Australian businesses are throwing money at heavily hyped artificial intelligence solutions but just one in seven companies is seeing revenue gains as a result, new surveys have shown as CEOs worry they are not keeping up with AI’s risk and complexity.

Just 14 per cent of the 108 Australian CEOs surveyed for PwC’s latest Global CEO Survey, released on Tuesday, said they had seen revenue gains from AI – well short of the global average of 30 per cent.

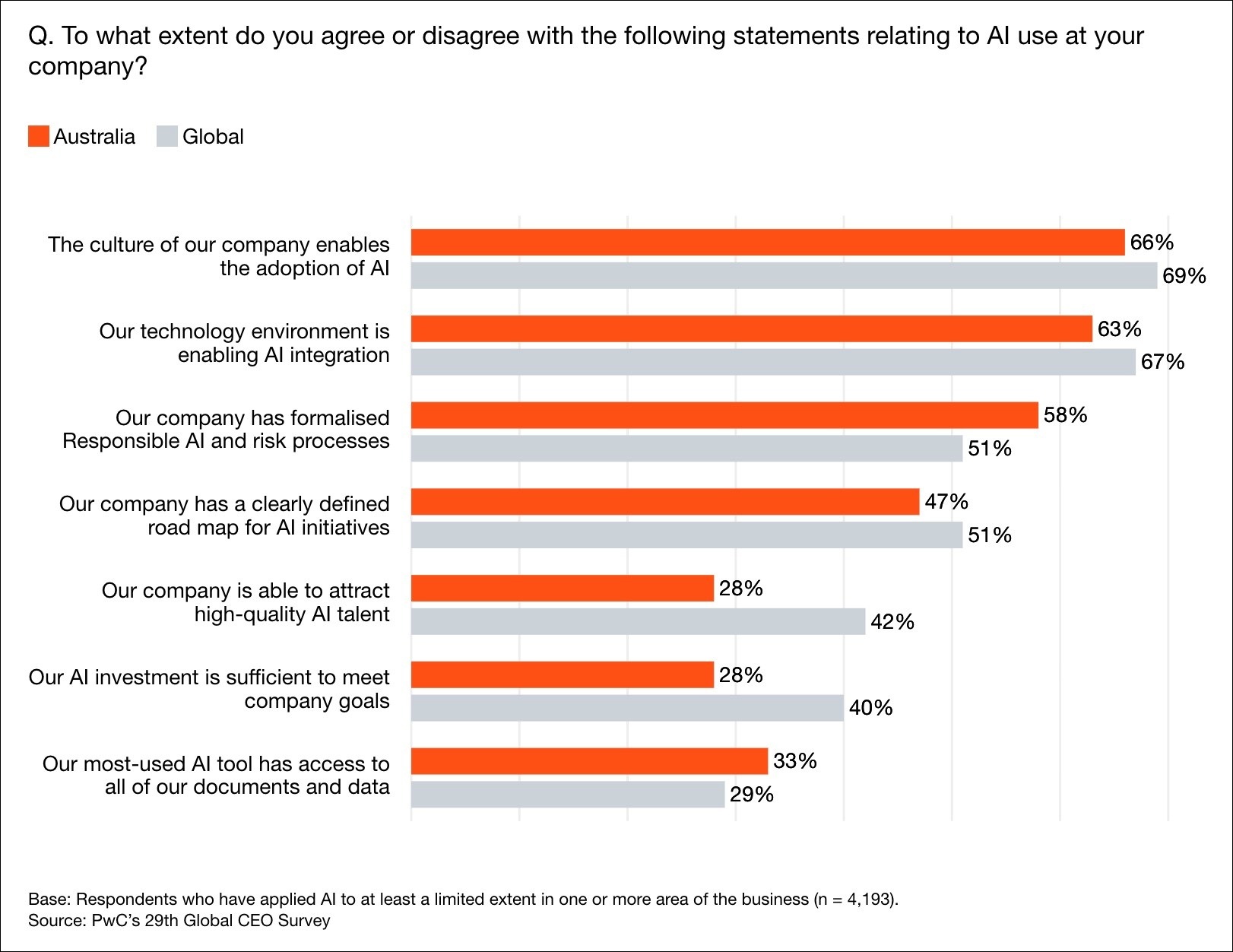

Australian CEOs know they are falling short, with just 28 per cent saying they have invested enough to deliver on their AI goals – well behind the global average of 40 per cent.

Many blame persisting AI skills shortages, with just 28 per cent reporting they can attract “high-quality technical AI talent” – lower than the global average of 42 per cent.

PwC’s analysis blamed a lack of innovation on the part of many businesses, whose early focus on implementing genAI chatbots distracted them from more beneficial AI applications implemented by their more progressive peers and competitors.

The consultancy found those companies adopting AI-first design principles reported return on investment (ROI) 20 times higher than those content with moderate productivity gains from chatbots and mainstream productivity tools.

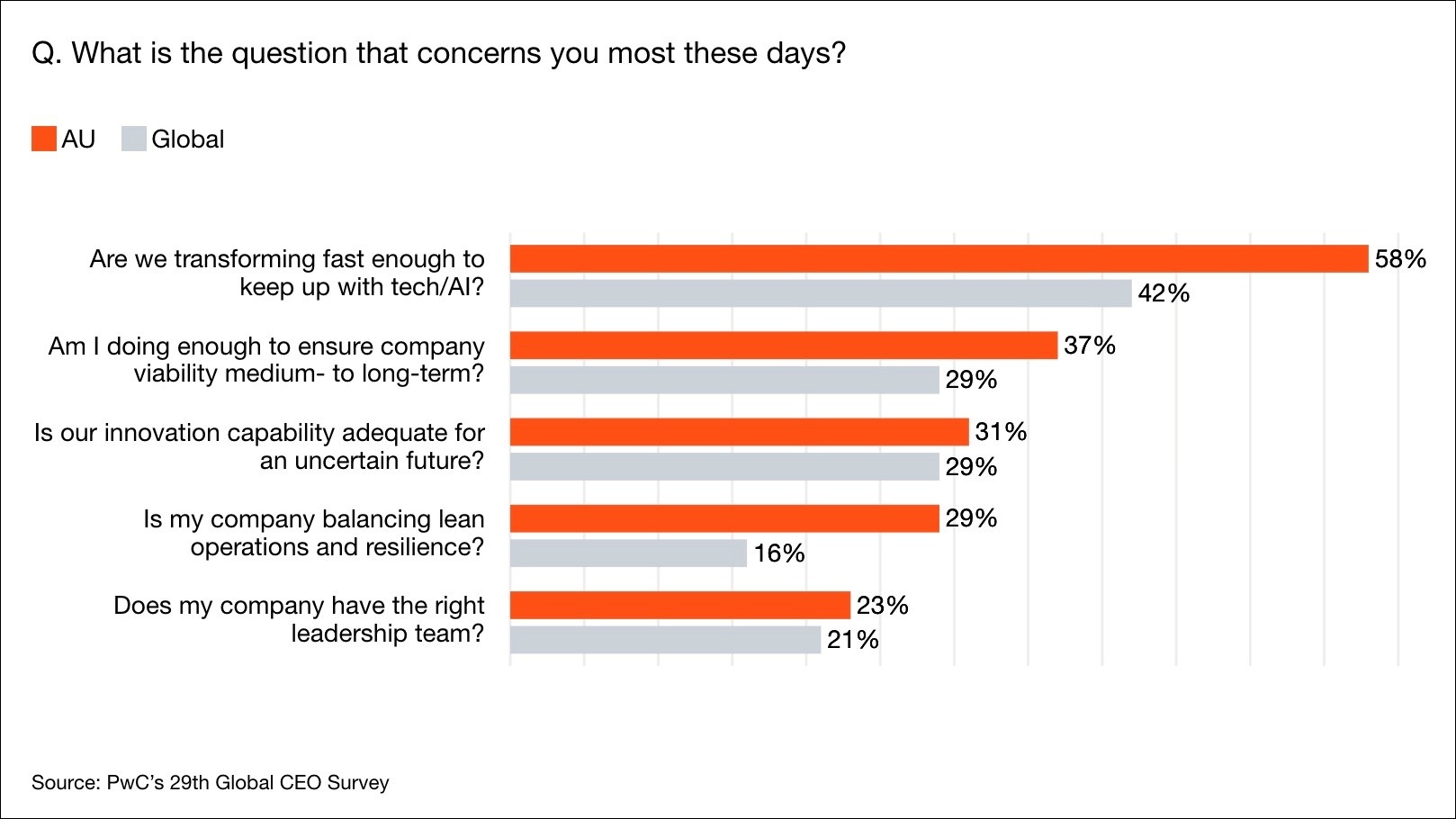

Australian CEOs seem aware that they’re falling short, with 58 per cent – far more than the 42 per cent globally – concerned about whether their businesses are transforming enough to build the foundations necessary to keep up with AI and other technology.

From AI hype to AI risk

Questions around AI’s business value are particularly problematic in Australia, where the newly updated Allianz Risk Barometer found AI had jumped from the eighth to the first highest business risk between 2025 and 2026.

That means local respondents are more concerned about AI than they are about cybersecurity, which ranked second – flipping a script in which business leaders globally ranked cybersecurity as the biggest risk and AI the second biggest.

“Companies increasingly see AI not only as a powerful strategic opportunity but also as a complex source of operational, legal, and reputational risk,” Allianz chief economist Ludovic Subran said.

PwC found Australian CEOs are more concerned than global peers about their transformation speed, company viability, and resilience. Image: PwC

Those risks relate not to AI-driven job losses, but to practices like automated decision making (ADM).

A recent government analysis of 23 federal agencies found many still lack transparency around their use of the increasingly AI-driven technology – perpetuating trust issues that continue to hobble AI adoption.

“We know that the consequences of the wrong advice, or wrong decisions, can be catastrophic and difficult to reverse,” Australasian Institute of Digital Health (AIDH) CEO Anja Nikolic recently told that organisation’s membership.

“Unfortunately, our collective understanding of the power and risks of AI remains patchy at best, even in our own sector.”

Building AI trust needs better data, infrastructure

The latest National AI Centre (NAIC) figures show 400 surveyed local businesses expected a range of benefits from AI adoption, ranging from faster access to accurate data and enhanced engagement, to better productivity and stronger security.

Yet as they continue to build confidence and manage AI risk, Australian businesses’ lack of confidence and execution risks marginalising them in a global AI ecosystem that analyst firm Gartner believes will see $3.7 trillion ($US2.5 trillion) of investment this year alone.

Australian leaders are focusing on responsible AI and risk management, but lag global peers in AI culture, technology, strategy, talent acquisition, and investment. Image: PwC

Despite this spend, a global Netskope survey found a lack of alignment between companies’ AI goals and their IT infrastructure, with just 38 per cent believing their existing IT infrastructure can keep up with the demands of AI.

Getting enough data – and ensuring its quality, security, and observability – were the biggest AI challenges named in a new Snowflake/Ecosystem analysis that also found 81 per cent of Australian firms struggled to demonstrate the value of AI investments.

That’s the world’s second highest rate of ROI failure – only South Korea reported more challenges quantifying AI’s return – due in no small part to the fact just 19 per cent of Australian businesses said they had fully integrated AI into their business strategy.

Despite failing to turn AI into new revenue streams, Australian CEOs remain optimistic revenues will grow over the next 12 months, with 49 per cent of local PwC respondents very or extremely confident in doing so, ahead of just 30 per cent globally.