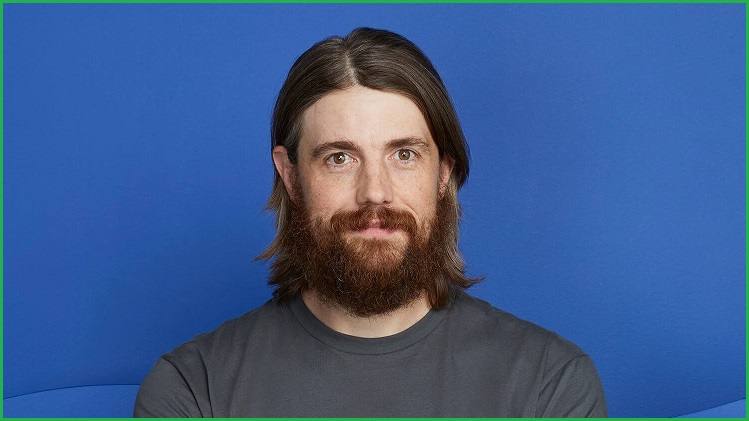

A consortium led by Atlassian CEO and founder Mike Cannon-Brookes made an $8 billion bid to buy electricity giant AGL Energy in an attempt to take over the company and turn it into a renewable energy powerhouse.

Grok Ventures, an investment firm run by Cannon-Brookes and his wife Annie, partnered with Canadian investors Brookfield to make the offer that would have seen the consortium buy 100 per cent of AGL’s shares at a price of $7.50 each.

AGL’s board slapped the offer back saying it was “not in the best interests” of shareholders and that it “materially undervalues the company”.

But there is no suggestion that Grok and Brookfield have given up on their attempts to own AGL.

Speaking to ABC’s RN Breakfast program, Cannon-Brookes said AGL’s response was “disappointing” but that the consortium will move forward to make the deal happen.

“Decarbonisation is the greatest economic opportunity facing Australia, but it requires vision and action,” he said.

The planned takeover would see AGL decommission its coal-fired power plants in favour of renewable energy options like solar and wind.

The consortium would bring its own capital to build renewable assets and fund the company’s transition away from fossil fuels.

Cannon-Brookes said he was “fairly confident” new owners of AGL could retire coal by 2030 and have it carbon-neutral by 2035.

“AGL is the single largest emitter in the country,” Cannon-Brookes told the ABC. “It represents over eight per cent of Australia’s emissions.

“That’s more than every single car on the road, more than all domestic and international aviation, and if it was a country [AGL’s emissions are] bigger than Sweden, Ireland or New Zealand.

“That would make this one of the biggest decarbonisation projects on Earth.”

When asked about the deal on Monday morning, Prime Minister Scott Morrison suggested that decommissioning power stations would drive energy prices up.

“Let me be really clear about something,” he said. “We need to ensure that our coal-fired generation runs to its life, because if it doesn’t, electricity prices go up, they don’t go down.”

Cannon-Brookes disagrees. He wants to use AGL as a case study in how to effectively transition a fossil fuel giant to renewable energy.

“We know that renewables are the cheaper source of power generation,” Cannon-Brookes said. “What you require is the ability, the capital to make that transition, and to do it sensibly and rationally.

“That is doing it inside of one organisation and I think we have the right partners in the consortium to do that.”

AGL is currently looking to de-merge and splinter off into two companies, Accel Energy and AGL Australia, by the middle of this year.

The proposed de-merger would see AGL Australia operate the company’s hydro-electric and solar power energy stations while Accel Energy would continue to run the coal-fired power plants.

The Brookfield Consortium’s offering was at a 4.7 per cent premium on Friday’s closing price of $7.16 per share, and rose on Monday’s news to $7.92 by the end of trade.

In response to the takeover bid, AGL Energy Chairman Peter Botten said it didn’t offer “an adequate premium” for the change of control.

“The board believes AGL Energy shareholders would be foregoing the opportunity to realise potential future value via AGL Energy’s proposed demerger as both proposed organisations pursue decisive action on decarbonisation,” Botten said.