Apple Pay has arrived in Australia for American Express cardholders, who can now turn their Apple iPhone or Watch into a mobile wallet.

It’s the first time Apple’s payment service has been offered outside of the US and UK, but its reach will be limited as Australia’s ‘Big 4’ banks refuse to sign on.

Fairfax reported in August that the banks were unwilling to grant Apple a 15-cent slice of the interchange fees they received for every $100 of transactions.

As news of Apple Pay’s limited arrival in Australia spread, many banking customers used social media to ask their institutions if and when they would sign on to offer the service.

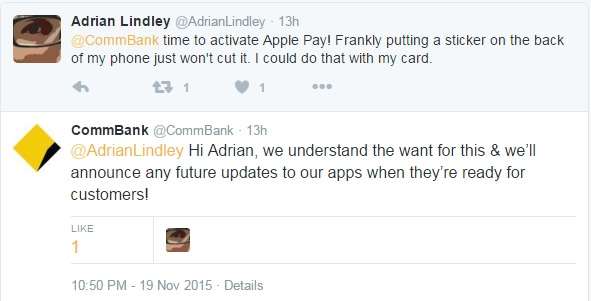

CBA told Twitter users that it would “announce future enhancements … when they’re ready for customers”, as it was repeatedly asked when it would support Apple Pay.

Other customers criticised CBA's own Tap & Pay service, which requires users to buy and attach a sticker for non-NFC enabled phones in order to make it work.

NAB similarly had no good news to share with its customers on Apple Pay.

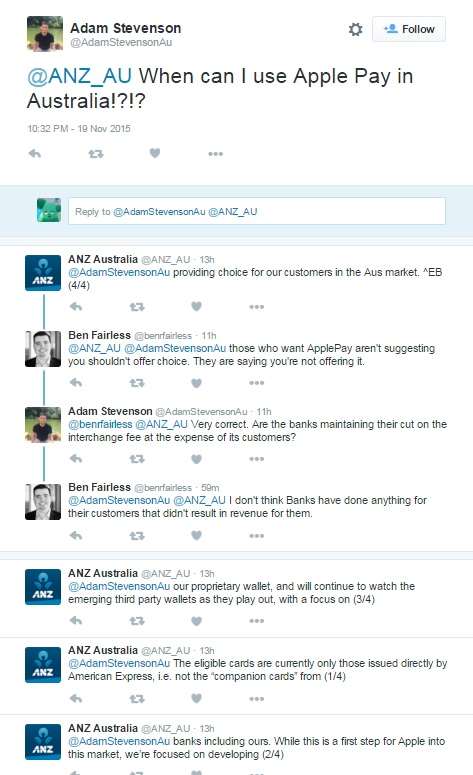

ANZ noted that it would concentrate on its GoMoney proprietary wallet technology and "watch" Apple Pay.

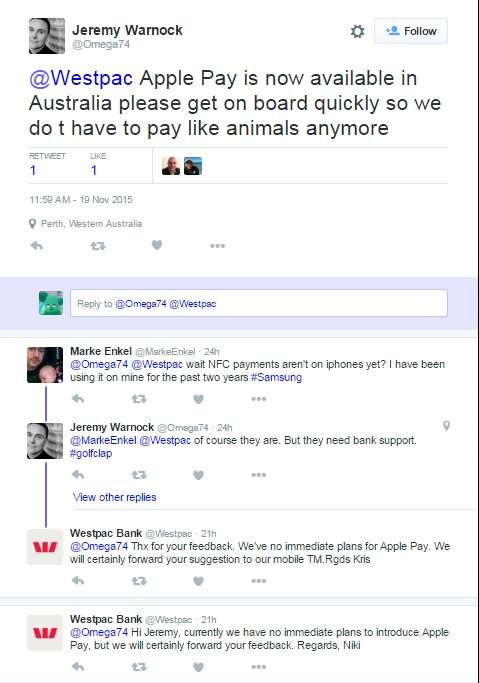

Westpac also spent a considerable number of tweets explaining its own position on Apple Pay.

Where Apple Pay is

Although Apple Pay isn't in a lot of places, it can be used by holders of American Express cards that are directly issued by American Express.

Technology commentator Trevor Long filmed one of his first purchases using an Apple Watch linked to his American Express card.

Completing the geek quinella, paying with Apple Watch. No phone required #ApplePay @AmexAU pic.twitter.com/UhHdTMaLHa

— Trevor Long (@trevorlong) November 19, 2015