The government’s national innovation and science agenda (NISA) was largely dormant in 2016, but is finishing with a flurry as two of the biggest ticket items are brought online in the space of a week.

Having managed to sneak the $200 million CSIRO Innovation Fund just inside NISA’s first year, the government has also now jumpstarted its $500 million Biomedical Translation Fund.

The public purse contribution to each fund is $70 million and $250 million respectively, with the remainder drawn from royalties and private sector investment.

Three venture capital fund managers have been appointed to oversee the biomedical fund, which is designed to get innovation out of the lab and to the patient.

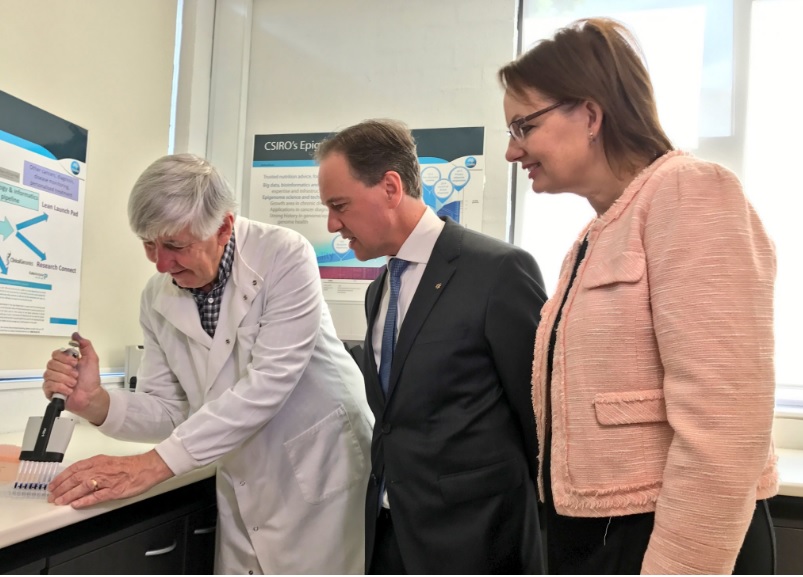

Brandon Capital Partners has been licensed to manage $115 million in Commonwealth capital and $115 million in private capital, the Minister for Industry, Innovation and Science Greg Hunt said.

The private sector funds it looks after have been drawn from biopharmaceutical investor CSL Limited and from several superannuation funds.

“Currently, promising Australian medical discoveries are often sold to large offshore pharmaceutical companies at early stages of development due to lack of investment capital available to the sector in Australia,” Brandon Capital Partner said.

It will focus its investments on companies with medical research projects at advanced pre-clinical, Phase I and Phase II stages of development, enabling them to pursue later-stage product development onshore.

Brandon called the biomedical translation fund a “once-in-a-generation initiative to make Australia a global leader in the commercialisation of biomedical discoveries.”

Also within the biomedical fund will be OneVentures, which will have a total pot of $170 million, and BioScience Managers with a pot “of at least $100 million.”

Sydney-based OneVentures already has $170 million in funds under management, and has invested in a range of tech start-ups including e-learning company Smart Sparrow and biotech firm Clinical Genomics.

Melbourne-based BioScience Managers said it wanted to help produce “globally competitive companies that produce life-saving products”.

“We really need to ensure that the next generation of companies like Cochlear, Resmed and CSL can grow and flourish from Australia and become international champions and this investment capital will certainly go a long way to ensuring that,’’ BioScience Managers’ managing director Jeremy Curnock Cook said.

“Too often great Australian ideas struggle to bridge that second valley of death as they struggle for capital to commercialise promising discoveries.”

Curnock Cook said his fund would look to create annual net returns “above 20 percent” for the seed money stumped up by the government and private sector.

“It is really important to remember that this money is not a handout – the Federal Government is rightly expecting to achieve a good financial return on its investment on behalf of taxpayers and the three fund managers appointed will certainly be seeking just that for the money they are investing on behalf of their investors,’’ he said.

At a launch event, Minister for Health and Aged Care Sussan Ley called the biomedical fund “a ‘smart money’ investment that leverages the talent of our home-grown innovators to deliver real health benefits to everyday Australians.”

“It will help upskill early-stage medical research here in Australia and create more jobs,” Ley said.

“Australia’s biomedical talent is world class and this investment capital will help to bring new drugs, devices, and therapies to market where they can improve the lives of patients.”