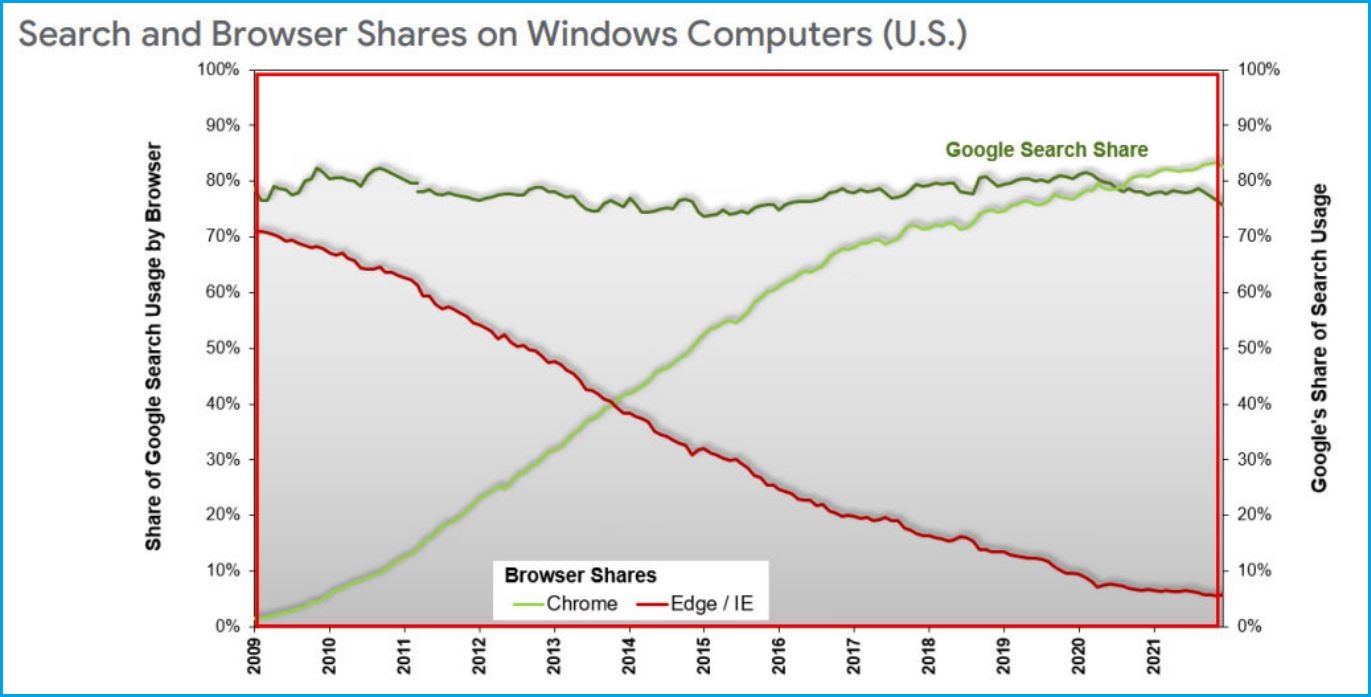

Mehta said Google still dominated search on Windows computers in the US, despite Microsoft’s Internet Explorer and Edge being its default browsers, and Bing their default search engine.

He said Google's domination wasn’t only due to the popularity of its Chrome browser, given “Google had an 80% search share on Windows when Chrome first launched, and that share has remained steady ever since”.

Image: US District Court for the District of Columbia / Supplied

“The power of defaults is evident, however, from the share of Bing users on Edge. Bing’s search share on Edge is approximately 80%; Google’s share is only 20%,” he added.

Mehta said Google knew that losing its defaults “would dramatically impact its bottom line”.

“For instance, Google has projected that losing the Safari default would result in a significant drop in queries and billions of dollars in lost revenues,” he said.

“The same would occur if Google were to lose the Android defaults."

Mehta wrote that even if a new competitor with a quality search engine tried to bid to become the default, “such a firm could compete only if it were prepared to pay partners upwards of billions of dollars in revenue share”.

US regulators have also filed suits against Apple in the smartphone space, Amazon in online retail, and Meta in the metaverse in recent years.