As Australian taxpayers prepare to file their tax returns for the 2024-25 financial year, the Australian Taxation Office (ATO) says it is focusing on expenses, deductions, and gig economy income this tax time.

Technology workers, just like those in other industries, could expect the ATO to crack down on errors in expenses they claimed — including in working from home deductions — as well as whether they correctly reported their other income sources.

Here’s what you need to know.

'Don’t just claim it and hope for the best’

In May the ATO revealed some of the “wildest” tax deductions Australian workers had tried to claim in recent years.

One of the incidents allegedly involved a mechanic whose claim was denied after they tried to claim a swathe of technology — including a TV, a gaming console, an air fryer, a microwave, and two vacuum cleaners — as work-related expenses.

ATO Assistant Commissioner Rob Thomson said work-related expenses needed to have “a close connection to your income earning activities” and needed to be substantiated by records such as receipts or invoices.

“We know in many instances mistakes relating to work-related expenses could be avoided with a little time and effort,” Thomson said.

“… If you’re not sure what you can or can’t claim, check the ATO website for detailed guidance, or ask your registered tax professional, if you have one.

“Don’t just claim it and hope for the best as penalties and interest may apply.”

ATO Assistant Commissioner Rob Thomson says work-related expenses must be directly connected to your income-earning. Image: ATO / Supplied

Millions of Australians claimed working from home deductions in 2024, the ATO said, and that was expected to occur again this year, through the two typical methods: the fixed rate method, and the actual cost method.

The fixed rate method allows you to claim 70 cents for every hour worked from home to cover costs such as internet, electricity, and phone usage, while the actual cost method requires records of all your work-related home expenses to work out how much you may claim.

Dr Angel Zhong, an associate professor of finance at RMIT University, said some taxpayers might believe some “common misconceptions” about claiming deductions for working from home.

“You must keep detailed records of your hours worked and ensure you’re not double-dipping by claiming additional expenses already included in the fixed rate,” Zhong said.

“You can’t claim rent or mortgage interest unless you’re running a business from home, and personal items like coffee, tea, or snacks are not deductible.

“Similarly, you can’t claim your entire internet or phone bill — only the portion that directly relates to your work.

“Being aware of these rules can help you avoid errors and potential [ATO] audits.”

Technology businesses can also claim tax deductions for the cost of digital products they used this financial year, such as software subscriptions, internet and cloud fees, and the cost of running websites.

Working from home deductions can be claimed through two typical methods: the fixed rate method, and the actual cost method. Image: Shutterstock

Gig work no longer ‘under the radar’

With income from more gig economy work now being reported directly to the ATO, workers making money through digital services have been warned they could face a larger tax bill this financial year if they have not already paid tax on that work, which may be their side hustle.

Digital platforms such as YouTube, Patreon, Airtasker, UberEats, and even OnlyFans are now legally required to report the income of their users to the ATO under the Sharing Economy Reporting Regime (SERR).

Jenny Wong, tax lead at accounting body CPA Australia, said the changes brought gig economy services in line with other third parties which already provided data to the ATO.

“Until this year, individuals have been required to self-declare the income from their side-hustles — now nothing will go under the radar,” Wong said.

"… These rules apply to a broad range of services, not just the most well-known.

“If you use a website to rent out a car parking space or your designer handbag, this income will be recorded, and you’ll need to pay tax.”

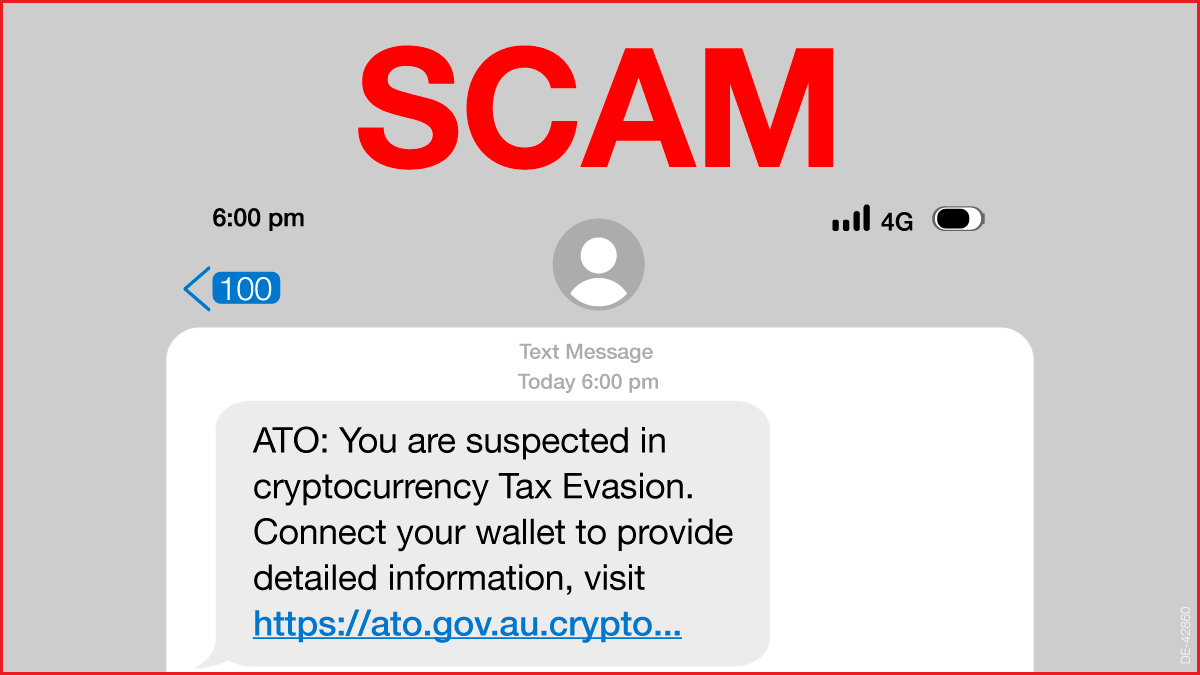

Beware of tax time scams

Tax time often brought with it an increase in attempted scams and threats from cybercriminals, experts said.

Reuben Koh, a director of security strategy at cybersecurity and cloud computing firm Akamai Technologies, said improvements in generative artificial intelligence models allowed scammers to quickly do deep research into potential victims, including companies.

It also allowed cybercriminals to create “more personalised and automated phishing attempts via email and SMS”.

“These scams often leverage themes like unclaimed refunds or urgent tax payments, using convincing logos such as the ATO and language such as the need to action an item in 24 hours, to pressure victims,” Koh said.

“For example, robocalls can include a mix of video, audio, and photos.

“These elements combined with deepfake content and AI-generated phishing text, encompass a very modern and highly effective way of conducting a scam or attack.”

The ATO says it will never send unsolicited messages containing hyperlinks. Image: ATO / Supplied

Businesses should also be on the lookout for email compromise scams, which often increased during tax time, Koh said.

All taxpayers should be “wary of scam emails, phone calls, and text messages claiming to be from the ATO”, the agency said in May.

“The ATO may use SMS or email to ask taxpayers to contact us, but will never send an unsolicited message containing a hyperlink to log on to online services.

“Always access ATO services directly by typing ato.gov.au or my.gov.au into your browser.”

Taxpayers who paid scammers or believed they had shared their personal information with cybercriminals were urged to contact the ATO immediately on 1800 008 540.

Scams can also be reported directly through the ATO website.