The effects of Australia’s politicised broadband policy are continuing to show in newly released world broadband rankings, with both the penetration and growth rate of fibre broadband services lagging OECD averages as the re-elected Labor government works to fast-track its last upgrades.

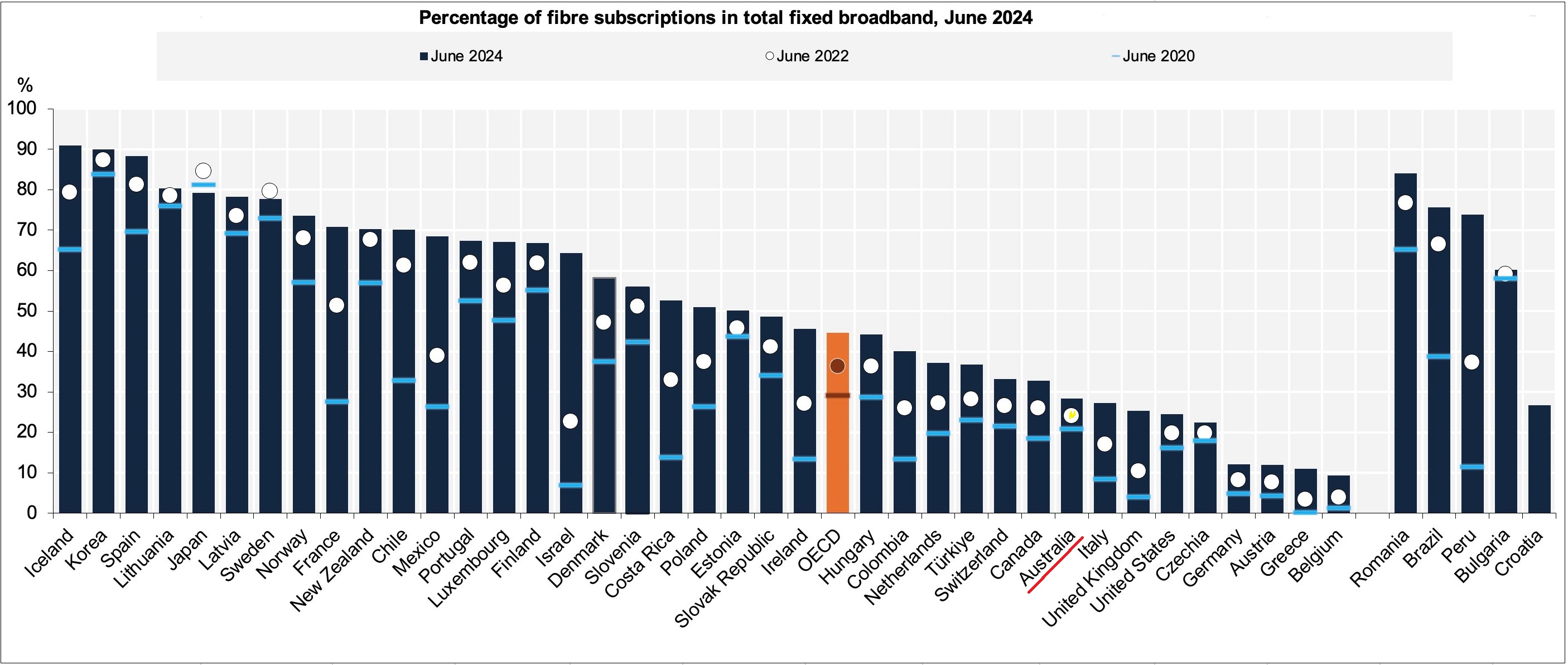

Australia ranked 31st out of 39 countries included in the OECD’s latest fibre broadband penetration tracker, with just 28.3 per cent of premises connected to fibre – well behind the OECD average of 44.6 per cent, and even further behind 10th ranked New Zealand, with 70.3 per cent penetration.

Some 90.9 per cent of broadband subscriptions in top-ranked Iceland run over fibre to the premises (FTTP) or equivalent services, slightly ahead of much more populous countries including South Korea (90 per cent), Spain (88.3 per cent), Japan (79.2 per cent), and France (70.9 per cent).

Australia, by contrast, inched out Italy (27.3 per cent), the UK (25.4 per cent), US (24.5 per cent) and the likes of Chechia, Germany, Austria, Greece, and Belgium.

Increasing fibre adoption “highlight[s] a continued shift toward high-quality connectivity,” the OECD noted in releasing its 2024 data set, which is updated biannually and also tracked each country’s change from the 2020 and 2022 numbers.

Australia was well behind in this respect, with fibre penetration increasing just 7.4 per cent since 2020; this was well behind countries like Israel (57.3 per cent), France (43.3 per cent), Mexico (40.1 per cent), the UK (21.3 per cent), Spain (18.7 per cent), and OECD average growth of 15.4 per cent.

This slow growth had kept overall broadband speeds in Australia behind the curve, with just 7.3 per cent of the population taking plans of 100Mbps or faster as of June 2024 – higher only than Mexico, Costa Rica, and Türkiye.

Source: OECD

Source: OECD

In South Korea, by contrast, 39 per cent of the population are running at 100Mbps or faster – with the OECD average at 19.6 per cent and most European countries at or above 25 per cent.

A rebuke of politicised broadband policy

The figures – which were measured in the year where the all-fibre model originally proposed by Labor in 2009 would have finished its rollout – show not only how far Australia’s adoption of fibre lags comparable countries, but how slowly it is recovering from a decade of policy chaos.

That chaos – which saw the original national broadband network (NBN) policy irrevocably changed to the Coalition’s hybrid multi technology mix (MTM) model – led to cost blowouts, worker shortages, overreliance on quickly overburdened new satellites, and vicious political argy-bargy.

And, of course, slow broadband, which spawned a crisis of sorts for NBN Co as the company found itself bleeding fixed-line customers as legacy infrastructure hindered end-user speeds and many users found they were happy to ditch costly NBN plans for rapidly accelerating 4G and 5G services.

Despite years of overwhelming evidence supporting the benefits of FTTP – and a clear consensus about its importance in other countries – the Australian government is still finishing the job, committing $3 billion during this month’s election to “finish” the NBN’s last fibre transition.

Source: OECD

That didn’t stop the Coalition from taking one last parting shot at Labor, slamming what it called “sparse funding commitments” and promising that if elected it would mandate minimum broadband speeds of 25Mbps – well below the average already enjoyed by most Australians.

One area Australia is getting right

For all its struggle to make FTTP broadband more widely adopted, there are signs that the government has been getting one part of the broadband mix right: Australia’s takeup of fixed wireless access (FWA) services was 10 per cent – nearly double the OECD average of 5.8 per cent.

Fixed wireless broadband – widely used for NBN services where terrestrial fibre connections are impractical or over-expensive – remains an important way of filling in coverage gaps for NBN Co, which recently expanded its footprint as a way of offloading demand from overloaded satellites.

FWA “offers a practical and cost-effective alternative,” the OECD noted, “particularly in underserved regions where access to high-quality connectivity can be challenging.”

“Several of the countries above the OECD average face geographic challenges that make fixed wireless solutions more attractive [including] large and sparsely populated countries such as Australia, Canada, and the United States.”

The OECD also noted surging adoption of machine-to-machine (M2M) data connections – used for Internet of Things (IoT) devices – and mobile broadband services, with average monthly data consumption per subscriber increasing from 8GB in June 2022 to 17GB two years later.