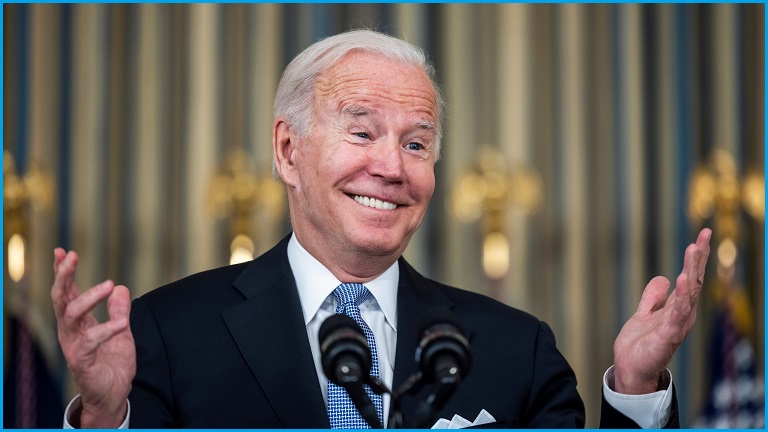

The US is going to develop stronger cryptocurrency regulation in order to bring digital assets in line with traditional financial markets while the country seriously considers creating a central bank digital currency (CBDC), President Joe Biden announced in an Executive Order (EO) on Thursday morning.

Biden’s EO begins with major policy statements about his administration’s desire to provide more consumer protection and stricter controls beyond Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) obligations.

“Advances in digital and distributed ledger technology for financial services have led to dramatic growth in markets for digital assets,” Biden said.

“[This has] profound implications for the protection of consumers, investors, and businesses, including data privacy and security; financial stability and systemic risk; crime; national security; the ability to exercise human rights; financial inclusion and equity; and energy demand and climate change.”

Biden signalled a move toward mainstream treatment of cryptocurrencies and blockchain technology with his administration officially recognising the financial and social power of digital assets and therefore a need to “support technological advances that promote responsible development and use of digital assets”.

He also sees cryptocurrency as a way to serve underbanked citizens – which was the stated goal of Facebook’s ill-fated digital asset Libra (later named to Diem) which was abandoned in the wake of intense regulatory scrutiny.

The policy shift comes with a set of directions for US government agencies to complete a range of reports about the use of digital assets, the financial effects of cryptocurrency, and other potential uses for blockchain technology including exchanging credits related to climate change mitigation.

Biden’s EO saw new direction for US Treasury and other agencies to move forward on the research and development of a US CBDC – a form of government-issued currency that is being implemented elsewhere in the world, most notably in China.

A senior official in the Biden administration said all reports asked for by Biden will be completed on an “accelerated timeline” and the government would then “move quickly” to act on their recommendations.

Many of the topics covered by Biden were recently also touched on by an Australian Industry Action Group on cyber security which urged the government to enhance security of digital currency exchanges and build out more consumer protections for investors.

But it also recognised Australia’s tendency to follow international partners on this sort of regulation.

Biden’s statement that he wants to see the US take the lead on developing international standards around the regulation of digital assets and cryptocurrency may pave the way for similar approaches in Australia.

Details of Biden’s cryptocurrency EO were initially leaked a day early when US Treasury released its planned announcement, only to take it down shortly after.

Industry was quick to react to news that Biden would not look to ban cryptocurrencies but rather seek to ingratiate digital assets into the traditional US economy.

In response to the initial leak, Nigel Green, CEO of financial advisory firm deVere Group, said Biden’s EO was a bullish sign for cryptocurrencies.

“Digital currencies are an inevitability in the ever more digital world that we live in,” Green said.

“When tech is driving the way we live, work, do business and much more besides, it makes sense to have money that runs on tech too.

“Also, it must be remembered that millennials – who are set to be the beneficiaries of the largest ever generational transfer of wealth – have been raised on technology, they’re digital natives.

“As such, the future of money is also, without doubt, going to be digital.”

Cryptocurrency markets have responded favourably to the news from Biden’s desk with market leader Bitcoin pulling up from a week-long slide to sit around the $57,000 mark.