It’s a big bang day in US markets.

Perhaps even the biggest bang day in history – because the big tech firms reporting their earnings today have never been more powerful, meaningful and important for the US economy.

The results they report today will make waves, for better and for worse.

Confessions and boasts

October is earnings season, where big companies come to the stock market to make their boasts and confessions.

Profits, losses, revenues and costs for the first quarter of the new financial year all are revealed.

Earnings seasons starts with a trickle of earnings from minor companies before building to something of a crescendo.

And Wednesday afternoon, US time, the crescendo reaches deafening levels as three of the biggest companies to ever exist report their earnings.

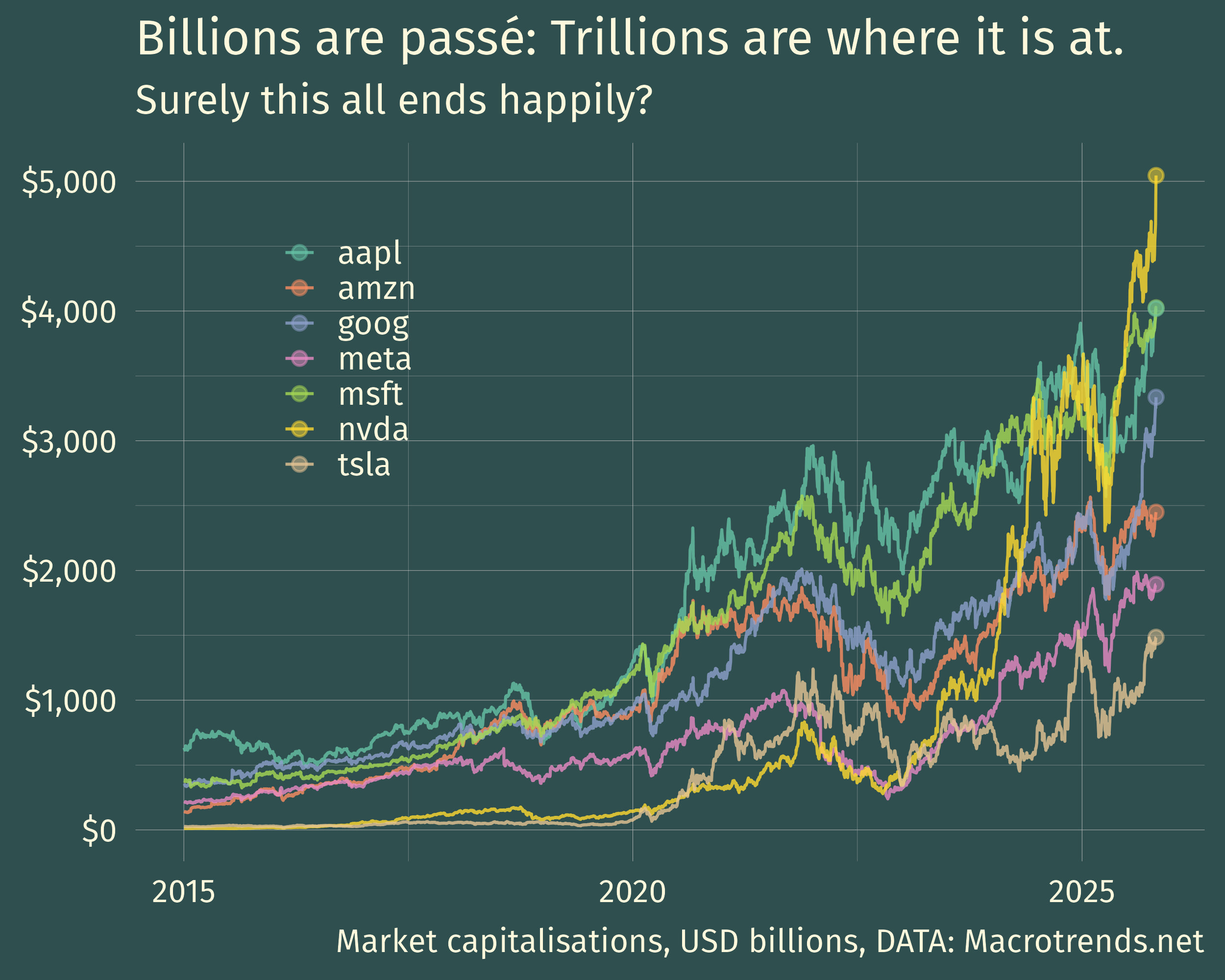

Meta, Facebook’s owner, is worth $1.9 trillion. Alphabet is worth $3.2 trillion. Microsoft is worth $4 trillion.

A year ago, the largest company in the world had a market cap of $3.5 trillion.

Now three companies are worth more than that (Apple, Microsoft and Nvidia).

One of them – Microsoft – reports earnings today.

Apple is tomorrow (as is Amazon, market cap $2.4 trillion).

Nvidia fans will have to wait until mid-November.

The share of the top few tech companies in the market capitalisation of the S&P 500 is higher than ever, meaning that the fate of the stock market hinges, more than ever before, on these few results.

The following chart shows the market value of the US tech companies known as the Magnificent Seven, and it illustrates neatly why they now loom so ominously over the rest of the stockmarket.

Lap up these numbers. Source: Supplied

At the same time, the value of the US stock market relative to US GDP is higher than ever, meaning that the implications of these earnings will resound deeper and further throughout US economy than before.

Not to mention that the US economy remains the biggest single part of the world economy and a major destination for Australian investment (for example, our superannuation is largely tied up in US indexes).

The whole world is gathered around the campfire that is America’s public markets, and that fire warms many hands.

Reading the numbers

So how did the big names go?

Let’s start with the smallest giant – Meta.

It grew revenue by 26 per cent and operating profits by 18 per cent.

Reported profits actually fell by 83 per cent due to complicated Trump-related once-off tax changes, but CEO Mark Zuckerberg still boasted of “a strong quarter.”

The middle giant – Alphabet – grew revenue 15 per cent while increasing profits 33 per cent. “Terrific” is what CEO Sundar Pichai called it and you can’t say that sounds like an exaggeration.

The largest giant being Microsoft reported its revenue was up 18 per cent and profits up 12 per cent.

Microsoft chief financial officer Amy Hood said the company was “exceeding expectations across revenue, operating income, and earnings per share.”

Sounds good right?

But this is how tightly wound markets are right now: two of those three companies plunged in after-hours trading. (Meta -7.4 per cent; Microsoft -3.8 per cent; Alphabet +6.8 per cent, at time of writing.)

Expectations are so elevated that you can grow revenue by $10 billion compared to the same period last year, like Microsoft did, boost profit even as you spend like a drunken sailor on AI and still leave markets bitterly disappointed.

Markets are primed for excellence, and so anything less is a failure.

This is why the tech sector represents such a risk.

If growth can make stock prices tumble, imagine what a bad quarter could do.

And if one bad quarter could cause havoc, imagine what the implication might be of AI investments turning out to be less useful than expected.

A huge amount of global welfare is riding on the judgments of a handful of tech executives.