The AI boom is driving major price hikes for consumer electronics as AI chipmakers take first dibs on critical memory hardware.

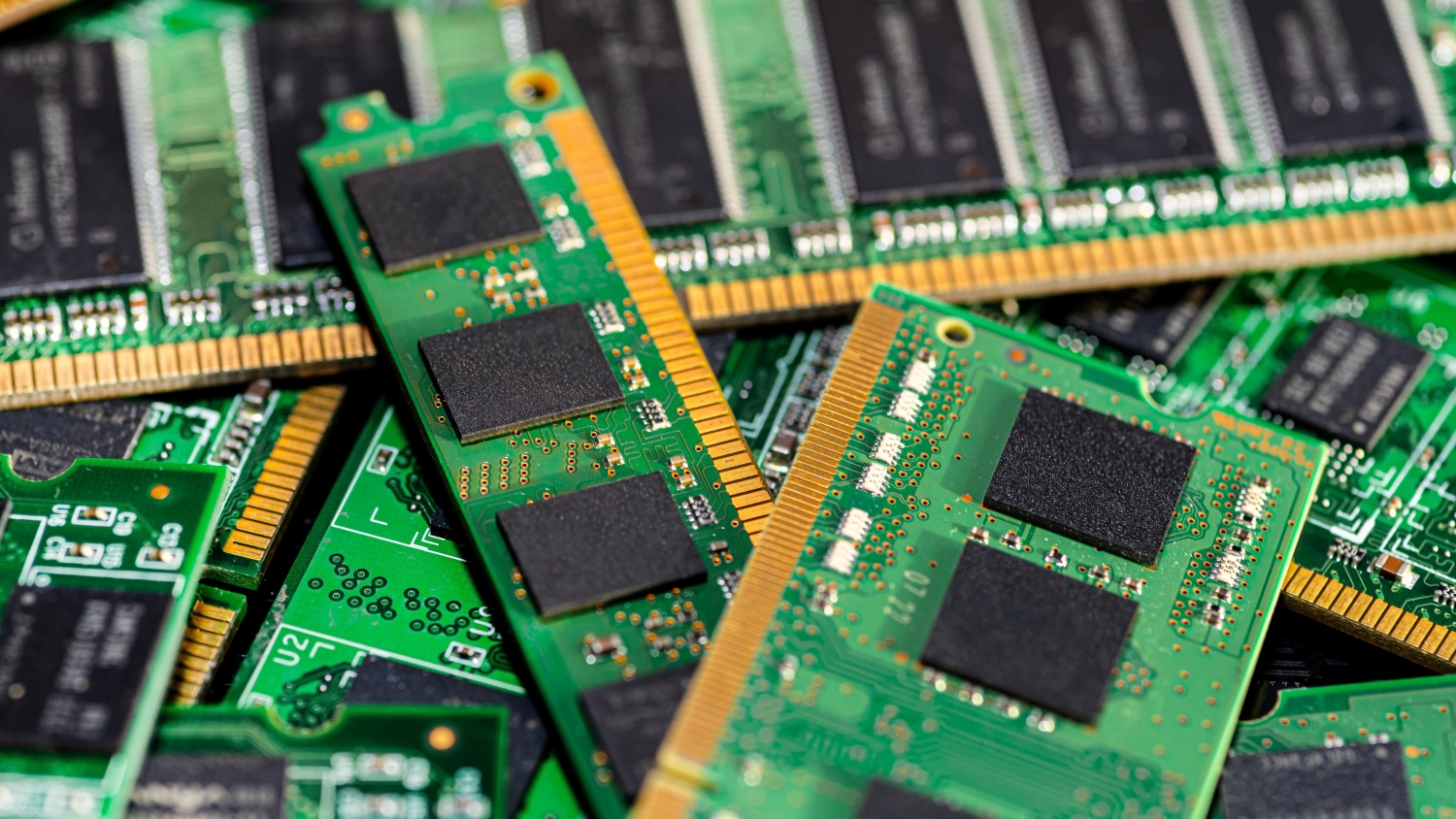

Random-access memory, or RAM, is used for short-term data storage in PCs, smartphones, and other devices; for any app you use or file you open, RAM is called to store and access active data.

With companies like Nvidia, Google, and AMD hoovering up increasing amounts of RAM in the race to build more AI infrastructure, supply and demand challenges are leaving everyday consumer devices more expensive to produce.

Research firm TrendForce forecasted contract prices for dynamic RAM (DRAM) – one of the most common types of RAM – would rise 55 to 60 per cent this quarter as suppliers increasingly catered to “rising AI server demand”.

Analysts at Omdia also predicted DRAM costs would climb 50 per cent in the first quarter of 2026, despite mainstream PC memory and storage costs having already risen 40 to 70 per cent in 2025.

“[This resulted] in cost increases being passed through to customers,” said Omdia principal analyst Ben Yeh.

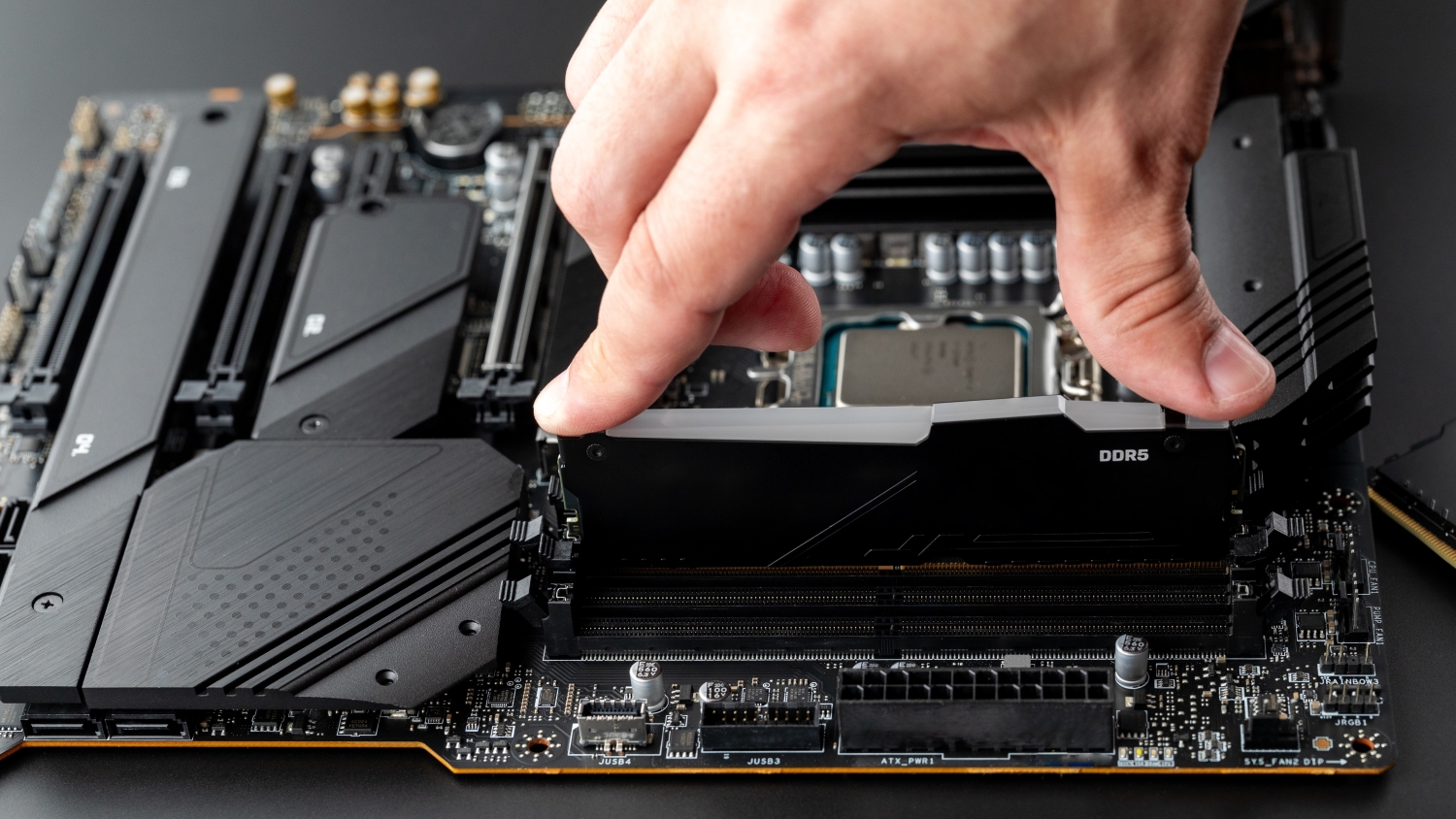

PC maker Framework announced Monday its higher-memory desktops would see significant price hikes thanks to memory supply shortages, jumping from $2,985 ($US1,999) to $3,672 ($US2,459) for its 128GB RAM systems.

“We held off on it as long as we could, but with memory prices from our suppliers continuing to increase rapidly, we’ve had to update the pricing on Framework desktop systems and mainboards,” the company said.

“It’s clear that this is going to be a challenging year and possibly even years for consumers.”

Consumer RAM ‘cannibalised’ by AI memory

Christopher Moore, vice president of marketing for major RAM manufacturer Micron, recently explained the company’s supply lines were under pressure thanks to increasing demand from AI companies.

“All these data centre build outs are going on, and the total addressable market of the enterprise or data centre business is growing,” he told WCCFTech.

“Us and our peers or competitors are all rushing to service these segments as much as we can, and there's just not enough supply to go around.”

The company announced in December that it would stop selling RAM to consumers via its popular Crucial brand, to instead meet demand for AI memory.

Data centre infrastructure used for AI computation typically requires large amounts of high-speed memory. Image: AWS

Notably, major memory vendor Samsung Electronics estimated its quarterly profits nearly tripled for the last three months of 2025, while Korean RAM manufacturer and Nvidia supplier SK Hynix said it was weighing a US stock market listing after its shares surged in domestic markets.

Oleg Zendel, research fellow in search systems and computing technologies at RMIT University, told Information Age that producing more “AI-grade memory” has effectively “cannibalised” consumer RAM on existing production lines.

He added “bottlenecks” in manufacturing were tied to a “limited amount” of cleanroom space, lithography equipment, and advanced fabrication facilities (fabs).

“Expanding capacity requires a very large investment and takes several years,” said Zendel.

“More RAM can be produced in principle, but not quickly enough to absorb sudden demand shifts.”

What will this mean for consumer devices?

Despite a 9.2 per cent year-on-year increase in PC shipments for 2025, Omdia found global PC shipments could conversely fall in 2026.

Sue Keay, director of the UNSW AI Institute, said the price of consumer devices was only “likely to rise over the next few years until memory supply can catch-up with demand”.

“That’s assuming there are no disruptions to current supply chains, which could have longer term impacts,” said Keay.

“With the price of RAM nearly doubling over the last few months it is hard to see how the suppliers of smartphones, TVs, and computers can absorb costs and not charge consumers higher prices.”

Industry analysts say RAM's high demand and limited supply could keep prices of consumer electronics elevated. Image: Shutterstock

Zendel also expected a “lasting effect” on the price of consumer devices as major memory producers like Samsung and SK Hynix prioritised high-bandwidth memory (HBM) for AI data centres over consumer-grade hardware.

“This imbalance is likely to translate into sustained cost pressure on consumer products, rather than a brief price spike,” said Zendel.

Meanwhile, reports have suggested the next generation of videogame consoles could be sold at higher prices or delayed from their intended 2027 to 2028 release windows.

Carl Pei, chief executive of UK consumer electronics company Nothing, said smartphone brands had the choice of either raising prices by “30 per cent or more”, or downgrading their specs.

“When something that used to get cheaper every year suddenly becomes a lot more expensive, the economics of building a smartphone fundamentally change,” said Pei.

A similar sentiment was echoed by Jean Philippe Bouchard, research vice president at analyst firm IDC, who predicted consumers might see PC memory specifications “lowered on average to preserve memory inventory on hand”.

“The year ahead is shaping up to be extremely volatile,” said Bouchard.