After launching its smart glasses, which have reportedly come to the attention of the Australian Privacy Commissioner, Facebook is getting set to launch its digital wallet Novi with digital currency Diem.

It comes after a Facebook executive admitted the social media platform has a "trust deficit” and is fighting fires on multiple fronts, with a Wall Street Journal investigation finding it applies different standards to high-profile users on the platform and reports it outsources toxic content moderation to consulting firms including Accenture.

Against the backdrop of this and its play for the metaverse, Facebook is pushing on with its plans to roll out digital payments across its platform including Facebook, Messenger and WhatsApp.

But regulators in the US may yet stymie the social media giant’s plans.

Novi explained

These two systems aren’t entirely new.

Novi was formerly known as Calibra and the Diem digital currency was initially called Libra.

Confused?

Novi is a digital wallet that will be linked to the Diem payment system to store and transact using digital currency.

Novi was inspired by the Latin words ‘novus’ for ‘new’ and ‘via’ for ‘way’.

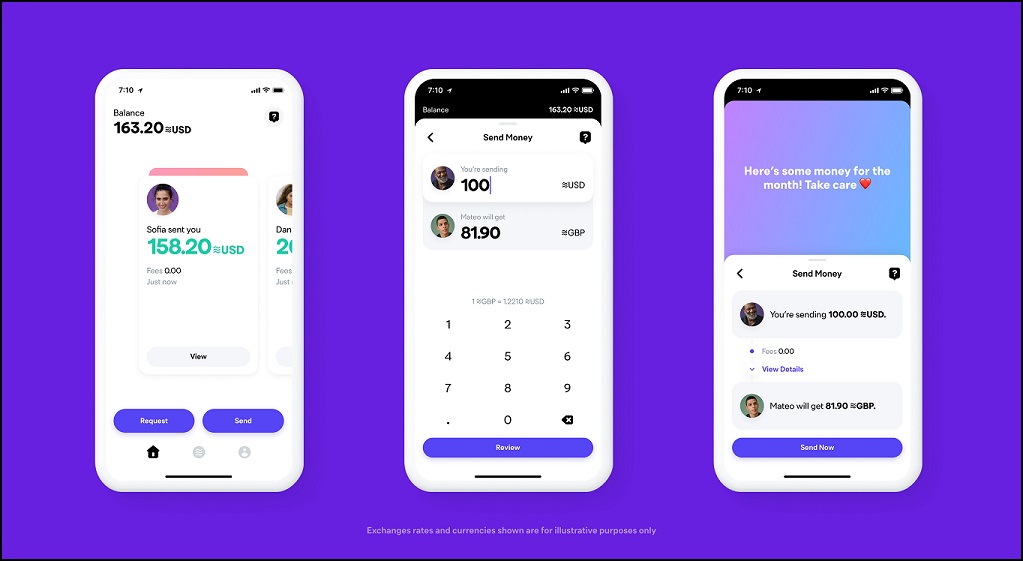

Novi in action. Photo: Supplied

In a statement, Facebook said Novi’s new visual identity and design represent the fluid movement of digital currencies.

“We’ve also included a nod to the Libra icon in the brand logo to underscore our commitment to the Libra network,” it said.

When funds are added to the wallet, they will be converted into the Diem digital currency.

To use Novi, users will first choose who they’re sending to, enter the amount, see the exchange rate and make the transfer.

It can also include a personal note to the recipient.

Novi will be available as a stand-alone app in the App Store and Google Play, and it will also be integrated into WhatsApp and Messenger apps, enabling funds to be sent and received to connections and businesses.

There will be no fees charged to add, send, receive or withdraw money, and transfers will arrive instantly.

At the moment, Novi is still in development but when it’s available, Facebook has said users will need a government-issued ID to sign up for an account to provide identification and prevent fraud.

Seize the Diem

Novi is designed for the Diem payment system, so when someone sends and receives money, they’ll be using Diem digital currency.

Through Novi, it will be possible to use the local currency to purchase Diem, and also convert Diem back to the local currency to withdraw money.

Diem is a new global payment system built on blockchain technology.

The Diem system incorporates three elements that are designed to create a more inclusive financial system: a secure, scalable and reliable blockchain as the technological backbone of the payment system; Diem digital currency backed by a reserve of assets made up of cash and short-term government securities; and governance managed by the Diem Association, an independent membership organisation.

To understand the connection, Novi is just one member of the Diem Association, which has others that are also using the Diem digital currency.

At the start, the Diem payment system will only support a few digital currencies, including USD, GBP and EUR that will have the same value in the country’s respective currency.

Over time, the Diem payment system is expected to widen support for additional digital currencies, although at this stage, there’s been no mention of AUD being available to use with Novi.

This system uses what’s known as “stablecoins” where the value of each virtual coin is tied to major currencies.

This is unlike cryptocurrencies such as bitcoin that are not linked to an external value.

When it started as Libra, it was not tied to any currency but this changed along with the name and is intended to keep the value stable and aid seamless transactions.

However, while Facebook moves along with its plans, company executives have been meeting with US government officials to reportedly allay fears that this new payment system will not impact the stability of the financial system if the value of the currency falls.