Central banks around the world have been slow to move on cryptocurrency.

But in Australia, one senior banker has made a fascinating admission.

He’s got ‘diamond hands’.

Diamond hands is the term of choice in cryptocurrency circles for those who hold (or, if you prefer ‘hodl’) their crypto against the tide of volatility and price changes.

The RBA’s head of payments systems, Dr Tony Richards, took the lectern at an event in Australia on Thursday and spoke at length about central bank policy on cryptocurrency.

It included all the usual censorious warnings that central bankers direct at the crypto space.

He described a “fervour” for cryptocurrencies that could reverse if people were “less influenced by fads and a fear of missing out.”

“The current speculative demand could begin to reverse, and much of the price increases of recent years could be unwound,” Dr Richards warned.

But the most interesting snippet in his speech was the admission that he, himself, dabbles.

He has done so since June 2014 (when the price of a Bitcoin was around $600), Dr Richards said.

“My initial purchase was a small amount of Bitcoin, which I have used for a few small transfers and even a purchase at a café that accepted Bitcoin, and then to diversify into some ether in August 2018,” Dr Richards said.

“After all, part of my job is to try to understand new payment instruments and technologies.”

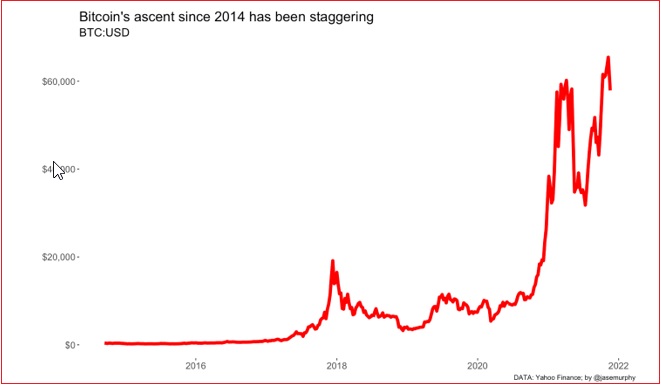

Nice work. Bitcoin has risen one hundred-fold since 2014 – that coffee he bought might pale in comparison to the famous pizza worth $600 million – but it would still sting.

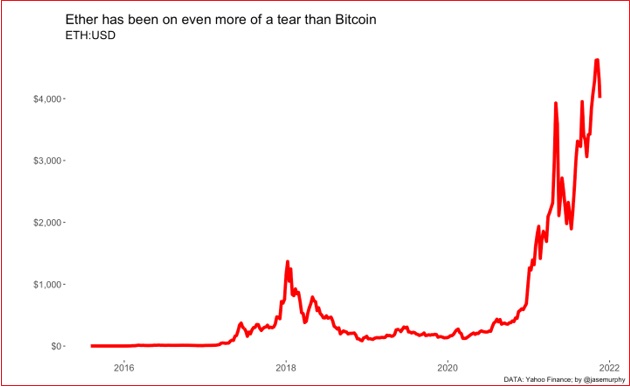

Timing one’s entry into Ethereum in 2018 is less of a tidy move – it is possible he bought at the peak at the time – but in recent times Ether has been tearing skyward like a rocket, so holding it has been an excellent idea.

Dr Richards, who is, incidentally, retiring from the Reserve Bank of Australia, wants us to know that he hasn’t minted a fortune.

“I stress that the amounts in question are still pretty small,” he said in his speech.

Of course, what “small” might mean exactly when you are a worker at an organisation that buys billions of dollars of bonds weekly is a matter of conjecture!

As an aside, it is interesting to note that RBA staff are already on a pretty good salary.

Dr Richard’s position at the RBA makes him one of its most senior staff, one of thirteen Heads of Departments (there is also a governor, a deputy governor and five Assistant Governors).

The RBA discloses that 25 staff made over $370,000 in 2021 - presumably Dr Richards is among them.

That would make him more highly paid than the chair of the US Federal Reserve, Jerome Powell, who makes US$200,000 a year, and whose financial disclosures suggest he does not have crypto in his portfolio, owning mostly equities and bonds.

Down the track

In the future, Dr Richards predicts asset transactions will happen in central bank-issued digital currencies, “or very safe stablecoins issued by regulated entities.”

“I expect that it will be rare that both parties to a transaction, especially a high-value one, will want the settlement to occur via payment in some cryptocurrency with high volatility,” he said.

He also argues that energy-intensivity and attractiveness for criminals are a weak point for crypto.

“If there were to be global policy action to deal with some particular concerns about the use of cryptocurrencies, plus the arrival of new stablecoins and [central bank-issued digital currencies] that could safely meet the needs of a wide range of users, existing cryptocurrencies might then have only niche use cases, at best.”

During his retirement, Dr Richards will be able to see if his predictions come true.

The true test, however, may be if he continues to ‘hodl’.