Australians affected by Facebook’s Cambridge Analytica scandal can now register to access compensation as part of a $50 million fund set up by parent company Meta as part of an agreement with the nation's information regulator.

The payment program, which was first announced in December 2024, was opened for registration on Friday by Meta and the fund’s administrator, consultancy firm KPMG Australia.

Here’s what you need to know about why the fund was established, whether you may be eligible to access it, and when payments are likely to be made.

What was the Cambridge Analytica scandal again?

The incident saw the personal information of some 80 million Facebook users — including more than 300,000 Australians — collected without consent in the 2010s by British political consulting firm Cambridge Analytica.

The data was gathered through a personality quiz on Facebook called ‘This is Your Digital Life’, developed by researcher Aleksandr Kogan, which scraped and sold off information not only about those who installed it, but also their Facebook friends.

Cambridge Analytica was accused of using the data in its political work, including the United Kingdom’s Brexit referendum and the 2016 US presidential campaigns of Ted Cruz and Donald Trump — accusations the now-defunct firm denied.

While Meta has not admitted responsibility for the incident in Australia, CEO Mark Zuckerberg told US Congress in 2018 that the company had made mistakes by not preventing Cambridge Analytica’s data collection.

How was a $50 million Australian fund established?

The fund, known as the Facebook Payment Program, was set up when Meta agreed to settle court proceedings through an enforceable undertaking with the Office of the Australian Information Commissioner (OAIC) in December 2024.

The OAIC first launched court proceedings against the company in March 2020, after beginning its investigations into the data harvesting as early as 2018.

The agency alleged Meta had breached Australia’s Privacy Act through “seriously and/or repeatedly [interfering] with the privacy of approximately 311,127 Australian Facebook users”.

The fund is the largest payment ever established over the privacy concerns of Australian individuals.

Meta declined to comment about the payment program when contacted by Information Age and instead referred to comments it made when the settlement was announced, including that the company “settles on a no admissions basis” and the alleged practices are “no longer relevant to how Meta’s products or systems work today”.

Mark Zuckerberg has previously said Meta (then called Facebook) made mistakes which allowed Cambridge Analytica to collect too much data. Image: Shutterstock

Who is eligible for the compensation fund?

To be eligible to make a claim, Australians will need to have held a Facebook account between 2 November 2013 and 17 December 2015, been in Australia for more than 30 days during that period, and have either installed the ‘This is Your Digital Life’ app or been Facebook friends with someone who did.

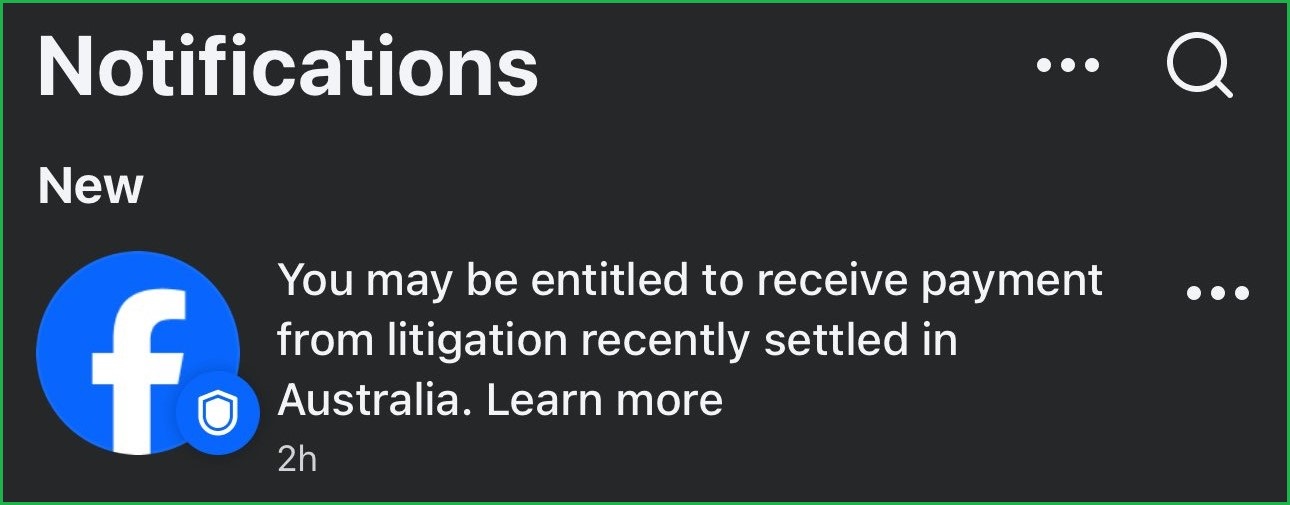

Meta has already notified “people that may be eligible” using a notification on Facebook which contains a unique identifier called a token, according to fund administrator KPMG — but those who did not receive a token will still be eligible to apply.

The token notification reads, “You may be entitled to receive payment from litigation recently settled in Australia. Learn More.”

Image: X / @eidaexoelf

Australian users with a token will be able to use it to “fast-track” their application, whereas those without a token will need to supply more evidence about their eligibility.

If you have not been given a token, KPMG says you can download and use emails you received from Facebook between 2 November 2013 and 17 December 2015 as evidence of your eligibility.

If you do not have any emails, you can provide a screenshot from your Facebook Activity Log which shows you had an active account during that time.

To prove without a token that you were in Australia for at least 30 days during that period, you may need to provide a copy of a bill, a lease agreement, or a receipt from an in-store purchase which shows you were in the country.

What if I’m not sure if I (or my Facebook friends) installed the app?

KPMG said neither it, nor Meta, would be able to help those without a token confirm whether they or a Facebook friend actually installed the app.

However, if you have not received a token notification on Facebook, you can check this Facebook help page which contains a “Was my information shared?” section for some users, outlining whether or not Meta believes you or your friends used ‘This is Your Digital Life’.

If you still believe you or one of your friends installed the app, you can still apply for compensation but will be asked to make a declaration of varying significance depending on the harms you are claiming.

As a requirement of Meta’s enforceable undertaking, KPMG "will not require further evidence” beyond these declarations to establish whether someone, or one of their Facebook friends, installed ‘This is Your Digital Life’.

If you are claiming specific financial or health impacts from your data being collected, you will be categorised as a Class 1 claimant and asked to provide proof of those impacts and complete a prepopulated statutory declaration which states you were an installer or a friend of an installer.

Knowingly providing a false statutory declaration may be a criminal offence, KPMG says.

If you are only claiming “generalised concern or embarrassment” such as “distress, worry, fear, humiliation or embarrassment”, you are a Class 2 claimant.

In that case, KPMG will ask you to make an electronic declaration as part of your submission and you will not need to provide evidence of the impacts.

Australian claimants will need to have held a Facebook account between 2 November 2013 and 17 December 2015, among other criteria. Image: Shutterstock

How do eligible Australians apply for compensation?

To double-check your eligibility and make a claim, visit facebookpaymentprogram.com.au — a site established by KPMG which is also accessible through the company’s website.

Registrations for the payment program will be open until 31 December 2025.

As government-issued identity documents are required during the application process, Australians should be wary of scammers who may use the opportunity to try and obtain their information, according to the OAIC.

"If you receive a call from anyone offering to help you with a payment or refund, hang up immediately,” the regulator said.

“Never give personal information to anyone calling you out of the blue; never give access to your computer or bank account; and never click on a link in a text message, or open an attachment in an email, if you were not expecting the text or email.”

How much could I be paid, and when?

While the total amount available for distribution is $50 million, the exact amount individuals will receive will depend on factors such as the class of their claim, the severity of the loss or damage if it is a Class 1 claim, and how many claims are received in total.

If all 300,000 or so eligible Australians applied and were awarded the same amount, everyone would receive around $160.

However, Class 1 claims will receive more, depending on the severity of the loss or damage suffered, so Class 2 claims will receive smaller amounts.

Successful Class 2 claimants will all receive the same amount at the end of the process, KPMG said, but only after Class 1 payments were determined.

KPMG also said its costs were paid separately by Meta and would not affect payments received by claimants.

When the firm completes its assessments in early June 2026, claimants can expect to receive an interim distribution statement and be asked to share their payment details.

Those interim amounts may change before KPMG issues final distribution statements in mid-July 2026, following internal reviews it may have to carry out due to disagreements with claimants.

Claimants should then expect to receive their payments in early August 2026, KPMG said.

Under its enforceable undertaking, Meta must direct KPMG to pay any leftover money to the Australian Government’s Consolidated Revenue Fund at the end of the process.