The Australian Taxation Office (ATO) has urged technology workers to correctly claim their expenses and not lodge their tax returns too quickly after the end of the financial year on 30 June.

The ATO announced in May that in 2024 it would focus on three common errors made by taxpayers: claiming incorrect work-related expenses, not including all income or allowances, and inflating claims for rental properties.

ATO assistant commissioner Rob Thomson said while these mistakes were sometimes genuine, they were also often deliberate.

“Take the time to get your return right,” he said.

Meanwhile, the Australian Communications and Media Authority (ACMA) has warned workers to be wary of tax scams this year.

Here’s what you need to know for your 2023-24 tax returns.

Claiming working from home and other expenses

In 2023, around 4 million people claimed a tax deduction related to working from home, the ATO said.

There are two methods you can use to claim expenses you incurred for working from home: the actual cost method and the fixed rate method.

The actual cost method involves keeping records or evidence of exactly how much you spent on work expenses and depreciating assets (which you weren’t already reimbursed for) in order to work from home.

To be eligible to use the actual cost method, you must have additional running expenses because of working from home, such as energy, phone and internet expenses, or stationery and computer consumables like paper and printer ink.

But, as the ATO explained, “You don't incur additional running expenses if other members of your household (who are not working from home) are in the same room as you while you are working from home.”

Here’s the ATO example: “Lee works from her lounge room while her partner and three children watch television. Lee isn't incurring any additional costs for lighting, heating or cooling as a result of working in that room, so she can't claim a deduction for them.”

You can only claim the work-related portion of your expenses as a deduction, with any private running expenses set aside on a “fair and reasonable basis”, the ATO says.

The other method — the fixed rate method — involves using a fixed rate set by the ATO, which last year increased to 67 cents per hour.

To claim it you will also need to have incurred additional running expenses for working from home.

This means having a record of the total number of hours you worked from home (such as a calendar, diary or spreadsheet) and the expenses you incurred (such as internet or electricity bills).

ATO assistant commissioner Rob Thomson said workers should take the time to get their returns right. Photo: Supplied / ATO

There are some things the fixed rate method won’t cover, including depreciating assets like computers, desks and chairs.

These can be claimed separately, including their maintenance and repair costs.

“If the item cost $300 or less and you use it mainly for a work-related purpose, you can claim an immediate deduction for the cost in the year you buy it,” the ATO said.

“This may include items, such as keyboards, computer mouses, power boards, desk lamps and chargers.”

If the item cost more than $300 or is part of a set costing more than $300, you can claim a deduction for the decline in value of the asset over its effective life.

You can also claim the work-related portion of expenses such as seminars and training courses, professional publications and union or professional association fees.

Costs such as car expenses, clothing expenses and self-education or study expenses can only be claimed under limited circumstances.

If you run a business which trades, invests, pays or receives cryptocurrency, the ATO website explains how that may be treated in tax returns.

There are three golden rules for claiming a tax deduction for work-related expenses, according to the ATO:

- you must have spent the money yourself and weren’t reimbursed,

- the expense must directly relate to earning your income, and

- you must have a record (usually a receipt) to prove it.

Rob Thomson said keeping good records would give you “the flexibility to use the method that works for you, and claim the expenses you are entitled to”.

“Copying and pasting your working from home claim from last year may be tempting, but this will likely mean we will be contacting you for a ‘please explain’,” he said.

“Your deductions will be disallowed if you’re not eligible or you don’t keep the right records."

The ATO said nine out of 10 taxpayers with rental properties were also claiming too much for things such as repairs and maintenance, or claiming expenses they were not allowed.

Thomson said this year the ATO would also be “focused on claims that may have been inflated to offset increases in rental income to get a greater tax benefit”.

Why you should wait to lodge your return

Some workers rush to lodge their tax returns from 1 July, eager to see if they can claim back any money.

But the ATO has again warned against this, as it has seen many people accidentally leave out important elements of their income.

Much of this information will eventually be pre-filled into your tax return, but it can take a few months for the ATO to receive it.

“We see lots of mistakes in July where people have forgotten to include interest from banks, dividend income, payments from other government agencies and private health insurers,” Thomson said.

“By lodging in early July, you are doubling your chances of having your tax return flagged as incorrect by the ATO.

“We know some prefer to tick their tax return off the to-do list early and not have to think about it for another 12 months, but the best way to ensure you get it right is to wait for just a few weeks to lodge.

“You can check if your employer has marked your income statement as ‘tax ready’ as well as if your pre-fill is available in myTax before you lodge.

“That way, an amendment doesn’t need to be made later, which could result in unnecessary delays."

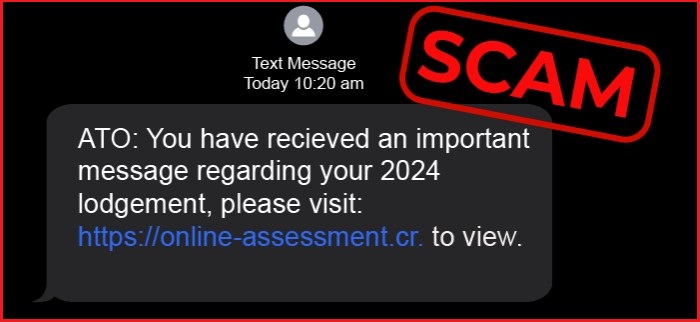

Beware of tax scams

ACMA has warned Australians to be aware they may receive scam emails, SMS or calls claiming to be about their tax returns over the coming months.

“Common tax scams include robo-calls or calls from people pretending to be from the Australian Tax Office or another government department,” ACMA says.

“These callers ask for urgent payment of a tax debt or say they need to fix personal information to process your tax refund.”

Scam emails or texts may claim to be from the ATO or myGov, and often include links which claim to allow you to update your details to receive a refund — these links should never be clicked.

Image: ACMA / Supplied

ACMA said taxpayers should always stop and check if they are unsure about a call or message they have received.

“Do not give your personal information or make payments to callers over the phone,” it said.

“Do not click on any links in emails or texts. These may be phishing scams designed to steal your personal or financial details.

“Do not rely on contact information given by callers or in emails and texts.

"Check if a call or message is genuine by contacting the business using details you confirm yourself, for example, on an official website, a bill or a secure app.”

ACMA said the ATO and myGov did not send text messages or emails with links to access their services.

“If you think you’ve been scammed, contact your bank immediately to stop any payments, tell your telco and help other Australians by reporting to Scamwatch,” ACMA said.

“Scammers target everyone. Talk with your friends and family – especially if they are in potentially vulnerable circumstances – about how to identify scams.”

Other tricks such as fake invoice scams can become more prevalent at tax time, according to Reuben Koh from cloud and cyber security company Akamai.

“Fraudsters impersonate financial executives requesting [fake] urgent transactions to be performed to meet tax requirements,” he said.

“Because everyone is rushing to meet accounting requirements in time, they may take less care with checking and verifying the authenticity of those requests.”

Koh said deepfake videos were also being used to conduct similar impersonations, and businesses should make sure their staff are well-trained to handle various types of suspected tax scams.