Tesla is no longer the world’s highest selling battery electric vehicle maker after Chinese rival BYD overtook the company in annual sales for the first time, according to sales figures reported on Friday.

The Elon Musk-led Tesla reported deliveries of 1.64 million battery electric vehicles (BEVs) in 2025, down 9 per cent compared with its 2024 numbers, which also saw a decline.

BYD sold 2.26 million BEVs in 2025 — a rise of 28 per cent, despite still being largely prevented from entering the US market due to high tariffs.

The company, which also produces plug-in hybrid electric vehicles (PHEVs), announced in December it had sold a total of 4.6 million “new energy vehicles” in 2025.

Tesla’s sales fell to around 418,000 in the fourth quarter of 2025 with a 16 per cent year-over-year decline in that period, short of many analysts’ expectations.

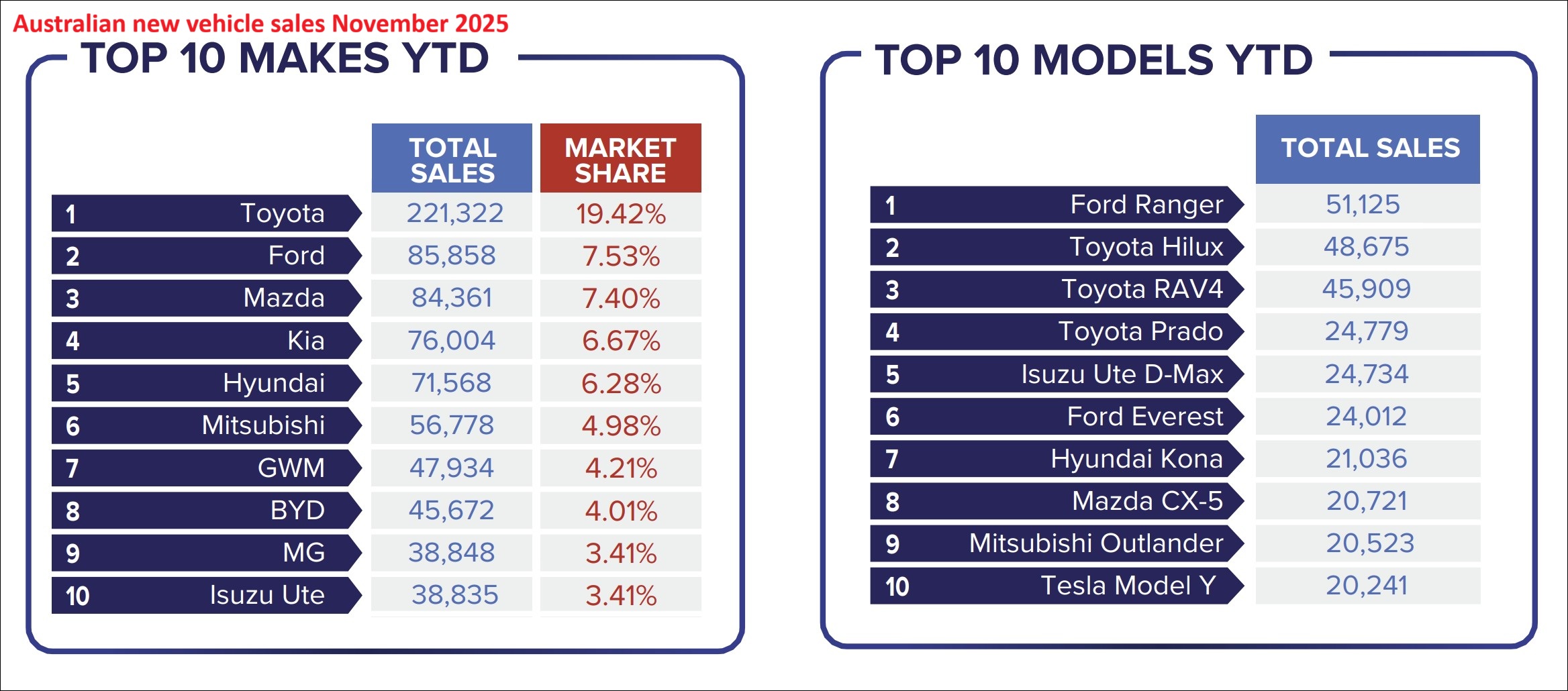

BYD has also ramped up pressure on Tesla in Australia, where the Chinese brand recorded the eighth highest number of sales in the year to November 2025, according to figures from the Federal Chamber of Automotive Industries (FCAI).

While Tesla sat outside the top 10, its Model Y was still the 10th highest selling vehicle in Australia between January and the end of November, according to data from the Australian Automotive Dealer Association (AADA).

Global sales of the company’s divisive Cybertruck ute, which is not yet available in Australia, have reportedly been well below Musk’s previously stated goal of 250,000 vehicles per year.

'New brands coming thick and fast’ in Australia

Other Chinese car makers GWM and MG were also among the 10 top vehicle sellers in Australia in November.

The nation was seeing a record increase in imported car brands, AADA said on Monday.

Modelling commissioned by the association found there would be 67 car brands in Australia in 2026, up from 39 in 2021, as more EVs and Asian companies entered the market.

AADA CEO James Voortman said the Australian market was seeing “new brands coming thick and fast”.

“These new brands see Australia as having very attractive policy settings that are geared for the supply of electric vehicles where they can test their product in a western market with low upfront investment when compared to other western countries,” he said in a statement.

FCAI chief executive Tony Weber said in December that Australians were seeing “growing” choice in BEVs, with 110 models available in the local market in 2025.

BEV sales accounted for 8.2 per cent of sales in the year to November 2025, up from 7.4 per cent for the same period the previous year, according to FCAI.

“We encourage governments to continue to invest in recharging infrastructure to support growth in consumer confidence in this new technology,” Weber said in a statement.

China's GWM, BYD, and MG were among the 10 highest selling car brands in Australia in the year to November 2025. Image: AADA / Supplied

Musk could still become world’s first trillionaire

Tesla's continued sales slump comes as the company faces increasing competition in the EV space, the US government’s phasing out of a tax credit for EV purchases, and buyer concerns over the conservative politics of Musk, who has become the richest person in the world.

The sales drop has occurred despite Tesla and Musk gaining public support from US President Donald Trump, who allowed Musk to promote Tesla models on the White House driveway in March 2025 and even purchased a Tesla himself, before reportedly deciding to sell it when his relationship with Musk fell apart in June.

The pair have appeared together intermittently since Musk reduced his controversial work with the US government, writing on his social media platform X on Monday that he had dinner with Trump and his wife Melania this week.

“2026 is going to be amazing!” Musk said.

Had a lovely dinner last night with @POTUS and @FLOTUS.

— Elon Musk (@elonmusk) January 4, 2026

2026 is going to be amazing! pic.twitter.com/1Oq35b1PEC

Tesla would begin mass production of its electric Semi truck, self-driving Cybercab, and humanoid robot Optimus in 2026, Musk said in November.

That was after shareholders approved a major pay package which could see Musk become the world’s first trillionaire if he achieves performances targets over the next decade.

Musk’s rocket company SpaceX is also expected to go public in 2026, which analysts expect could be one of the largest initial public offerings (IPOs) in recent years, and would further increase Musk’s wealth.

While SpaceX is not expected to achieve its goal of sending a Starship rocket to Mars in 2026, Musk said on Sunday that the company would eventually produce Starships “at massive volume”.

“Maybe as high as 10,000 ships per year,” wrote the billionaire, who is known for often overstating his companies’ potential achievements.