Whatever their previous opinions, a procession of world leaders and big tech CEOs have fallen in line behind Elon Musk to congratulate US President-Elect Donald Trump as analysts weigh implications for Australia’s tech industry – and crypto investors enjoy instant upside.

Apple CEO Tim Cook, who has earned Trump’s praise over a long relationship, said on X that the company looks forward to working with the new president to ensure the US “continues to lead with and be fueled by ingenuity, innovation, and creativity.”

Echoing Trump’s comments that he would usher in a “golden age” for the US, Google and Alphabet CEO Sundar Pichai wrote that “we are in a golden age of American innovation and are committed to working with his administration to help bring the benefits to everyone.”

Reflecting concerns about Trump’s promise of retribution towards his critics, former Australian prime minister and current US ambassador Kevin Rudd, for his part, cleansed his social media timelines of earlier posts critical of Trump to avoid their “being misconstrued”.

Despite blowback from 2017 comments that Trump “scares the shit out of me”, Prime Minister Anthony Albanese congratulated him while lauding the US-Australian “commitment to great democracies” – even as Greens leader Adam Bandt called Trump’s win “terrifying”.

Former Trump critic OpenAI CEO Sam Altman congratulated Trump while noting that “it is critically important that the US maintains its lead in developing AI with democratic values”, a nod to ongoing controversy around ‘guardrails’ on AI seen as crucial for national security.

Altman faces other threats from Musk, who abandoned all pretence of neutrality to launch an all-out campaign for Trump that included questionable $1 million voter giveaways, as he basks in Trump’s largesse while pursuing regulations favourable for OpenAI competitor xAI.

xAI – along with Musk’s other ventures including Tesla, SpaceX, Starlink, and Neuralink – will likely benefit from his proximity to the Oval Office – with Trump promising to appoint Musk as head of a government efficiency commission and Musk eyeing more political involvement.

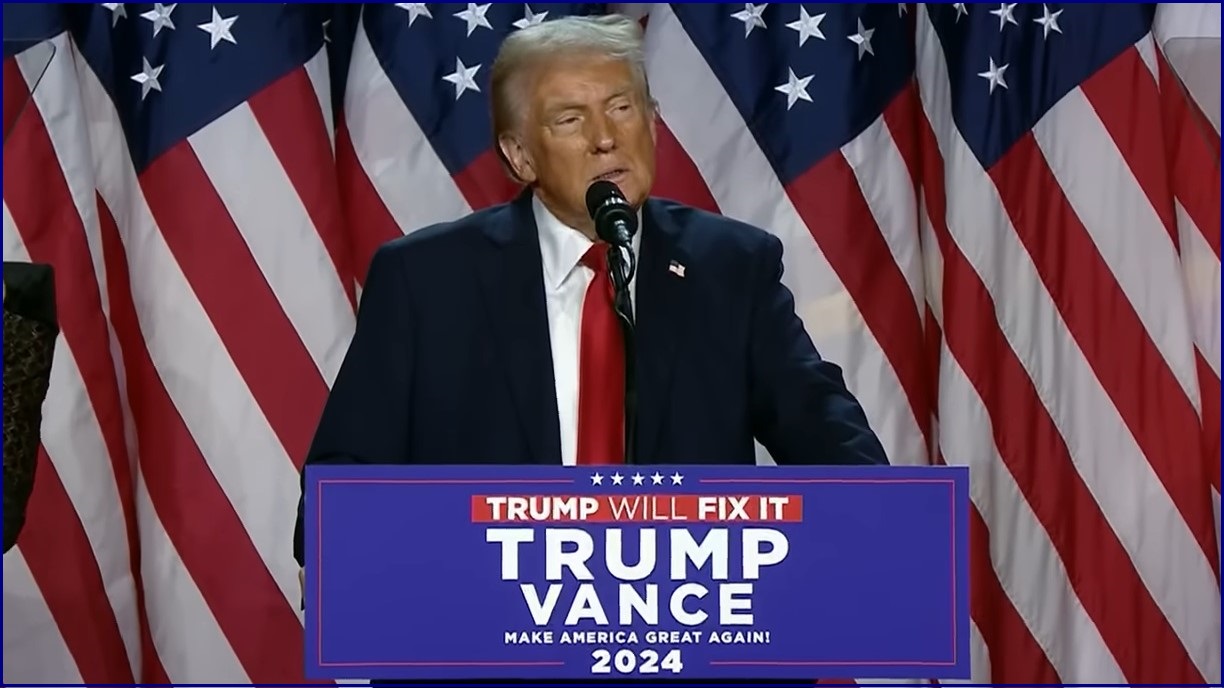

Donald Trump effusively praised Elon Musk (pictured) in his victory speech. Photo: Shutterstock

That means the election play by Musk, the world’s richest person, will likely play off by helping him shape tariffs, trade restrictions and other policies aiming to prevent Chinese rivals from undercutting US innovation in fields like AI, electric vehicles, and space tech.

Musk will likely press for regulatory approval for Tesla’s self driving robotaxis and other full autonomous vehicles, Economist Intelligence Unit lead analyst for technology and telecoms Dexter Thillien said, “even as the technology is not yet fully mature for such a roll-out.”

If Trump repeals Biden's Executive Order on AI, Thillien warned, there would be “very few rules, if any, concerning the technology. While this could help innovation, it would also increase the potential harms of AI.”

Analysts have warned that those tariffs could be problematic for a US economy enjoying near full employment and lower inflation after the Biden presidency, with the imposts driving prices and inflation back up even as the US economy shrinks by up to 4 per cent.

Implications for Australia still unclear

Trump’s anti-regulation stance, and adulation of Musk, could complicate Australian regulators’ efforts to rein in “arrogant” Big Tech firms to control misinformation, impose age limits and limit content targeting – even as advocacy groups push for tighter regulations.

“It wouldn’t be at all surprising to see these major players double down on efforts to expand their influence should the incoming president follow through on his promises to deregulate the sector with specific policy action,” said Adapt principal research analyst Shane Hill.

“The Australian government will need to direct even more attention to efforts aimed at preventing online harm."

A higher US dollar – and commensurately lower Australian dollar – could hit innovation funding, as would visa changes by a migration-focused administration that could complicate Australian entrepreneurs’ push into US markets.

Hill flagged the potential impact of “new policies restricting (or enabling) the movement of capital, tech procurement, and mobility of Australian tech workers and innovators with in-demand skills in and out of the United States".

“Whether or not Australian innovators will receive a pass from new protectionist measures remains the open question,” he said, “…the potential for further brain-drain in Australia is a distinct and concerning possibility.”

Optimism reshapes crypto, share markets

As billionaires celebrated and analysts scrambled to understand how Trump’s election will shape tech policy, early expectations include a low-regulation AI approach, stalling of the Google antitrust breakup, and boosts for favoured US innovators like Nvidia, Intel, and Tesla.

“For Big Tech, I don’t expect significant changes compared with the status quo,” financial news service Barron’s senior writer Tae Kim offered, noting that Trump’s promise to cut red tape “should be good news for smaller innovative AI startups that won’t have to spend resources on compliance".

Fluctuating policies around Taiwan – a major chip supplier to the US and a flashpoint in the Sino-American relationship – are the “biggest caveat”, Kim said, warning that Trump’s past comments suggest he might be less interested in protecting the island nation from China.

If China blockades or invades Taiwan in the midst of a Trump policy vacuum, Kim said, it could “send the global economy into chaos as nearly all the world’s advanced chips, which are critical for modern living, are still made in Taiwan".

In the short term, financial markets have benefited from an uptick of optimism both overseas – where some welcomed his election as a “shot in the arm” for innovators – and in Australia, where the implications of a Trump return have long been debated.

The ASX followed global markets by rising as Trump’s historic election victory played out on Wednesday, but it was outpaced by the tech-focused ASX All Technology Index, which telegraphed the sector’s optimism as its surge continued at the start of Thursday’s trading.

Cryptocurrency also surged, with Bitcoin reaching record highs of more than $114,000 ($US75,000) as crypto ‘whales’ jumped onboard when Trump’s win became increasingly likely.

As a self-professed ally of crypto, Trump – who recently launched his own cryptocurrency – has made big promises to the industry as he hinted at moves to stockpile all of the Bitcoin the government “currently holds or acquires into the future".