Australian small businesses exporting to customers in the US are losing millions during nearly a month of delayed or lost sales, after Australia Post announced that its fortnight-long stoppage of shipments to the US could extend until nearly the end of September.

The delivery giant’s shipments to the US were shut down on 29 August after it admitted that it was unprepared to enforce tariff collection requirements imposed by the US government when it suspended the long-running de minimis exemption on that date.

The freeze on shipments to the US is set to continue for up to another fortnight, Australia Post said this week in announcing that it “plans to resume” shipments to the US and its territories “on or before” 25 September – a 27 day stoppage in total.

That’s less than a week after the 19 September deadline for sea mail shipments – a key milestone in the runup to the end-of-year delivery surge – and threatens to exacerbate a backlog of online orders piling up in warehouses and spare bedrooms across Australia.

Just how big of a backlog?

ABS figures show that Australian businesses exported $517 billion worth of merchandise goods during 2024, with $23.8 billion, or 4.6 per cent of this going to the US.

Given that Australia Post delivered a reported 2.3 billion articles during fiscal 2023-24 – an average of 6.3 million articles per day – extrapolation suggests that Australian businesses and individuals could be sending 289,000 packages to the US per day.

That means by the time Australia post resumes US shipments, Australian exporters could conceivably have a backlog of 7.8 million packages waiting to be shipped there – overloading airlines that have been scaling back package delivery capacity.

Cutting off small businesses from their customers

Among the many problems created by the 10 per cent tariffs – which have increased the price of Australian exports to the US – is the direct impact on small businesses, which comprise 93 per cent of Australian exporters and rely on exports to thrive.

While larger companies often have commercial relationships with larger courier companies like DHL and FedEx, small and home-based businesses disproportionately rely on Australia Post to ship their products to the US – and they’re feeling it.

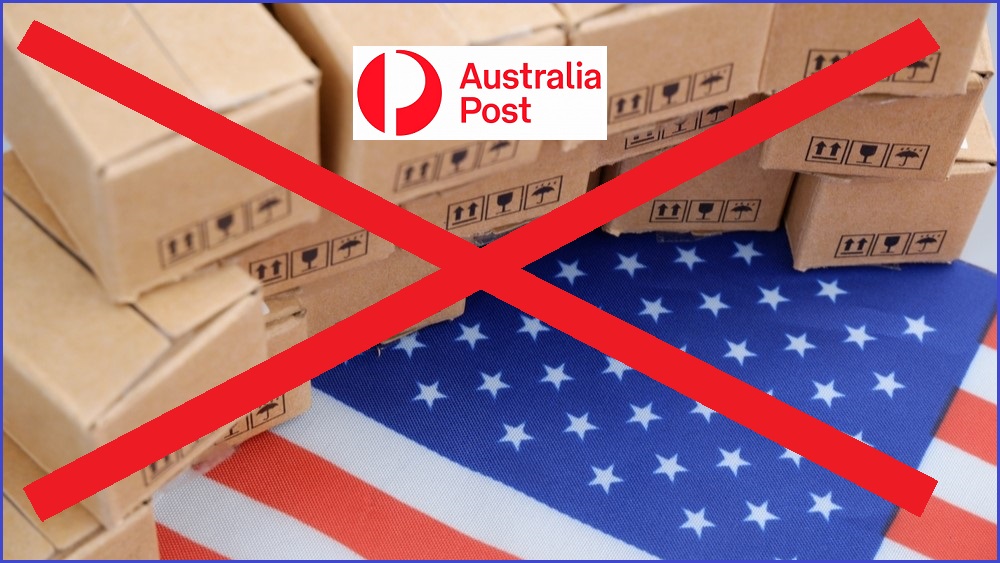

Australia Post halted deliveries to the US on 29 August. Photo: Shutterstock / Information Age

“Small businesses have faced real challenges during the postal freeze,” Matthew Addison, chair of industry advocacy group Council of Small Business Organisations Australia (COSBOA), told Information Age.

Inability to fill export orders “has meant lost income, delayed deliveries, and extra effort to maintain customer confidence,” he said, noting that “small businesses often don’t have the flexibility to switch couriers or absorb higher freight costs.”

“Any disruption can have a noticeable impact on their operations…. Even with services expected to resume later this month, small operators are working hard to manage backlogs and keep customers satisfied.”

Maximising the end of de minimis

With 1.36 billion packages worth $98 billion ($US64.6 billion) entering the US last year under the de minimis rule – including 600,000 Shein and Temu deliveries per day – the consequences of its elimination are now playing out around the world.

Experts advise exporters to actively reassess product lineups and delivery supply chains, auditing products that were below the $1,200 ($US800) de minimis threshold and modelling pricing scenarios including tariffs, and exploring hybrid fulfilment models.

As the loss of de minimis exemptions damages the margins of many high-volume, low-cost e-commerce operators, exporters should also be adopting new technology solutions to automate declarations, and streamline tariff compliance and payment.

Adoption of AI to optimise supply chains is fast becoming part of the solution, logistics specialist Epicor noted in recently releasing its new Agility Index 2025, which found 56 per cent of 966 supply chain professionals, in Australia and elsewhere, adopting AI.

Yet no matter how much AI logistics operators and exporters adopt to speed Australian exports, they can do little about arbitrary trade policy changes like the elimination of the de minimis rule – meaning that adapting is the only option for Australian exporters.

The stoppages “highlight how sensitive small businesses are to sudden changes in international trade processes,” Addison said, “especially when guidance and communication are limited.”

Governments should, he added, “act promptly to resolve the underlying tariff and administrative barriers on small-value exports to the US… Small businesses need certainty to continue trading effectively, and it’s important exporters are supported.”