Apple’s smartphone sales have plummeted since the end of last year, pushing Samsung up into the top spot for the most number of handsets shipped.

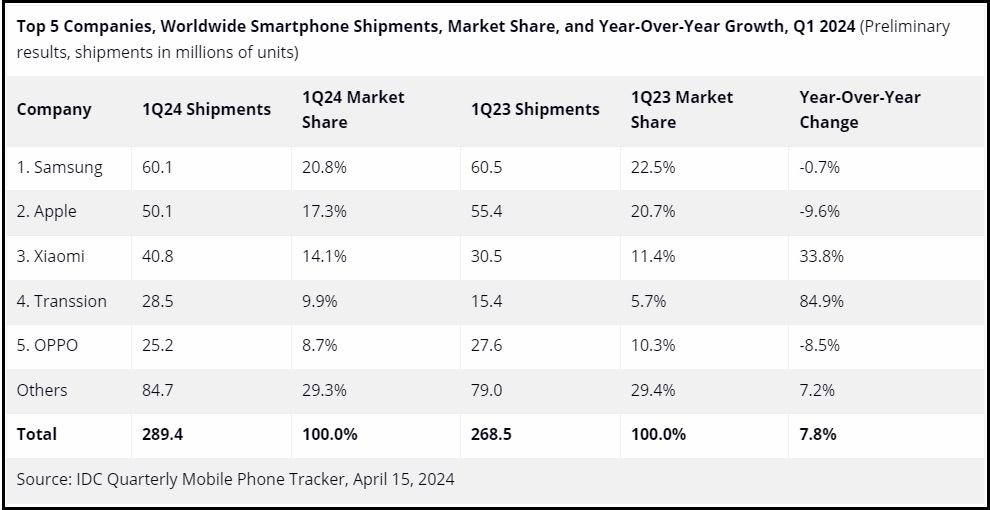

According to new data released by research firm IDC, Apple moved 50.1m units in the first quarter of 2024, almost 10% less than the same period last year.

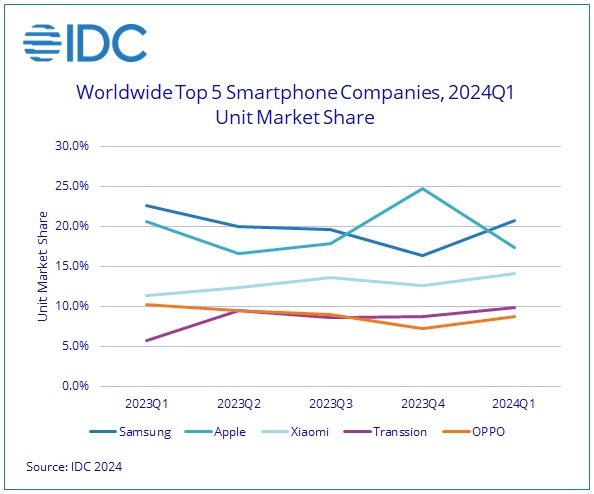

This decline has seen Samsung reclaim first place in market share, holding 20.8% compared to Apple’s 17.3%.

“While Apple managed to capture the top spot at the end of 2023, Samsung successfully reasserted itself as the leading smartphone provider in the first quarter,” said Ryan Reith, group vice president with IDC’s Worldwide Mobility and Consumer Device Trackers.

In contrast, the market at large grew 7.8% year on year.

This figure, representing three consecutive quarters of growth, may indicate that sales are finally returning to their stronger pre-pandemic levels.

"The smartphone market is emerging from the turbulence of the last two years both stronger and changed,” said Nabila Popal, research director with IDC’s Worldwide Tracker Team.

These changes have included a power shift between the top five brands, with companies like Xiaomi and Transsion taking a larger slice of the pie.

Apple and Samsung have also faced an unprecedented sales fall in China, the largest smartphone market in the world.

This follows a decision by the Chinese Government and other major companies to ban foreign-made devices in workplaces, which has seen local competitors Xiaomi and Huawei explode in popularity.

“While the top two players both saw negative growth in the first quarter, it seems Samsung is in a stronger position overall than they were in recent quarters,” Nabila added.

Apple losing its crunch

Losing market share and falling sales numbers are just the latest in a series of setbacks Apple has faced in recent months.

In March, the United States Government filed a landmark lawsuit against the tech giant.

The suit alleges that Apple restricted access to its systems to prevent competition and create a monopoly, thereby violating antitrust laws.

This followed news the company was slapped with a $3 billion fine by the European Union (EU) for anti-competitive practices related to its Apple Music streaming service.

Regulatory pressure from the EU has also forced the company to allow third-party app stores and alternative contactless payment options.

The EU is also pursuing legal action against Apple for alleged antitrust violations relating to the company’s mobile payments service.

With both the EU and US promising further crackdowns on tech firms for anti-competitive behaviour, it’s possible there will be more challenges on Apple’s horizon.

In a further surprise, the company announced in February that it was canning its long-awaited Apple car.

The secretive project to create an autonomous electric vehicle had been underway since 2014.

December 2023 saw the company halt all US sales of its popular Apple Watch, pulling the product from shelves due to a patent dispute.

The dispute was related to the device’s light-based pulse oximetry technology, which can be used to measure blood oxygen levels and is estimated to be worth $25 billion.

Apple is currently appealing the decision made by the US International Trade Commission (ITC), which found that it had violated patents belonging to Masimo Corporation and Cercacor Laboratories.

In October last year, Apple was accused of “climate-washing” in their claims that its new line of products were carbon neutral.

The company claimed that certain product combinations in its new Apple Watch line created fewer carbon emissions than were offset or captured during its production.

However, this assertion was challenged in a report released by the Institute of Public and Environmental Affairs, which pointed out Apple restricted sustainability data for some suppliers.

Of the information that was available, several suppliers were shown to have increased their carbon emissions.