Fast-growing buy now, pay later (BNPL) companies will be required to limit the kinds of customers they target, and be able to justify it to the regulator.

Financial watchdog ASIC released its long-awaited report on the explosive sector this week, outlining new ‘design and distribution’ obligations designed to rein companies in on the appropriateness of their customers.

“If the (BNPL) provider’s data indicates that consumers are paying missed payment fees repeatedly, for example, or that these fees represent a significant proportion of the amount borrowed, the provider will need to consider why this is occurring… and how this can be addressed,” ASIC wrote.

Once defined, ASIC said it expects companies to “review the outcomes of their arrangement and consider whether changes are required” to make sure their demographic isn’t being hurt by the products.

“While (BNPL) arrangements have been embraced as a way to make purchases more affordable, some consumers are missing payments, paying missed payment fees and struggling to meet other financial commitments.”

In the last financial year, 21% of all users ended up copping a fee, collectively paying these companies $43 million.

Around one in five users told ASIC they were cutting back or forgoing essentials like food to service their debts while 15% were taking out additional loans. Despite taking those desperate steps, more than half of those people still missed their repayments.

The data undermines one of the key defences the BNPL sector has raised in its fight against regulation.

As Australia’s unemployment rises, these companies have been eager to market themselves as budgeting tools – even going as far to compare themselves to tech companies – and downplay the potential harm their products pose to those in financial difficulty.

The regulators, and the federal government, have so far appeared content to accept this argument and allow the sector to essentially self-regulate.

A Fintech Senate Committee concluded earlier this year that further regulation could put competition at risk.

Despite potential issues with its voluntary code of conduct, ASIC appears to have waved the white flag on going any further without government support.

“Policy and regulation of the (BNPL) industry remain a matter for Government and, ultimately, the Parliament,” ASIC said.

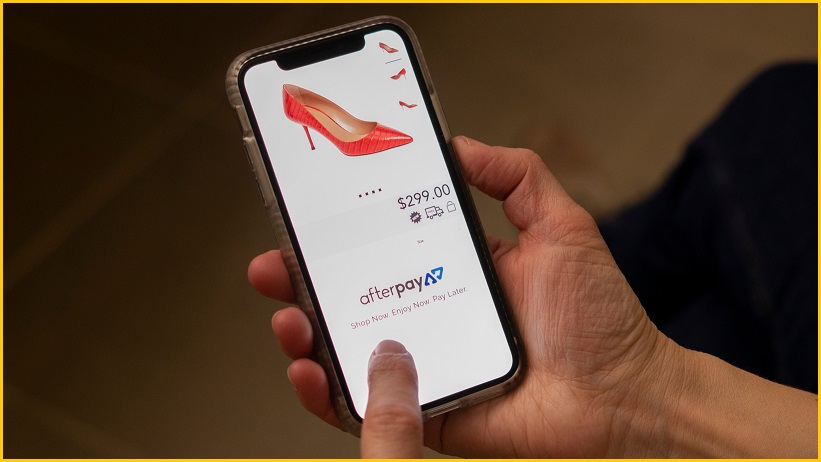

Afterpay and Zip unperturbed by new rules

The largest two players in the large field were supportive of the new report.

Zip co-founder and chief operating officer Peter Gray, who has called for more regulation, said his company would continue to go above and beyond its minimum requirements.

“There are different BNPL providers in Australia with different business models and different ways of engaging with consumers. Many of these models rely on late fees to make the economics work…Zip does not,” he said in a statement to the ASX.

“While we believe the Code is a very good start, Zip will continue to implement its own higher standards, particularly around customer suitability.”

Afterpay meanwhile, which represents 73% of all BNPL transactions, said, “the forthcoming design and distribution obligations, which focus on consumer outcomes and harms rather than imposing prescriptive compliance obligations, will play an important role in promoting good consumer outcomes”.

“It also comments that there is a significant role for industry self-regulation with broad industry support and commitment to ensure good consumer outcomes.”

The BNPL sector last year doubled in size

By the time extra regulations come into play in October next year, the sector may already be used by a good portion of the country.

The latest report shows BNPL active accounts doubled last year to almost 3.75 million people. The top six companies share 6.1 million users between them, or nearly one in three Australian adults.

If it were to maintain anywhere near the current growth trajectory over the next 12 months, more than half of the country would be signed up to a service.

Without typical credit protections, users will have to rely on the hope that the sector simply does right by them.

This article originally appeared on Business Insider Australia.