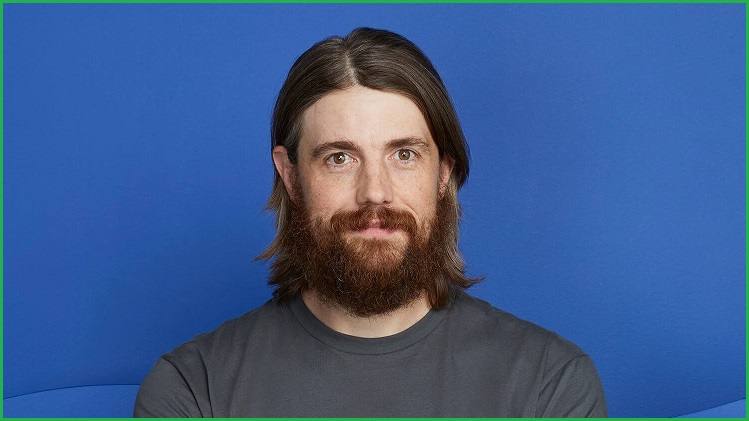

An investment group run by Atlassian CEO and climate activist Mike Cannon-Brookes has taken an 11 per cent stake in AGL Energy as it looks to stop a planned demerger of the company and focus instead on fully transitioning into renewable energy sources.

AGL Energy is preparing to demerge and become two separate entities: energy retailer AGL Australia, and generator Accel Energy which would operate existing fossil fuel assets like coal-fired power stations.

In a letter to the AGL board, Cannon-Brookes called the demerger “globally irresponsible” noting the company is “currently the single largest contributor to carbon emissions in Australia”.

“Under the demerger proposal, AGL Australia will continue to source a majority of its energy from Accel Energy, which today generates electricity with 50 per cent higher emissions intensity than the rest of the grid,” he told the board.

“We believe this exposure to coal-fired power generation is inconsistent with your proposal that AGL Australia will be a leader in sustainability.”

Earlier this year, Cannon-Brookes unsuccessfully tried to stop the demerger through a full takeover bid by a consortium of investors that would have taken AGL private.

The board knocked back Cannon-Brookes’ initial offer of $7.50 per share and its second raised offer of $8.25 per share.

👋🏻 @Grok_Ventures has acquired more than an 11% interest in @AGL - becoming the largest shareholder.

— Mike Cannon-Brookes 👨🏼💻🧢🇦🇺 (@mcannonbrookes) May 2, 2022

We will be voting against the upcoming, flawed demerger.

Why?

For more information, read below 👇🏻 and go to https://t.co/tZHXCQpmP9 #keepittogether

1/9

Now Grok Ventures, Cannon-Brookes’s investment group, has bought 56.7 million shares of AGL at $8.62 each – a $489 million purchase – and has made an equity swap deal with JP Morgan for a further 19.1 million shares.

All told Grok’s shares make up just over 11 per cent of AGL stock, turning the investment group into AGL’s largest individual shareholder.

But it’s still not enough to single-handedly turn back the demerger vote since either 50 per cent of shareholders present at next month’s meeting, or 25 per cent of the total votes cast, have to vote against the demerger.

To drum up shareholder support for his position, Cannon-Brookes has created a campaign called Keep it Together Australia.

“By not transitioning fast enough away from fossil fuels, the board has presided over AGL’s value plummeting to the tune of almost 70 per cent in five years,” he said in a statement, noting AGL’s share price was $26.76 in late April 2017 and was down to $8.68 last week.

“We intend to vote every AGL share we control at the relevant time against the demerger, and we call on fellow AGL shareholders to vote against the demerger to avoid further value destruction.”

AGL shareholders vote on the demerger on 15 June.