Repeated surveys show Australian millennials warming to cryptocurrency instead of conventional investments – but with many likely to pour four-figure tax refunds into volatile crypto, one fintech startup believes it has found a less risky way to build a crypto portfolio.

The digital equivalent of a piggy bank, Perth-based Bamboo has built a novel business model applying the concept of dollar cost averaging to crypto by regularly investing small sums into cryptocurrency.

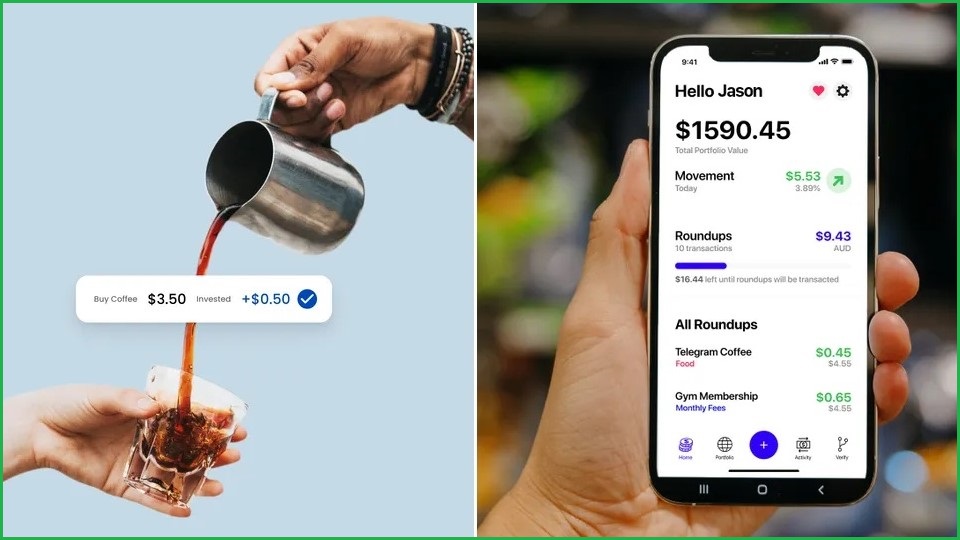

Rather than requiring customers to buy large chunks of crypto like a conventional exchange, the company uses open-banking APIs to monitor bank account or credit-card transactions, then round up to the nearest dollar and invest the difference into crypto.

By allowing people to invest at a slow but regular pace, Bamboo CEO Blake Cassidy told Information Age, the fintech “designed out all the hurdles or barriers to entry, to make investing in crypto as simple and effortless as possible.”

“Instead of buying $10,000 in bitcoin and then watching it go down,” he said, “we are more about long-term, sustainable investment strategies to compound returns and create more sustainable investing behaviours.”

The idea of responsible investing may seem antithetical to those attracted by reports of crypto millionaires buying supercars and $110m ($US83m) mansions, but Cassidy is confident that it will continue to gain traction with ordinary Australians who see crypto as a way to counter the runaway costs of property and everyday living.

Fully 76 per cent of investors said they had made a profit from their cryptocurrency investments, according to a recent YouGov/Swyftx survey that found the average Australian crypto investor made $10,662 in profit over the past 12 months – with over 20 per cent of investors reporting profits of more than $30,000.

A recent Kraken survey found 14 per cent of Australians already have a cryptocurrency portfolio and 39 per cent of millennials believe crypto is a good alternative to buying an investment property, while late last year yet another found that 45 per cent of millennials would rather buy bitcoin more than shares, real estate, and gold.

Hedging against volatility

Bamboo may have struggled in its first two years – the original founders sold out to investment firm Digital Capital Management (DCM) a year after launching their app in 2019 – but with DCM and digital currency exchange group Mine Capital now aboard, user numbers have grown more than tenfold this year and Cassidy believes crypto’s growing mainstream profile could soon see over 50,000 users on the micro-investment platform.

“It’s our hypothesis that the next five million Australians that purchase cryptocurrencies aren’t going to be interfacing an exchange,” he explained. “They’re going to be using fintech savings apps to buy little bits every day, week or month.”

“This works really well for a volatile asset class because it removes a lot of risk around volatility.”

Rather than positioning itself as a cryptocurrency exchange or a holder of deposits, Bamboo’s platform is only a facilitator of transactions – leaning heavily on APIs to monitor purchases, withdraw small amounts and automatically invest them into crypto.

Bamboo has integrated with more than 20 Australian banks, allowing it to function as a seamless extension of investors’ accounts rather than a replacement for them.

Crypto transactions are handled through digital asset infrastructure provider Fireblocks, a fast-growing startup that recently completed a $425m ($US310m) series D fundraising that valued the company at $3b ($US2.2b).

“We create the user experience and make all the magic happen in the back end,” Cassidy said, flagging planned international expansion as the company finalises a planned Series A capital raising.

By providing the crypto equivalent of a piggy bank, Cassidy believes app-driven dollar cost averaging will appeal to Australians that still feel cryptocurrency is too volatile for large investments.

“In the same way we used to come home with a pocket full of change and put it in a tin to go on a holiday at the end of the year,” he said, “we slide in a digital version of that.”

“Micro savings is perfect for people looking to get into crypto for the first time and dip their toe in.”