Subscriptions have made it easy to access powerful cloud and mobile applications for a seeming bargain – but as new-year price increases take effect, it’s important to watch outgoings before your subscription commitments empty your wallet.

Netflix subscribers felt the pain this month after the streaming giant boosted monthly fees for US subscribers by $US1 ($A1.39) or $US2 ($A2.77) – potentially generating over $US1.78b ($A2.47) in additional annual revenues from its reported 148.5m customers worldwide (reports suggest Australian customers may be spared this time around).

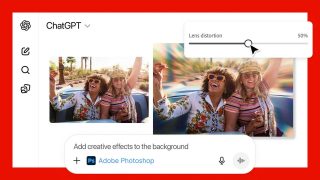

On February 12, Adobe will increase prices just as it did last year, when users complained of a 75 percent increase in pricing for its Adobe Creative Suite. And Google this month announced that, from April, the 4 million businesses using its G Suite cloud productivity tools will pay 20 percent more for privilege.

Boosting prices with each renewal

Users of LogMeIn’s GoToMyPC remote-access tool have copped even more stunning subscription price rises: this author, for one, saw a subscription plan increase from $US168 last year to $US924 this year – a 450 percent increase that resulted in an automatic credit-card charge for $A1,337.

“Like many SaaS-based companies in the industry, each year products are reviewed to make sure we are in line with the market”, LogMeIn told Information Age while noting that subscribers were emailed about the new price 30 days prior.

.png)

LogMeIn gives its slogan new meaning with its recent hefty price increases. Photo: Supplied

The company claimed the subscription was non-refundable but offered to halve the price, before finally refunding the charge when threatened with a complaint to the Australian Competition and Consumer Commission (ACCC).

It’s not the first time LogMeIn has been flagged for jacking up prices on the quiet: its user forum is filled with complaints from customers about questionable pricing and difficulties cancelling subscriptions.

Last July, law firms such as Kirby McInerney and Hagens Berman began soliciting plaintiffs for class actions when LogMeIn’s shares dropped 25.5 percent after its admission that “disappointing renewal rates” would hit 2018 revenues.

It all adds up

Subscriptions may allow easier budgeting, but with each supplier increasing prices independently, overall expenditures can quickly add up.

Stephen Molloy knows all too well how quickly the subscription trap can bite, having recently made a conscious effort to subscribe to both software plans and lifestyle programs like food-delivery service HelloFresh and shaving disruptor Dollar Shave Club.

“When you see Adobe software available for $50 per month, it seems quite reasonable,” says Molloy, a graphic designer with Sydney-based Lomah Studios. “But after a few years of continually paying that all the time, there’s no direct link between physical money and what you’ve gotten. And it includes things that I don’t use and don’t need.”

Mobile applications have been moving in the same direction, with application developers raking in billions from consumers that buy subscription-based apps and then forget they’re paying monthly charges indefinitely.

Many apps start charging after a trial period that may be just a few days, with one TechCrunch analysis citing the example of a document-scanning utility that is bringing in $US14.3m ($A19.8m) annually by pestering users to subscribe for $US3.99 ($A5.50) per week or $US4.99 ($A6.91) per month.

Clamping down on sneaks

Australian consumer authorities caution businesses to be transparent about subscription services: “The ACCC would be concerned where a term in a contract allows a business to change an important term in a contract, ie the price of the service, without the consent or agreement of the consumer,” a spokesperson told Information Age.

“The ACCC would [also] be concerned where a business increases the price of a product or service that is covered by an automatic rollover without giving consumers notice and an adequate period to decide to opt out of their contract.”

Recognising that subscription practices are catching many customers unawares, Mastercard this month announced new requirements for merchants selling products through subscriptions – who will be required, among other things, to get customer consent before their trial period is transitioned into a full-priced subscription.

With prices rising regularly, regularly reviewing subscription costs is essential for anyone who is embracing subscription models. A recent Business Software Alliance report found that businesses can reduce annual software costs by 30 percent through aggressive monitoring and software license optimisation.

End users, however, need to manage costs the old-fashioned way: by watching their credit-card statement, and remembering to stop subscriptions of applications, services, and mobile apps they aren’t using.

.jpg)