Australia’s competition regulator says the dominance of the country's three major cloud computing providers — Microsoft, Google, and Amazon Web Services (AWS) — means such companies could be incentivised to engage in anti-competitive behaviour, potentially increasing risks to consumers and the wider market.

The major cloud providers — often called ‘hyperscalers’ due to their capacity and reach — could use their dominance to anti-competitively bundle or preference their own cloud and AI services, increase prices, and make it harder for competitors to enter the market, the Australian Competition and Consumer Commission (ACCC) said on Monday.

The findings, part of the tenth and final report of the ACCC's five-year Digital Platform Services Inquiry, argued the vertical integration of “vast, incumbent digital platforms” such as cloud providers meant such platforms controlled much of the cloud computing and AI supply chain.

While the report found the continued growth of cloud computing would provide “significant benefits for businesses and consumers” in Australia, it also laid out concerns about flow-on effects for the burgeoning generative AI sector.

ACCC chair Gina Cass-Gottlieb said harms to competition in generative AI “could hamper innovation, result in lower quality products and services, and force Australian businesses and consumers to pay more”.

A new digital competition regime proposed by the federal government in December 2024 should be designed to allow the ACCC to monitor the effects of "new technologies that emerge over time" such as generative AI, Cass-Gottlieb argued.

'Smaller or emerging providers cannot compete’

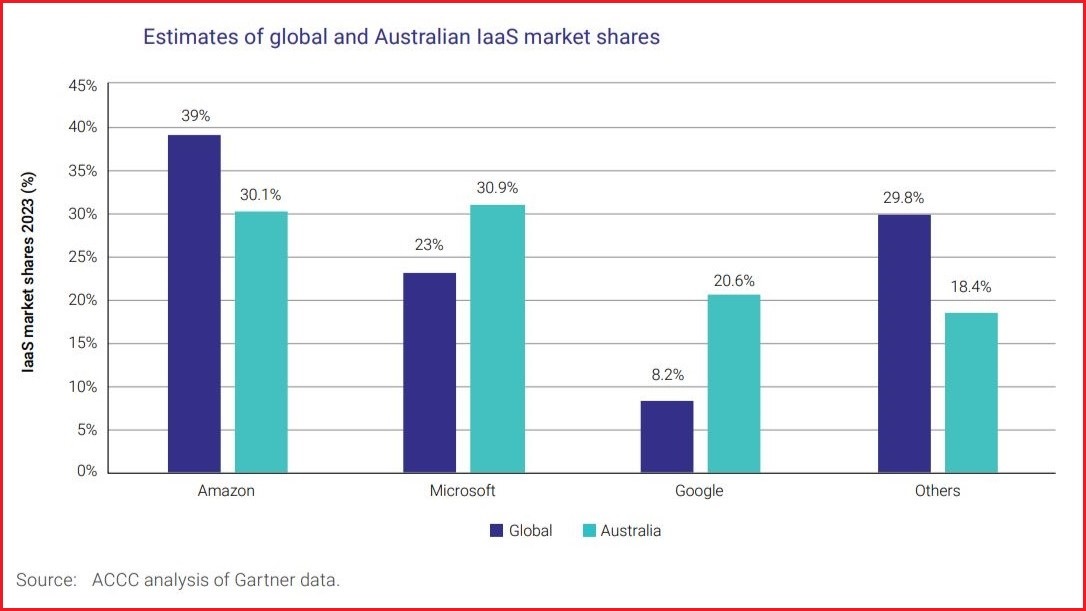

Both Microsoft and AWS have been estimated to hold around 30 per cent of Australia’s cloud computing market, with Google holding an estimated 20 per cent.

While other providers in Australia made up around 20 per cent of the market in 2023 according to ACCC analysis of data from advisory firm Gartner, outside of Australia they held around 30 per cent of the global market.

The ACCC report noted major cloud providers were planning major investments in data centres amid increased use of cloud-based generative AI tools, including in Australia.

Australian organisations are expected to spend nearly $26.6 billion on public cloud services in 2025, an increase of 18.9 per cent from 2024, according to Gartner.

AWS, which was selected to hold 'Top Secret' Australian national security and defence data in 2024, last week announced it would increase its local data centre investments to $20 billion between 2025 and 2029.

While the pledge was largely welcomed by the local industry, some organisations raised concerns over competition and data sovereignty.

Microsoft also pledged in 2023 to spend at least $5 billion building nine new data centres in Australia.

Image: ACCC Digital Platform Services Inquiry final report / Supplied

In its submission to the ACCC inquiry, broadcaster SBS said competitive advantages held by hyperscalers meant “smaller or emerging providers cannot compete”.

“As an example, if AWS is being utilised by an organisation, Amazon’s own AI services are also on offer as self-preferenced services by Amazon,” SBS wrote in August 2024.

“If organisations or consumers seek to utilise other AI services, such services may not be compatible with AWS.

“In a similar vein, if Microsoft's Azure cloud platform is utilised, then its Copilot AI tools are self-preferenced by Microsoft.”

The Australian Computer Society (ACS) — which represents almost 50,000 local tech workers and is the publisher of Information Age — wrote in its submission that it encouraged the ACCC “to act swiftly and ensure local entrants have a fair chance to compete".

Hyperscalers argue prices are down and competition is up

AWS and Microsoft told the ACCC cloud prices had decreased over time due to efficiency gains spurred by competition, but ACCC said it did not have access to historical pricing information to verify those claims.

It also noted “the complexity of combined pay-as-you-go pricing, fees, and licensing costs, as well as the variety of products available, creates challenges in assessing the current and historical prices of cloud products”.

Google argued in its submission that Australia’s cloud computing market was “capable of delivering good outcomes for customers in terms of quality, price and innovation”, but suggested Microsoft had made it “not commercially feasible” for organisations to move on-premises Microsoft software to any cloud provider other than Microsoft’s Azure service.

The search giant encouraged ACCC to investigate Microsoft’s licensing practices.

“Google believes that Microsoft’s software licensing restrictions are the only material barrier to fair and effective competition in the market for cloud infrastructure services, both in Australia and globally,” Google said in its September submission.

Microsoft, Google, and AWS all argued Australia had competitive cloud and AI markets, and cited smaller players such as Oracle, IBM, Alibaba, Snowflake, and Australian provider Macquarie Cloud Services.

AWS said there was “healthy competition”, while both Microsoft and AWS said they had commercial incentives to ensure cloud and AI services were available to as many people as possible — including by offering AI models other than their own.

Microsoft argued it was “common for AI application developers and deployers, including in Australia, to utilise a range of different models, rather than relying on one", while AWS argued there was “no evidence of serious competitive harms that support fast-tracking a novel economy-wide regulation”.

Andrew Leigh, the Assistant Minister for Productivity, Competition, Charities, and Treasury, said the the ACCC’s report was welcomed by the government, which sought to create a digital economy in which “innovation flourishes and no one is above the rules”.

The government's potential updates to digital competition law are also expected to target the likes of Google and Apple’s mobile app stores, as well as Google’s dominance of online advertising technologies.